EUR/USD

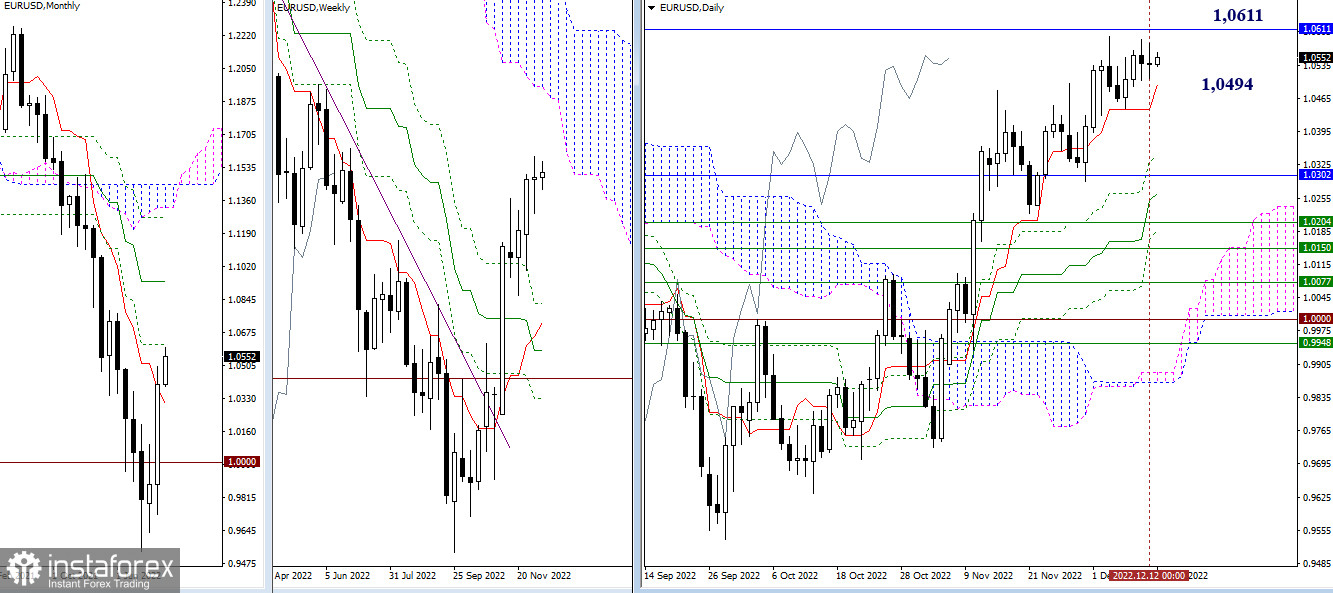

Higher time frames

Technically, little changed yesterday. The pair is still consolidating. Resistance is seen at 1.0611, in line with the monthly Fibo Kijun, while support stands at 1.0494. The situation may change if the quote breaks through either of the barriers.

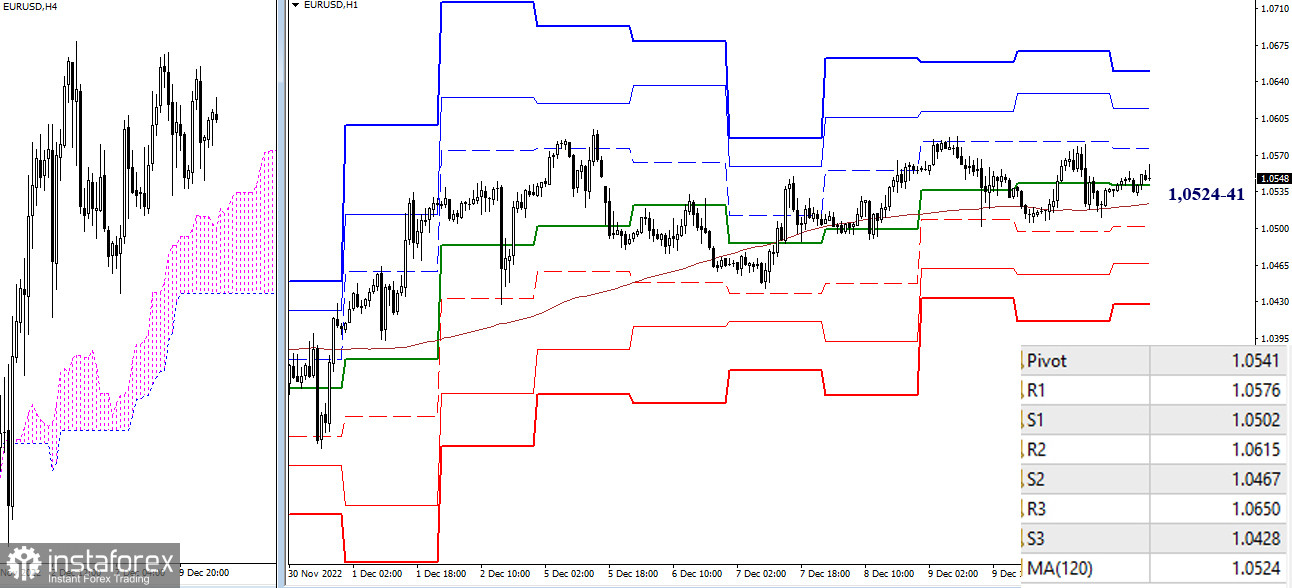

H4 – H1

In lower time frames, the pair keeps trading within the area of 1.0524-41 (central Pivot point + weekly long-term trend). Classic Pivot levels serve as intraday reference points. Resistance is seen at 1.0576, 1.0615, and 1.0650. Meanwhile, support stands at 1.0502, 1.0467, and 1.0428.

***

GBP/USD

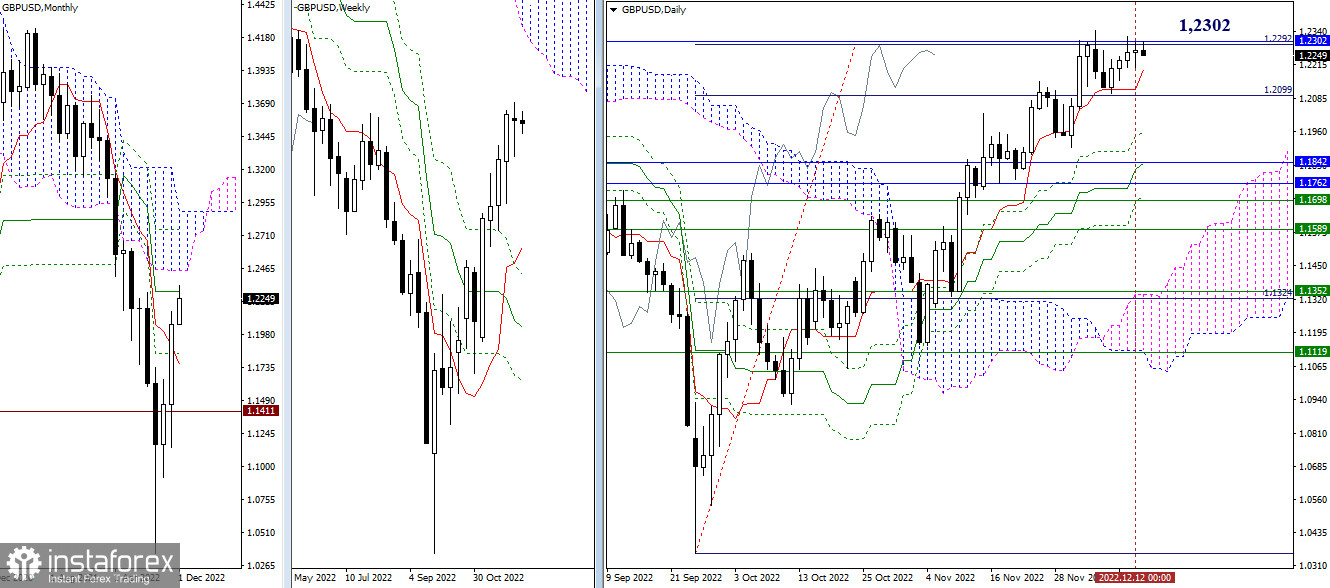

Higher time frames

The pair is moving below 1.2292-1.2302 resistance. A breakout through the barrier or a clear rebound will determine the pair's further movement. The nearest support is seen at 1.2197 (daily short-term trend).

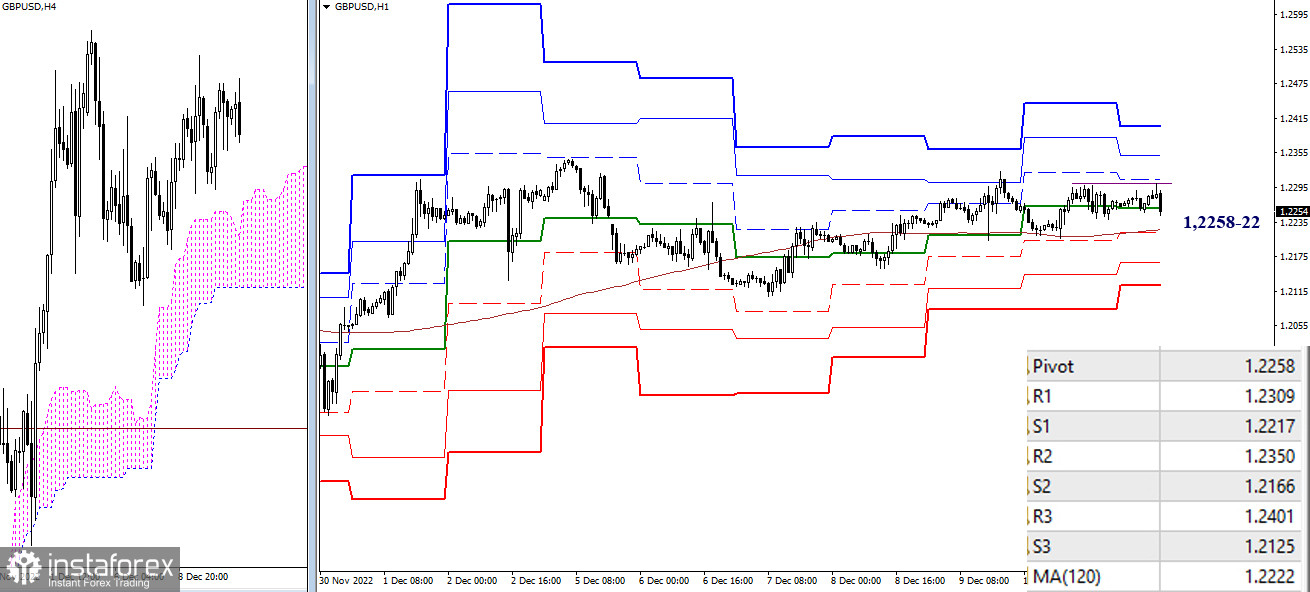

H4 – H1

In lower time frames, support stands at 1.2222-58 (central Pivot point + weekly long-term trend). Although the pair is moving sideways, the bulls are now more active. In case of a breakout through resistance at 1.2302, the quote may test the classic Pivot resistance levels of 1.2309, 1.2350, and 1.2401 intraday. Consolidation below 1.2222-58 may trigger an increase in bullish activity. Bearish reference points are seen at 1.2166 (S2) and 1.2125 (S3).

***

Technical analysis indicators:

Higher time frames: Ichimoku Kinko Hyo (9.26.52) and Fibo Kijun

H1: Pivot Points (classic) + Moving Average with Period 120 (weekly long-term trend)