The dynamics of the major currencies this week, including the euro, the franc, as well as the dollar and the pound, will most likely be determined by the meetings of the central banks of the respective countries.

The first among them to complete its meeting is the Fed. Its interest rate decision will be published on Wednesday (at 19:00 GMT), while the Bank of England's decision will be on Thursday (at 12:00 GMT).

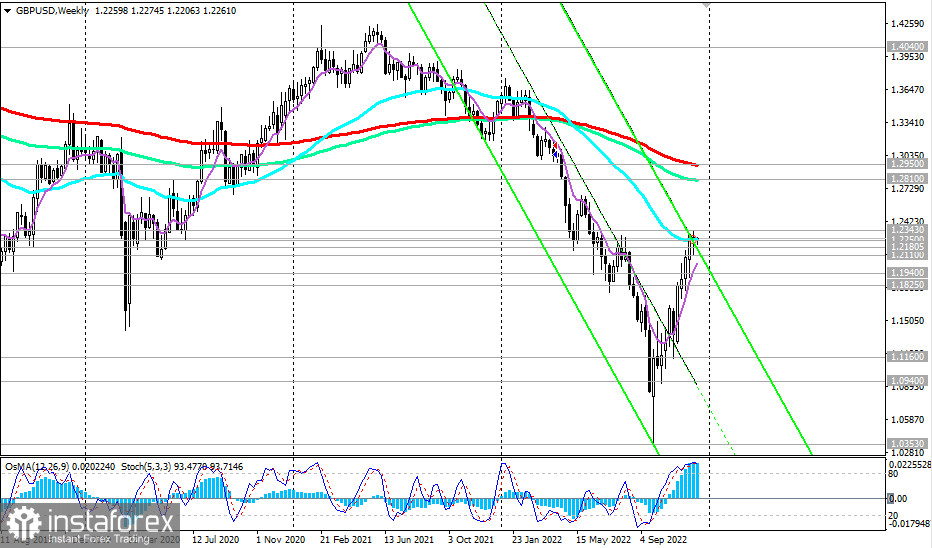

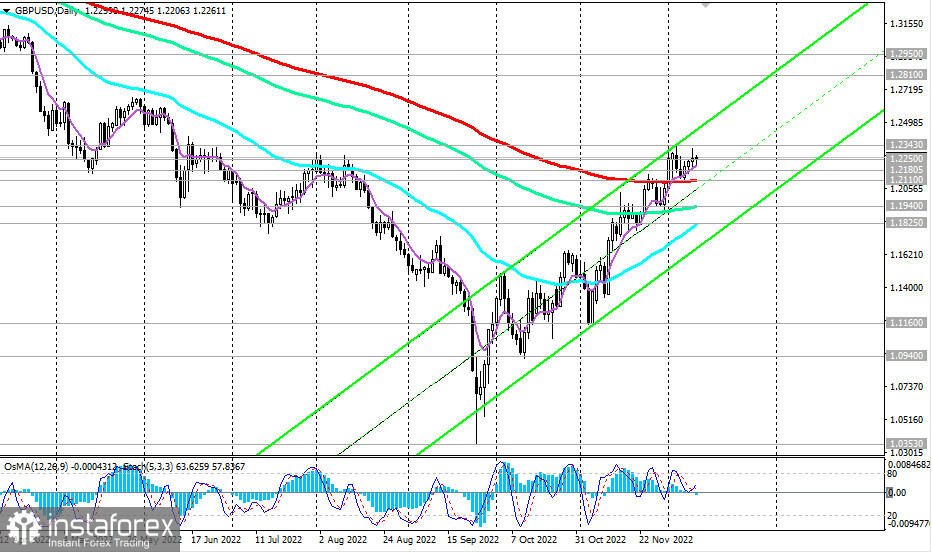

The GBP/USD pair is developing positive dynamics, trying to break into the zone above the 1.2250 long-term resistance level (50 EMA on the weekly chart). In case of breaking through the 1.2343 local resistance level, further growth towards the key resistance levels 1.2810 (144 EMA on the weekly chart), 1.2950 (200 EMA on the weekly chart), separating the long-term GBP/USD bullish trend from the bearish one, is not ruled out.

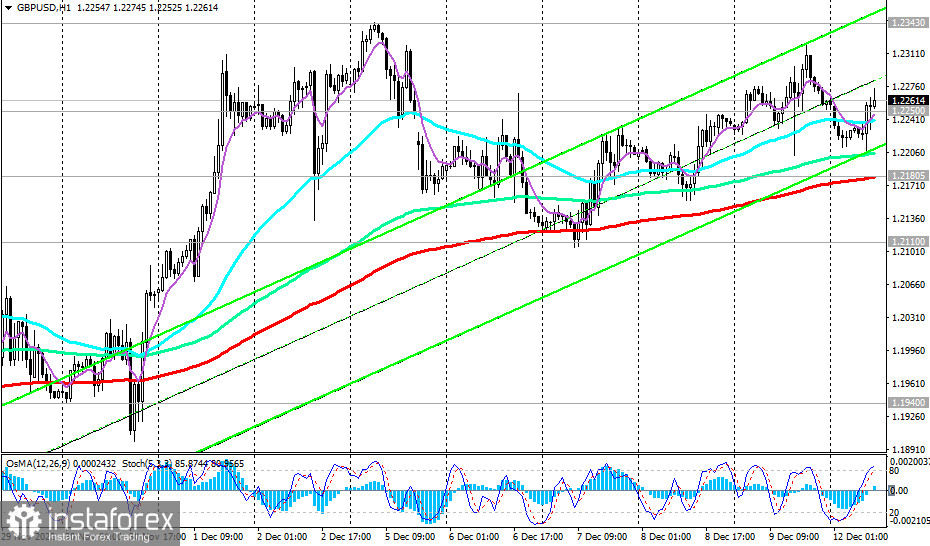

In this sense, and counting on the implementation of this scenario, it makes sense to place pending stop orders to buy just above the resistance levels 1.2322, 1.2343 with targets at the levels we have indicated.

Alternatively, the price will break through the 1.2110 key support level (200 EMA on the daily chart of GBP/USD), heading after the breakdown of the 1.1940 support level (144 EMA on the daily chart) deep into the descending channel on the weekly chart. Its lower limit is below 1.0200, i.e. even lower than the local multi-year low of 1.0353 reached by the pair at the end of September, just before the intervention of the Bank of England in trading on the government bond market. This scenario for the resumption of the decline, which, according to some economists' forecasts, may be even deeper, also has a right to exist.

The very first signal for its implementation will be a breakdown of the 1.2180 important short-term support level (200 EMA on the 1-hour chart), and the 1.1825 support level (local support level and 50 EMA on the daily chart) will be the confirmation.

In the meantime, long positions remain preferrable above the 1.2110 support level.

Support levels: 1.2250, 1.2200, 1.2180, 1.2110, 1.2100, 1.2000, 1.1940, 1.1900, 1.1825, 1.1800

Resistance levels: 1.2322, 1.2340, 1.2400, 1.2500, 1.2810, 1.2950

Trading Tips

Sell Stop 1.2190. Stop-Loss 1.2310. Take-Profit 1.2180, 1.2110, 1.2100, 1.2000, 1.1940, 1.1900, 1.1825, 1.1800, 1.1575, 1.1500, 1.1400, 1.1300, 1.1200, 1.1160, 1.0940

Buy Stop 1.2310. Stop-Loss 1.2190. Take-Profit 1.2320, 1.2340, 1.2400, 1.2500, 1.2810, 1.2950