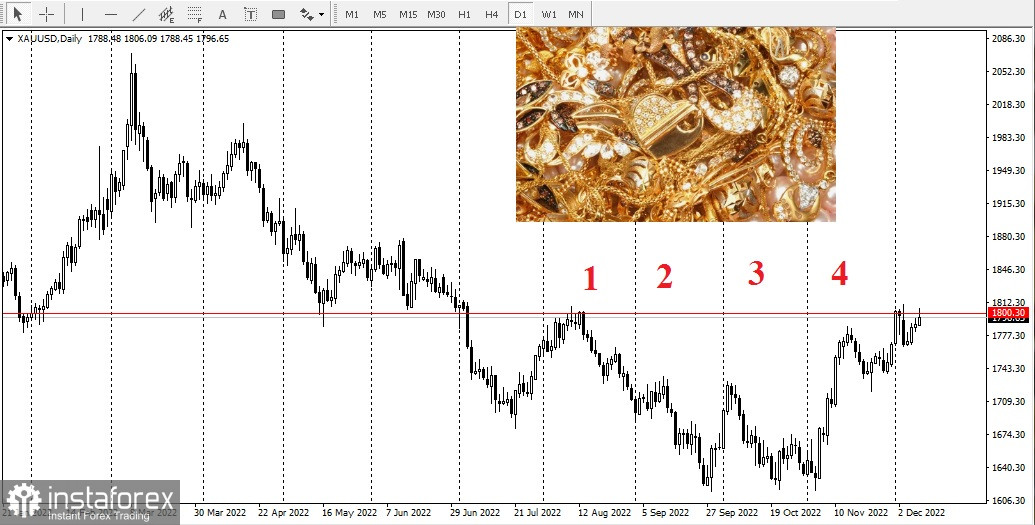

The latest weekly gold survey shows that retail gold investors remain optimistic as prices hit a four-month high by the end of the week.

While there is a lot of uncertainty in the market, most analysts agreed that the Federal Reserve's decision on monetary policy on Wednesday will have a significant impact on the precious metal later this year.

The Federal Reserve is expected to slow down its rate hikes to 50 basis points. However, some analysts say it's more important to keep an eye on the central bank's updated forecasts.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is bearish on gold in the near term as the Federal Reserve has not yet finished raising interest rates.

"Even if the Fed slows the pace of rate hikes, it may also increase the terminal rate, which could boost [the U.S. dollar]," he said.

However, according to Adam Button, chief currency strategist Forexlive.com, if the Fed's actions are less aggressive, gold will increase in price.

"The bond market is signaling that the Federal Reserve has already gone too far," he said.

Along with supportive US monetary policy, Button said he is bullish on gold due to strong seasonal factors.

"This is the time to buy gold. You buy gold in December and sell it in February. The seasonal trade in gold is the most predictable," he said.

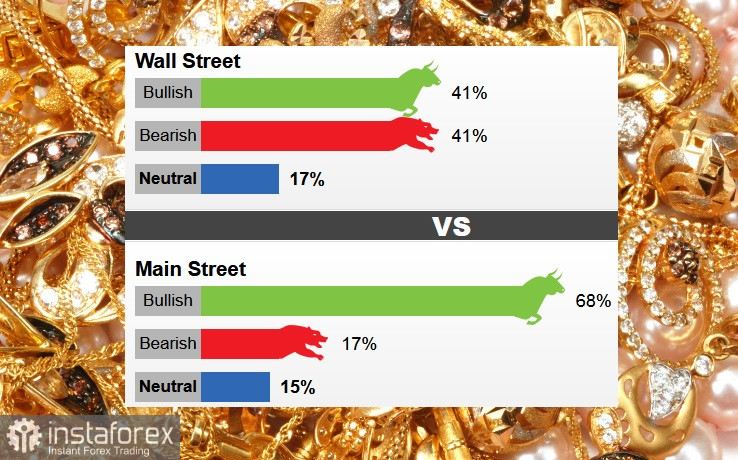

Last week, 17 Wall Street analysts took part in the gold survey. Both bullish and bearish received seven votes each, or 41%, and three analysts, or 17%, expected gold prices to trade sideways this week.

In the online Main Street poll, 661 people voted. Of these, 450 respondents, or 68%, expect gold prices to rise. Another 115 voters, or 17%, said the price would go down, while 96 voters, or 15%, were neutral.

Sean Lusk, co-director of commercial hedging at Walsh Trading, believes that after Friday's strong movement, some investors will take some profits at the beginning of this week, which will lead to lower prices ahead of the Federal Reserve meeting. He added that the mood in the gold market has changed.

"With so much uncertainty still out there, investors are going back to what they know and are looking for assets with a history of wealth preservation," he said.

Adrian Day, president of Adrian Day Asset management, said as investors lose faith in central banks' ability to control inflation, gold prices will continue to rise.

"Maybe this week, maybe next, gold will break above $1,800 and convince more investors to jump on board as it becomes more obvious that the Federal Reserve and European Central Bank will be unable to attain their inflation goals without causing a recession," he said.