In the previous analytical review, I drew your attention to the level of 1.0546 and recommended entering the market from it. Let's have a look at the 5-minute chart and analyze the situation there. The price broke through and returned below 1.0546, as well as a top-down test gave a sell signal. However, the price has not dropped sharply at the moment of writing this article. As long as the pair is trading below 1.0546, we can expect a larger decline in the pair. In this connection, the technical picture and the trading plan for the second half of the day have not changed.

Long positions on EUR/USD:

After the US inflation data, the market is expecting a burst of volatility. We can easily determine the direction of the pair. If the consumer price index is above the economists' forecasts and shows growth, we may expect a strengthening of the US dollar and a fall of the EUR/USD pair. If inflation in the US continues to fall, we can expect a sharper upward movement of the euro. In this case, the euro may move above the current sideways channel. These are the scenarios we will base our analysis on. If the price declines and forms a false breakout at 1.0511, it may give a buy signal, which opens the way to 1.0546 in the middle of the sideways channel, as well as to 1.0584, its upper boundary, which almost coincides with the monthly high. A breakthrough and a top-down test of this level are likely to strengthen bulls' positions, allowing them to pave the way to 1.0624. It will also be possible to go above this level if inflationary pressure in the US decreases. Following this scenario, the target is located at 1.0663, where traders may lock in profits. If the EUR/USD pair decreases during the North American session and we see weak activity from bulls at 1.0511, the pressure on the euro is likely to increase. This may trigger bulls' Stop Loss orders, counting on the continuation of the trend. In this case, only a false breakout at the support of 1.0446 may create a buy signal. One may open long positions on a rebound only from 1.0395 or lower near the low of 1.0346, allowing an upward intraday correction of 30-35 pips.

Short positions on EUR/USD:

Bears are going with the flow. They need to control the resistance of 1.0546 and protect the upper boundary of the sideways channel at 1.0584. The price may form a false breakout at this level after the release of the US inflation data, which is expected to demonstrate a decline. This is likely to lead to the entry point into short positions and the euro could be dragged to the lower boundary of the channel and the nearest support at 1.0511. If the pair breaks through and settles below this level on news that prices do rise in the US in November along with a downward test of this level, this may give an additional signal, triggering bulls' Stop Loss orders. In this case, the euro may fall to 1.0446, where traders may gain profits. The next target is located at 1.0395, where bulls may show their activity again and will try to push the euro higher before tomorrow's meeting of the Federal Reserve. If the EUR/USD pair moves up during the North American session and bears are weak at 1.0584, they may lose confidence in their strengths, while bulls will have a good chance to hit a new monthly high near 1.0624. You may sell the euro from this level only on a false breakout. Short positions on the euro can be opened from the high of 1.0663, allowing a downward correction of 30-35 pips.

Indicator signals:

Moving averages

The pair is trading near the 30- and 50-day moving averages, indicating an uncertainty with the further direction of the price.

Note: Period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

If the price declines, the lower band of the indicator near 1.0520 will offer support.

Indicators description

- Moving average defines the current trend by smoothing out market volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing out market volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator. Fast EMA 12. Slow EMA 26. SMA 9

- Bollinger Bands. Period 20

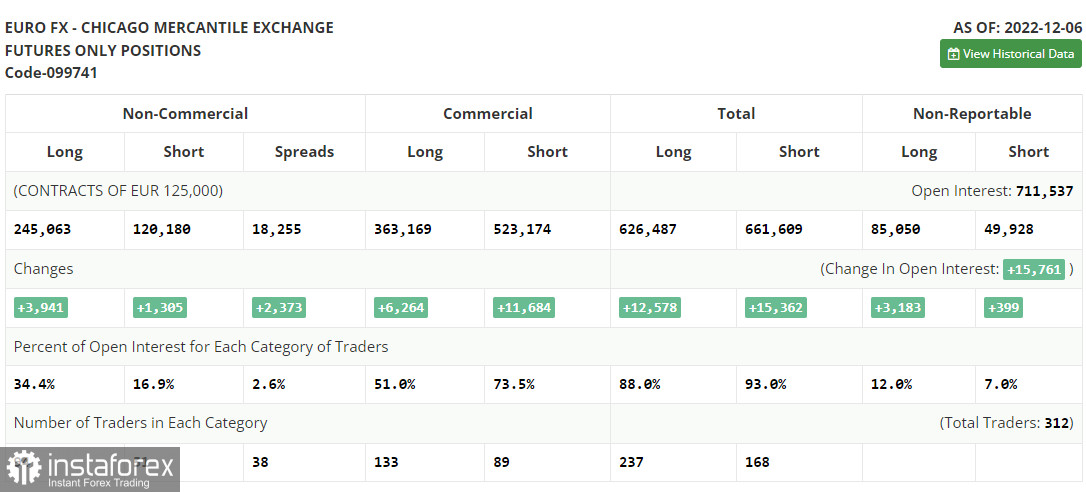

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of noncommercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.