The latest consumer inflation data in the US indicated a noticeable decline, which caused a strong drop in dollar, an increase in demand for equities and a decline in government bond yields. The report noted that CPI in the US fell from 7.7% to 7.1% y/y in November and decreased from 0.4% to 0.1% m/m. Although this is much lower than expected, the figure really impressed investors, so there was a strong rally ahead of the announcement of the Fed's decision on monetary policy.

More importantly, the central bank will also reveal its forecasts for future inflation, GDP and unemployment, which will give investors an indication of how long the rate hike cycle will last and how deep a possible recession could be. In addition, Fed Chairman Jerome Powell has a speech scheduled, in which he is likely to discuss their assessment of the economy and future plans for monetary policy.

So far, markets believe that his statements will be hawkish, but some are expecting a softer one where the Fed will say that it will be ready to stop raising rates sooner rather than later. If things go that way, a rally will be seen in all markets, accompanied by a weaker dollar.

Forecasts for today:

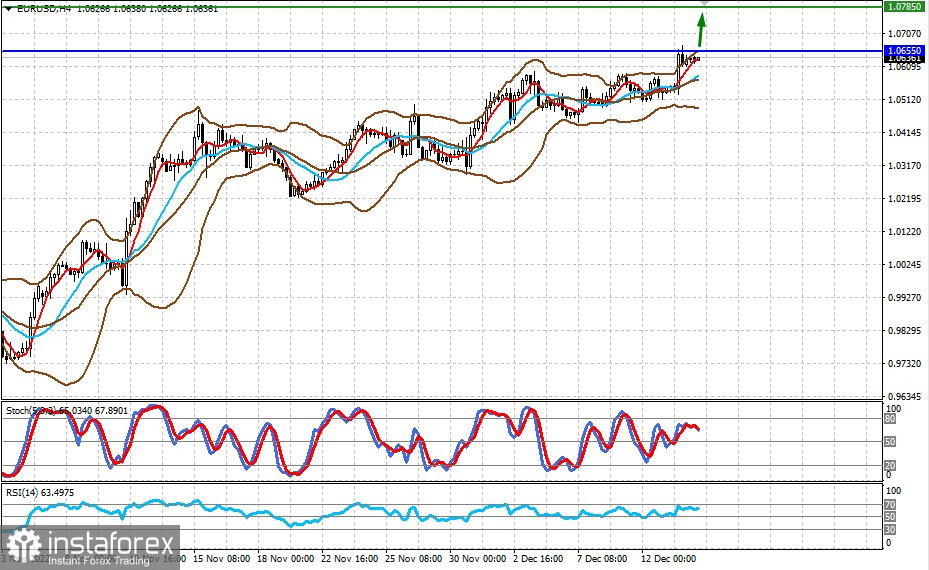

EUR/USD

The pair is currently consolidating below 1.0655. If the Fed says positive statements, it could hit 1.0785.

USD/CAD

The pair is trading above the level of 1.3520. A rise in oil prices and a decline in dollar could take it to 1.3400.