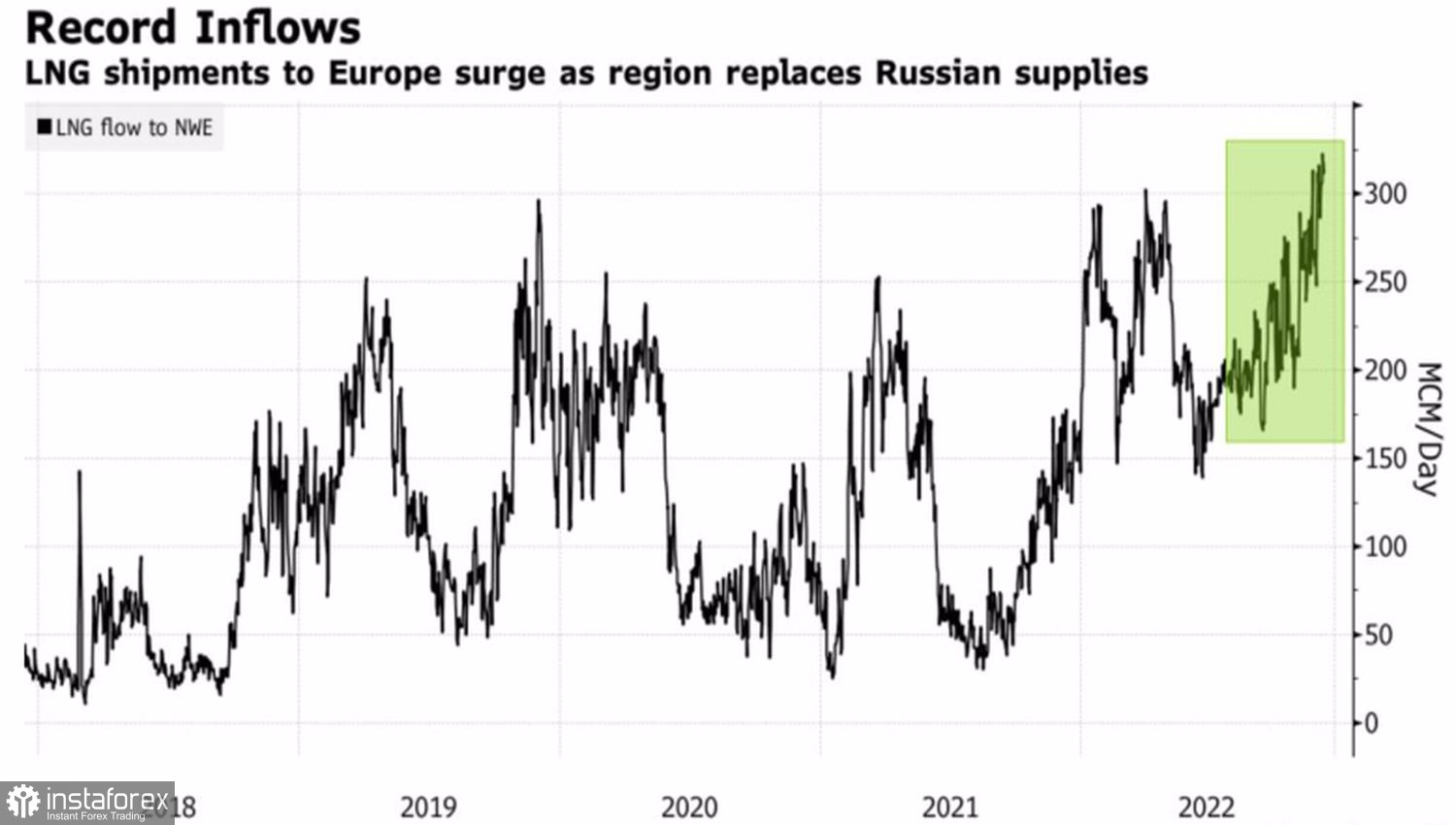

While investors are wondering how to react to the U.S. inflation data, the euro did not turn a hair. The regional currency is on the rise, having taken on the factor of declining gas prices in Europe. Despite the cold weather, which is expected to continue until the end of the second decade of December, the cost of blue fuel is rising against the background of more full storage than usual at this time of year and record LNG imports. As a result, fears of an energy crisis are receding, and the recession in the eurozone seems almost painless, which pushes EURUSD quotes up.

Gas storage facilities in Europe are 88% full, which is higher than the average for this time of year, while Germany is 94% full. The currency bloc's largest economy will most likely not have to face rationing this year or next, so the energy crisis no longer looks like a doom for the currency bloc. Moreover, LNG imports to the euro area are growing by leaps and bounds, and nuclear power plants in France operate stably even in conditions of a sharp cold snap.

Dynamics of LNG imports to Europe

U.S. stock index futures also add fuel to the fire, with their rally signaling that the U.S. stock market may open higher. This puts pressure on the dollar as a safe-haven asset.

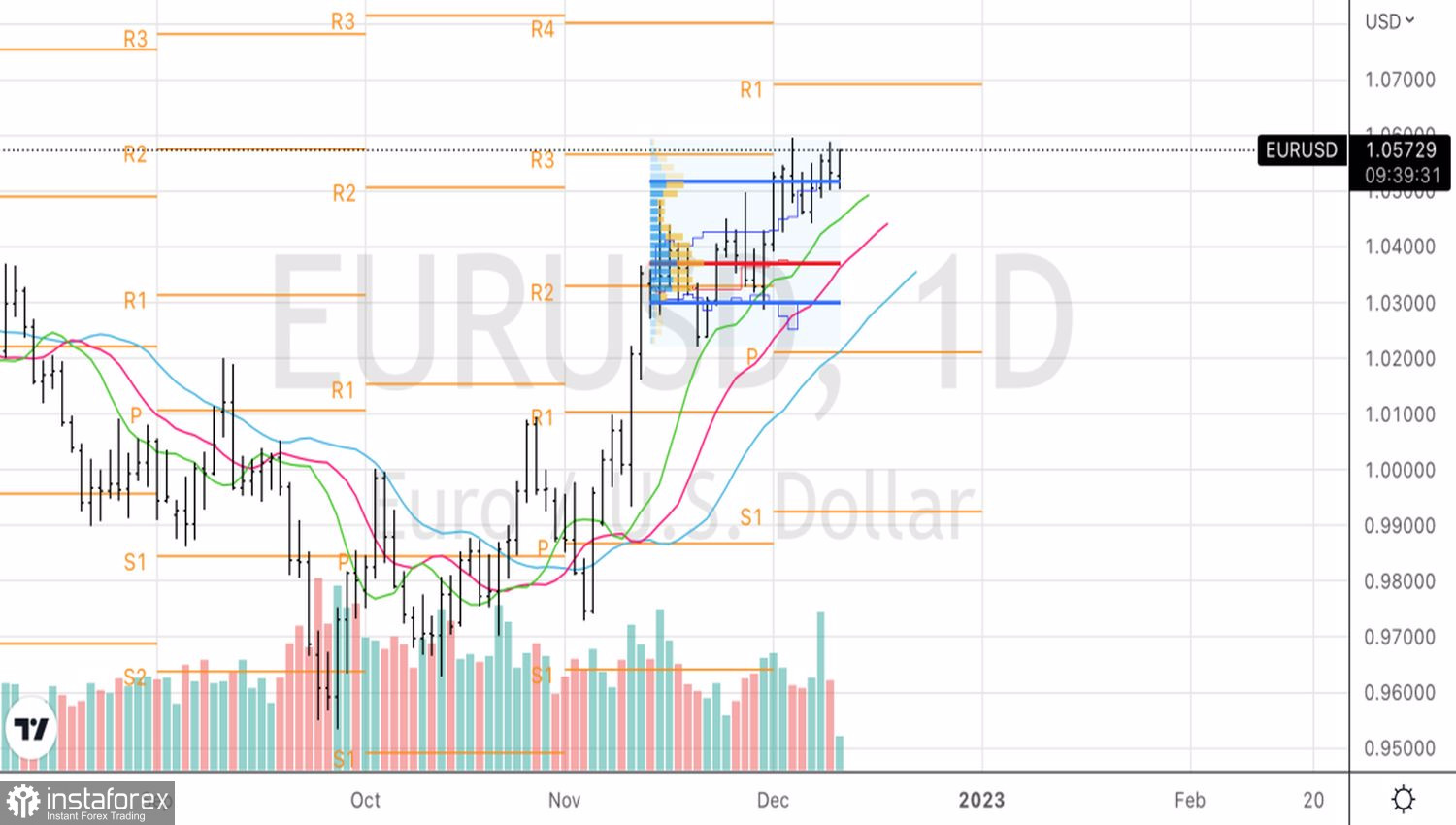

However, the EURUSD rally looks premature. The fate of the pair will depend on the direction of inflation in the United States, as well as on the verdicts of the Fed and the ECB. The faster growth of U.S. producer prices in November than Bloomberg experts expected cooled the hot heads of euro fans at the end of the week by December 9. Nevertheless, the main currency pair started the new five-day period in good spirits.

U.S. Producer Price Trends

The market stubbornly does not want to consolidate ahead of important events, although Barclays sees high risks of EURUSD moving to medium-term trading ranges. They say that the potential of the euro rally is limited by the terms of trade, which will remain unsatisfactory for a long time. However, the strengthening of the US dollar also has its limits, as China is on the way to opening its own economy. Thus, a "bearish" scenario for greenback is unlikely to play out in the near future.

Reuters experts came to the same opinion, predicting a fall in EURUSD to 1.03 in three months, followed by an increase in the pair to 1.07 in 12 months. Whether they are right or not, time will tell. As well as the release of data on US inflation for November and the verdict of the central banks. If there is no hint of a dovish turn in the FOMC forecasts, that is, a cut in the federal funds rate in 2023, the US dollar may go on a counterattack.

Technically, a successful storm of the 1.057–1.0575 pivot points will strengthen the risks of the EURUSD rally towards 1.069. It is possible to risk buying the pair, but we should be ready for its violent reaction to the American CPI, including a serious collapse. The euro falling below the upper limit of the fair value at $1.0515 is a reason for short-term selling.