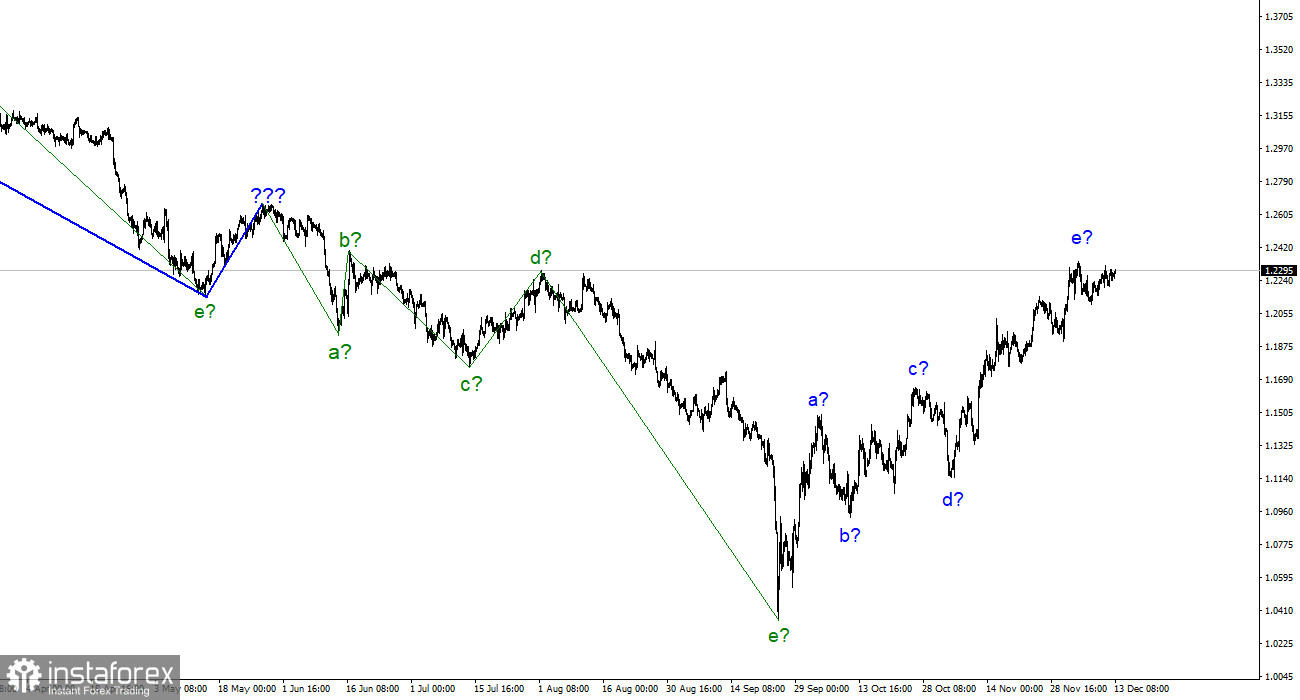

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still needs to call for any clarifications. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be completed. As a result, the instrument's price increase may last for a while. Both instruments are still forming an upward trend segment that will eventually lead to a mutual decline. Recently, the British pound's news background has been so varied that it is challenging to sum it up in one word. The British pound had more than enough causes to rise and fall. As you can see, it primarily chooses the first option and still does so today. The proposed wave e has become more complicated due to the recent rise in quotes. It's already evolved into a fairly extended form at this point. I am currently waiting for the decline of both instruments. Still, these trend sections may take an even longer form because the wave marking on both instruments allows the ascending section to be built up to completion at any time.

The British reports were crucial but boring.

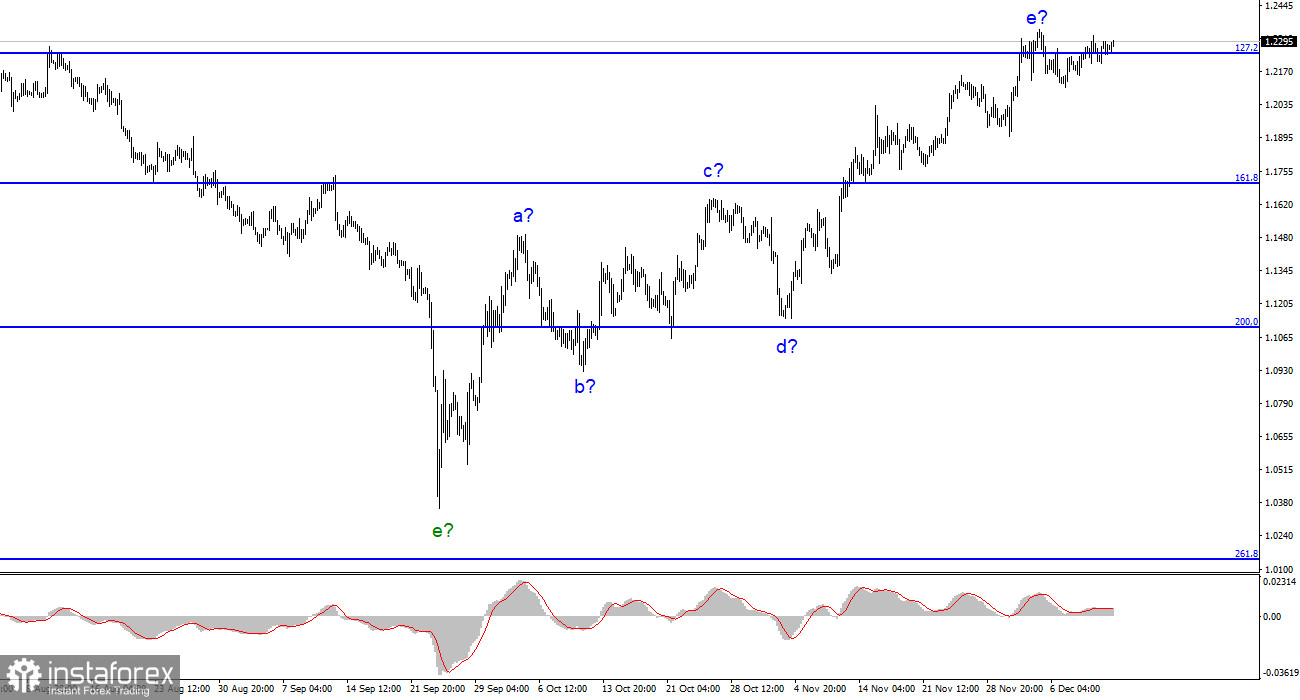

On Tuesday, the pound/dollar exchange rate increased by 25 basis points. It is difficult to anticipate changes in the wave marking with such a high trading volume. The instrument has primarily moved along the Fibonacci level of 127.2% over the last two weeks, which is close to the anticipated peak of wave e. Therefore, if this wave is finished, no new descending wave has yet to be created. It is strange because there were opportunities to sell or buy the pound this week on the market. The UK released its October GDP and industrial production reports on Monday, and its October unemployment and wage reports were released this morning. While we could wait for a real market response thanks to the names of these reports, their underlying meanings proved uninteresting. I can only single out the rising 3.7% unemployment rate. It should be noted that this level is still very low, though. The market anticipated a 0.5% increase in GDP in October, but this was less than expected. Even though the other two reports were less significant, the market remained calm despite their results.

All the above information suggests that there were no compelling reasons to engage in active trading yesterday or today. Although everyone is anticipating a resonance value from US inflation and a robust market response, I still hope such reasons will surface in the afternoon. Nothing could go completely wrong. The British reports can serve as an example of how inflation can perfectly align with market expectations. In this instance, there won't be any significant movements today. Of course, I'm still waiting for a report with an interesting value, but the demand for US currency must increase. The inflation report should be as flimsy and ambiguous as possible.

Conclusions in general

The construction of a new downward trend segment is predicated on the wave pattern of the pound/dollar instrument. I cannot advise purchasing the instrument at this time because the wave marking permits the construction of a downward trend section. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer form.

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.