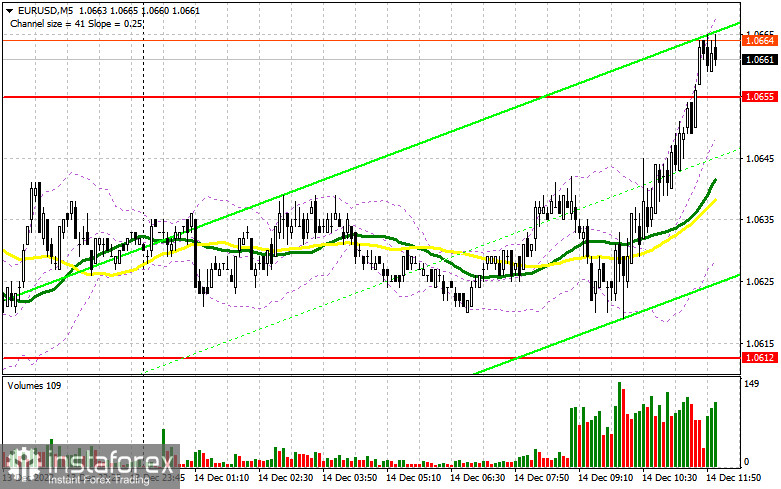

In the morning article, I highlighted the level of 1.0655 and recommended making decisions, bearing this level in mind. Now let's take a look at the 5-minute chart and try to find out what actually happened. The price indeed moved toward this level but no false breakout happened. So, the currency pair didn't suggest market entry points in the first half of the day. The technical picture changed a bit ahead of the North American trade. Let's adjust our trading plans to this market situation.

What is needed to open long positions on EUR/USD

A lot of traders rely on further growth of EUR/USD after the Fed's policy meeting, especially if Jerome Powell sends a clear message that the central bank is poised to soften its aggressive monetary policy next year. The market sentiment will also depend on the Fed's forecasts which might cause market jitters before Powell's press conference. Thus, I would advise you not to make hasty trading decisions and to trade prudently on the ground of the available information.

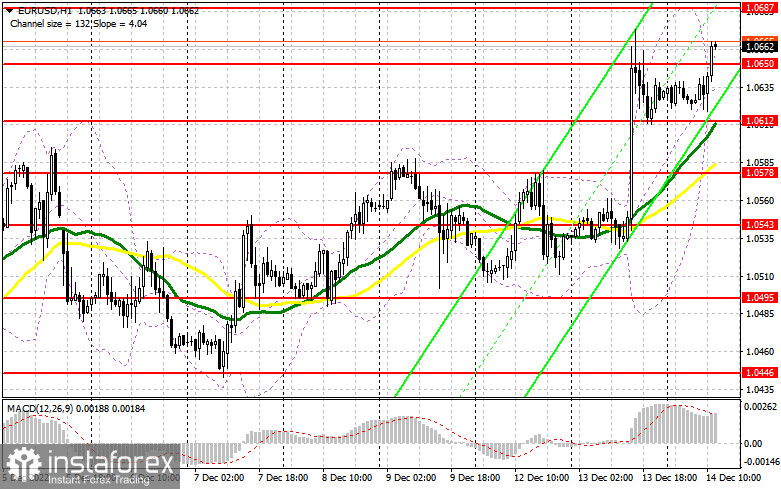

From the technical viewpoint, a level of 1.0650 could suggest nice buying opportunities. A decline and a false breakout at this level will provide a signal for entering long positions following the uptrend. The door will be open towards 1.0687. A breakout and the opposite test of this level downwards will reinforce the bullish sentiment in case the Fed comes up with dovish rhetoric, hence EUR/USD will be able to climb as high as 1.0714.

The price will be able to surpass this level easily if the US Fed drops a hint about the moderation in the pace of rate hikes in the second half of 2023. Therefore, the highest target at 1.0741 will be hit where I recommend profit-taking. In case EUR/USD declines in the New York trade and the buyers lack activity at around 1.1650, the pressure on the euro will escalate. This will activate stop losses of the buyers who reckoned a further uptrend. In this case, only a false breakout at the nearest support of 1.0612 will be an excuse to buy the pair. We could open long positions on EUR/USD immediately at a drop from 1/0578 or lower from 1.0543, bearing in mind a 30-35-pips intraday upward move.

What is needed to open short positions on EUR/USD

The sellers are not resisting the ongoing price action as they realize what developments the Fed's meeting might trigger tonight. Having missed 1.0655, I hope that the bears will focus on 1.0687. Only a false breakout, if it happens after the Fed's meeting, will create the market entry point for short positions that will the euro to the nearest support at 1.0650. A breakout and consolidation lower will generate an extra sell signal on the condition that the Federal Reserve sticks to its hawkish stance. The support level should be also updated which will activate the buyers' stop orders. So, EUR/USD will fall to 1.0578 where moving averages are passing. This is the level where I recommend profit-taking. The lowest target is seen at 1.0543 where the buyers will enter the market, trying to buy at the bottom.

In case EUR/USD grows in the American session and the bears don't assert themselves at 1.0687, which is the most realistic scenario, the sellers might lose confidence. Thus, the buyers will gain an opportunity to update a higher high at about 1.0714. I would recommend selling from this level only at a false breakout. We could open short positions on EUR/USD immediately at a bounce from 1.0741, bearing in mind a 30-35-pips downward move.

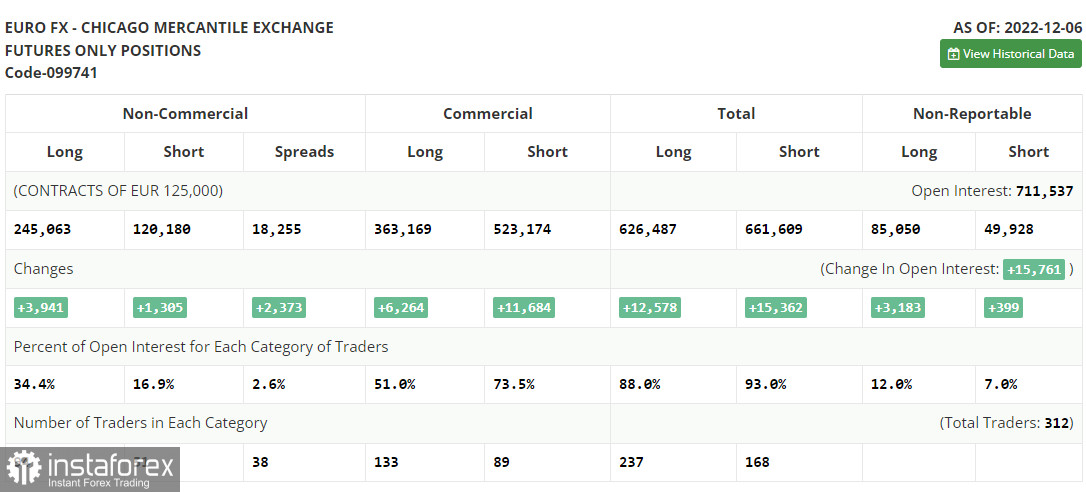

The COT report (Commitment of Traders) for December 6 recorded an increase in both long and short positions. Strong data on the US economic growth was released last week. On the other hand, traders got to know a similarly strong report on GDP growth in the Eurozone in Q3 2022, which was eventually upgraded. This ensured the demand for risky assets. However, everything could have changed this week as the market was alert to the highly anticipated US inflation data. The actual CPI reading came in softer than expected in November in annual terms.

Today, the Federal Reserve is completing its two-day policy meeting. Fed Chairman Jerome Powell may revise his rhetoric to more hawkish one, which will support the US dollar. It turns out that inflation in the US has been ebbing away. Therefore, a larger upward push for the euro could be expected by the end of the year. The COT report indicated that long non-commercial positions rose by 3,941 to 245,063, while short non-commercial positions jumped by 1,305 to 120,180. At the end of the week, the total non-commercial net position rose slightly and amounted to 123,113 against 122 234. It means that investors are still optimistic and ready to continue buying the euro at current levels. The market just needs a new fundamental reason. EUR/USD closed on Friday lower at 1.0315 against 1.0342, the closing price of the previous week.

Indicators' signals:

The currency pair is trading above the 30 and 50 daily moving averages. It indicates a further bullish trend.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD goes down, the indicator's lower border at 1.0612 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.