Details of economic calendar on December 9

The US PPI slowed down its annual pace of growth to 6.9% from 6.8%. This is a fresh sign that consumer inflation will quickly follow suit. In turn, such evidence proves again that the Federal Reserve is likely to moderate the pace of further rate hikes.

Overview of technical charts on December 9

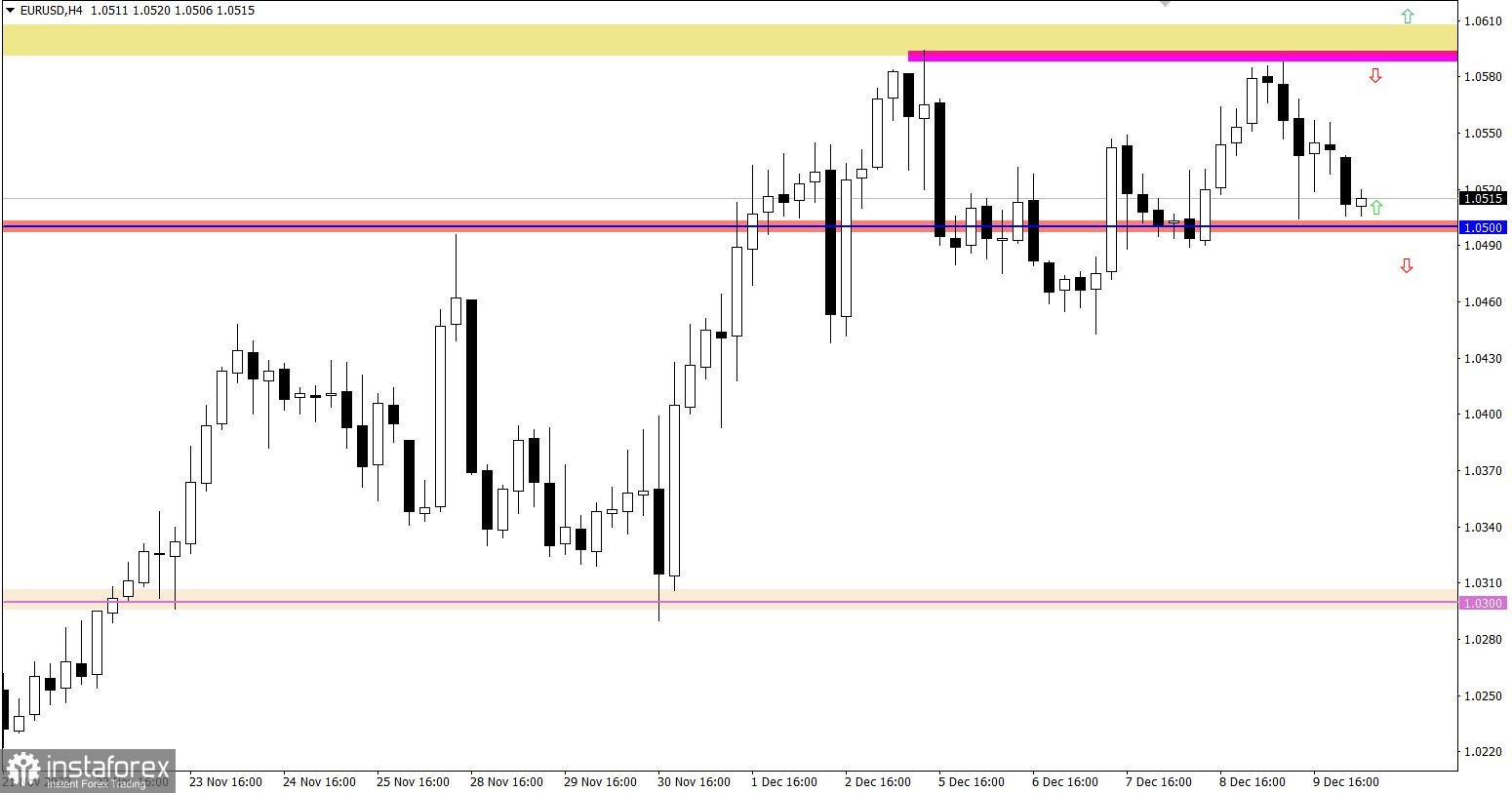

EUR/USD approached local highs at 1.0580/1.0600 of the upward cycle. Traders cut on their long positions. As a result, the price retreated to 1.0500.

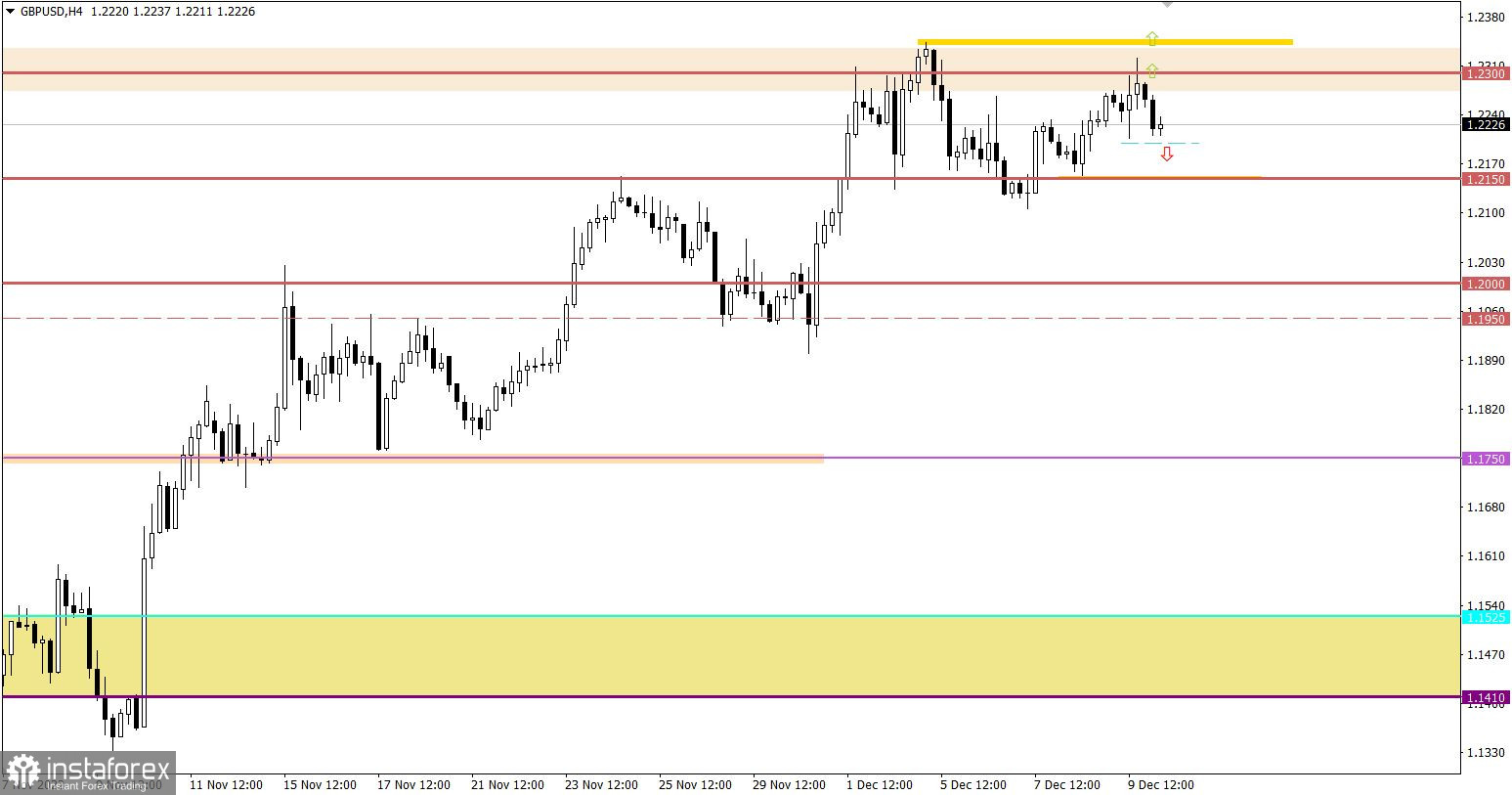

GBP/USD dropped off resistance at 1.2300. In consequence, the market saw a decrease in short positions. This price move pushed the pound sterling almost 100 pips down. Nevertheless, the price action did not develop any drastic changes.

Economic calendar on December 12

During the European session, the UK reported on its industrial production whose decline eased to -2.4% on year in October from -3.1%.

Trading plan for EUR/USD on December 12

Under such market conditions, EUR/USD could be locked between the two crucial levels of 1.0500/1.0600. This price move will enable the accumulation of trading forces. Eventually, the price will gain momentum, escaping beyond any of these levels in a particular direction.

To sum everything up:

The upward scenario will be considered by traders in case the price settles above 1.0600 on the 4-hour chart.

The downward scenario will come into play in case the price settles below 1.0480 on the 4-hour chart.

Trading plan for GBP/USD on December 12

Despite the local activity of the sellers, the currency pair is still following the overall uptrend which came into existence from the lows of the downtrend. Therefore, the second successful attempt to hold above 1.2300 may eventually lead to a higher high of the upward cycle.

As for the downward scenario, the price needs to settle below 1.2200 to create some conditions for its development. In this case, the instrument may head towards 1.2150. At the same time, the overall trend remains upward.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: the opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed on history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.