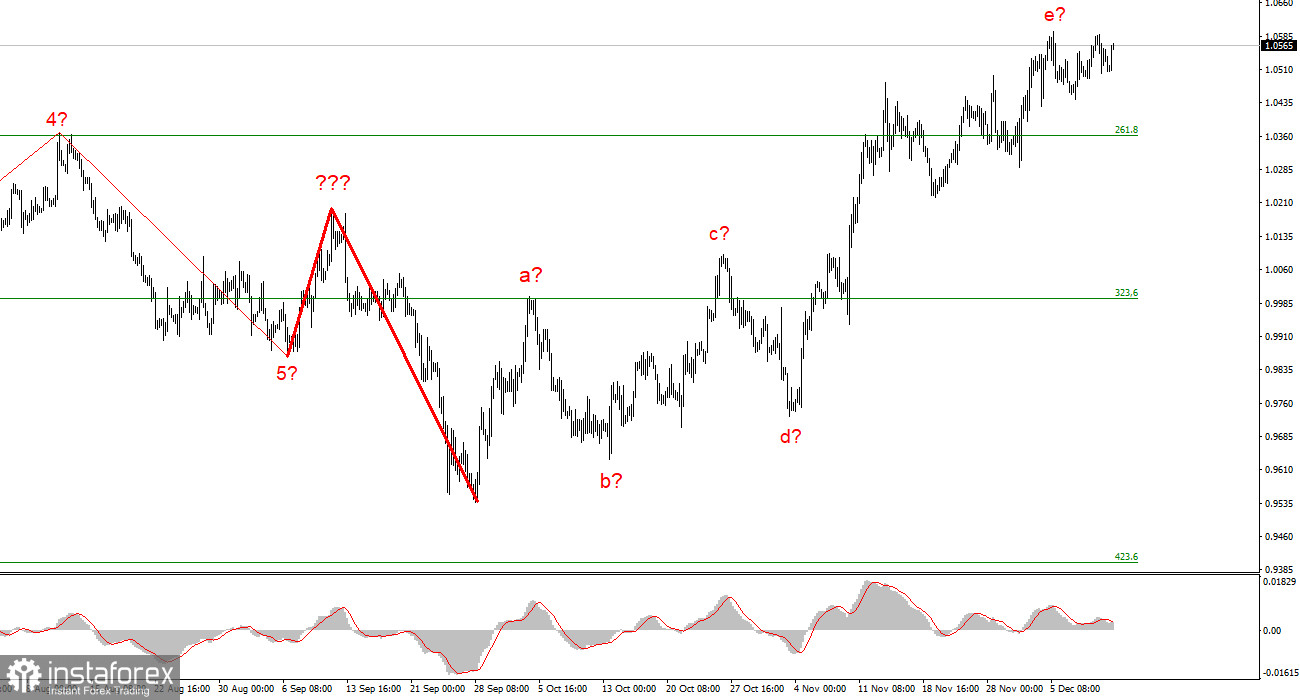

The wave marking on the euro/dollar instrument's 4-hour chart still appears to be quite accurate, but the entire upward section of the trend is becoming more convoluted. It has already assumed a clear corrective and somewhat prolonged form. Waves a-b-c-d-e have been combined into a complex correction structure, with wave e having a significantly more complex form than the other waves. Since wave e is much higher than the peak of wave C, if the wave markings are accurate, construction on this structure may be nearly finished. In this instance, it is anticipated that we will construct at least three waves downward, but if the most recent phase of the trend is corrective, the subsequent phase will probably be impulsive. Therefore, I am preparing for a new, significant decline in the instrument. The market will be ready to sell when a new attempt to breach the 1.0359 level, which corresponds to 261.8% Fibonacci, is successful. The last decline of the instrument, however, is not the first wave of a new descending section; rather, the rise in the instrument's quotes over the past few weeks suggests that the entire wave e may end up being longer. Consequently, the scenario involving the first two waves of a new downward trend segment is rejected. Because there is no increase in demand for US currency, the wave pattern starts to become muddled and complex.

The euro/dollar exchange rate is steady.

On Monday, the euro/dollar instrument increased by 30 basis points. The first day of the week did not have much amplitude, but this week will be full of interesting events, so I am anticipating some strong movements. There was no background news on Monday, but this situation won't last long. The US will release its November consumer price index tomorrow, and I rank it among the most significant economic reports to date. And not just for the US dollar and the US, as the Fed's monetary policy depends entirely on the inflation rate. For the entire foreign exchange market, this report is crucial.

The US inflation rate has been steadily falling over the past few months, which has given the FOMC cause to consider reducing the rate at which interest rates are raised. But what if inflation continues to decline until a certain point? The market expects a rise in the dollar rate to 5.00–5.25%; however, if inflation doesn't continue to decline, the Fed may decide to make one or two additional increases. As a result, the slowdown in December might not be the "beginning of the end" but "the beginning of a longer tightening of monetary policy." Any significant drop in US inflation could, in one way or another, result in a further decline in demand for the dollar. And as such, a slight decline or lack thereof can support the US dollar. As a result, the dollar may significantly decrease or increase tomorrow. Additionally, the market is expected to trade very actively on Wednesday and Thursday as we await the outcomes of the ECB and Fed meetings. The wave pattern indicates that the instrument will decline, so I'm still waiting for it to do so.

Conclusions in general

Based on the analysis, the construction of the upward trend section has become more complicated than the five-wave and is nearing completion. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. The likelihood of this scenario is increasing, and there is a chance that the upward portion of the trend will become even more extended and complicated.

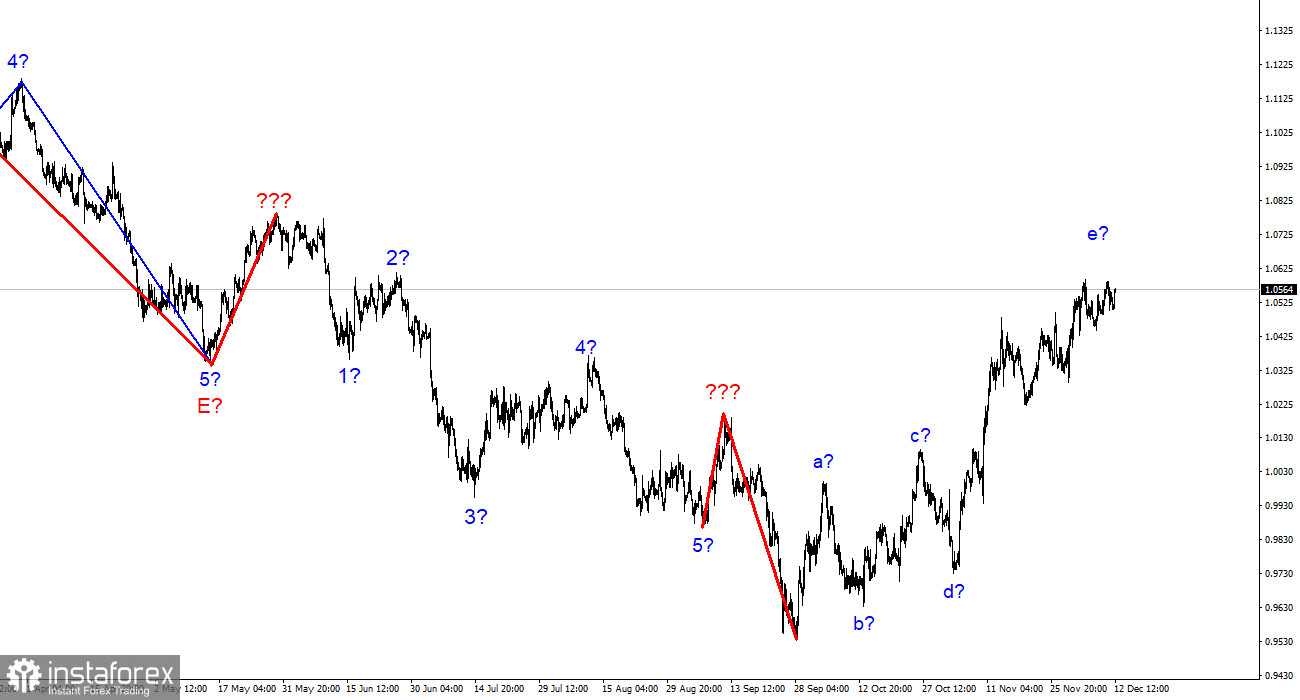

The wave marking of the descending trend segment becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this section is finished, work on a downward trend section may resume.