Markets held their breath as they awaited the release of U.S. consumer price data, when, in fact, inflation is the old hero. Recession will be the new one in 2023, which will change all inter-market relationships. If in 2022 stocks fell in response to rising U.S. Treasury yields, next year, the rally in debt rates will lead to purchases of risky assets. And all because the Fed intends to take into account bilateral risks.

In 2022, investors were obsessed with inflation. At the beginning of the year, they criticized the Fed for being too slow, and in the middle they criticized the Fed for raising rates too fast. It was time to slow down. The central bank has started talking about a soft landing, but the markets don't believe it. First, the yield curve inversion is at its highest levels since 1980. It has preceded almost all recessions, so the downside risks are very high.

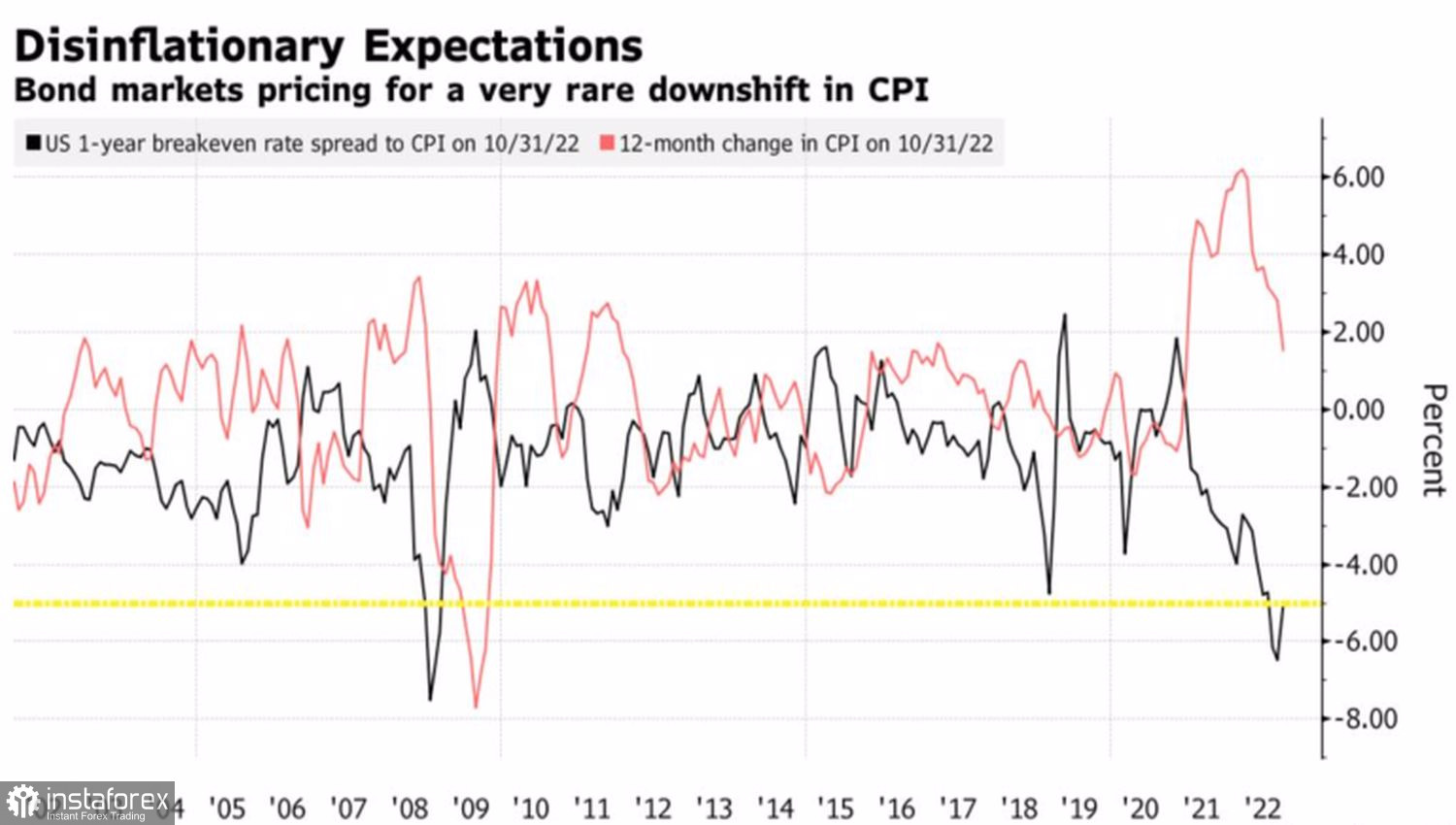

Secondly, inflation expectations measured using bond market instruments for one year are at 2.18%. In order to return the CPI to this level, a price reduction of 5 percentage points is required. This has happened only three times over the past 60 years. And all three times ended in recession. In 1975–1976, 1981–1982 and in 2008 after the collapse of Lehman Brothers.

Dynamics of debt market expectations for inflation

Thus, the market is trumpeting a recession. And this fact sheds light on the mystery of why investors expect a cut in the federal funds rate at the end of 2023. They say a shrinking U.S. economy will turn the Fed from a hawk to a dove. For now, however, the Fed has time to show its commitment to fighting inflation. Much still depends on the dynamics of consumer prices. Old heroes are reluctant to give way to new ones. Forex is no exception.

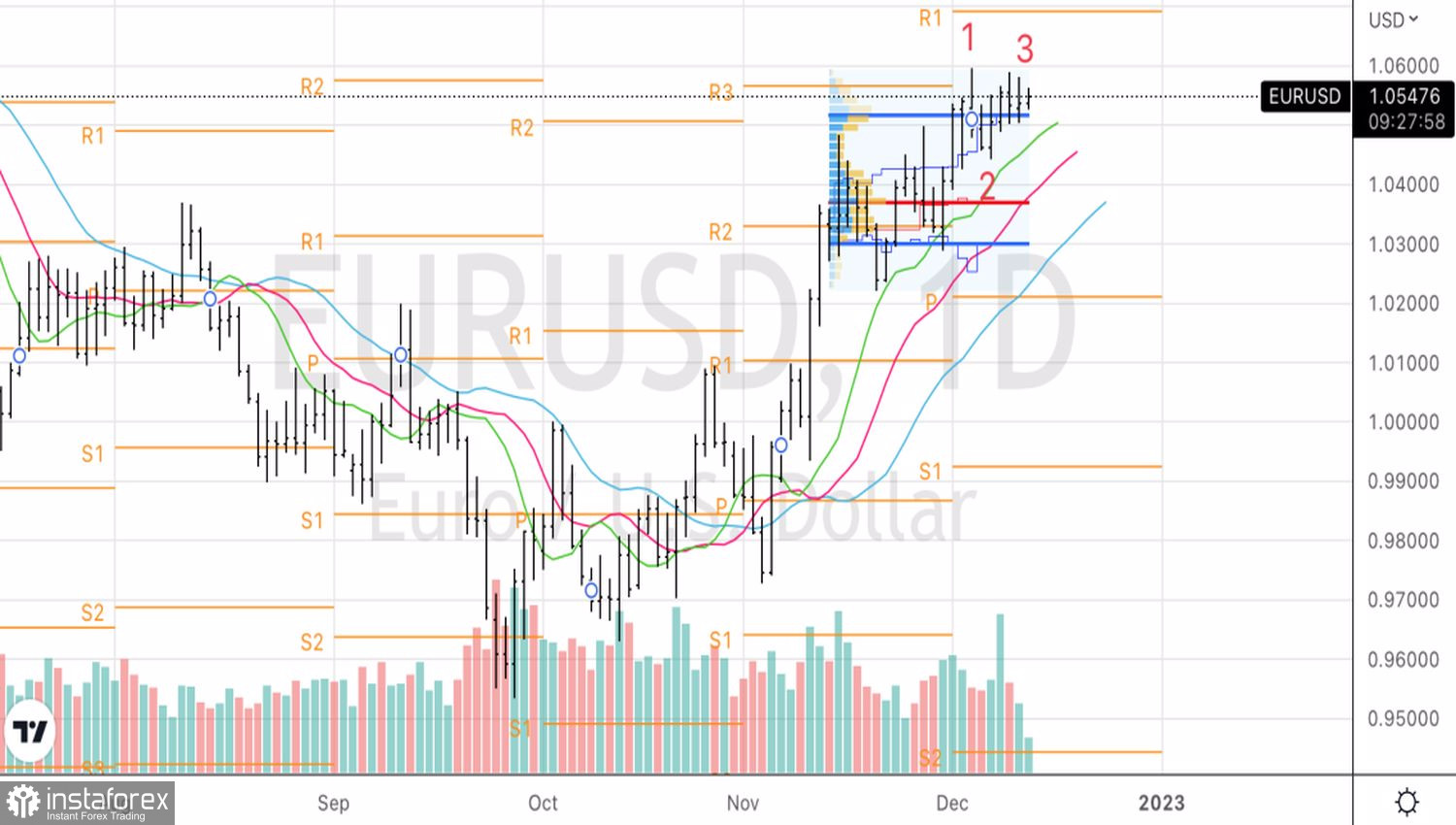

According to the Bloomberg consensus forecast, CPI will slow from 7.7% to 7.3%, and core inflation will drop from 6.3% to 6.1%. If the process of its slowdown goes faster, EURUSD may rise. However, the potential for a rally is likely to be limited, as investors will decide to lock in profits before the results of the December FOMC meeting are announced. The Committee meeting has bilateral risks for the U.S. dollar. It could get preferential treatment if the FOMC forecasts a higher peak in the federal funds rate than the market's expected 5%. It could weaken if Jerome Powell signals that at the first central bank meeting in 2023, the cost of borrowing will rise by 25 bps rather than 50 bps.

Most likely, we are expecting a roller coaster for the main currency pair, especially since the ECB will make its verdict a day after the Fed.

Technically, EURUSD can both work out the 1-2-3 reversal pattern and restore the upward trend. In the first case, we sell the euro on a breakout of support at 1.0505. In the second case, we buy from the high of the internal bar at 1.058. You should not get carried away with holding the formed positions: reversals may follow from the levels of 1.046 and 1.062.