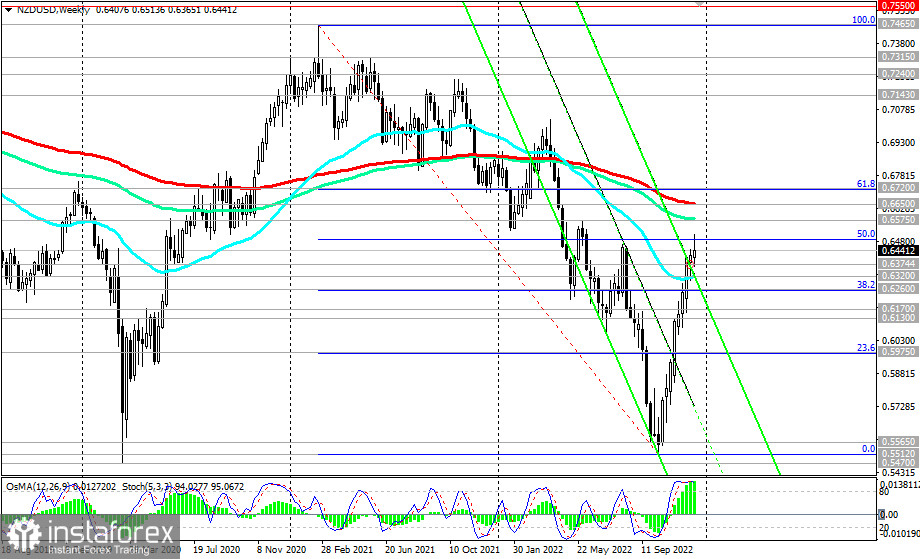

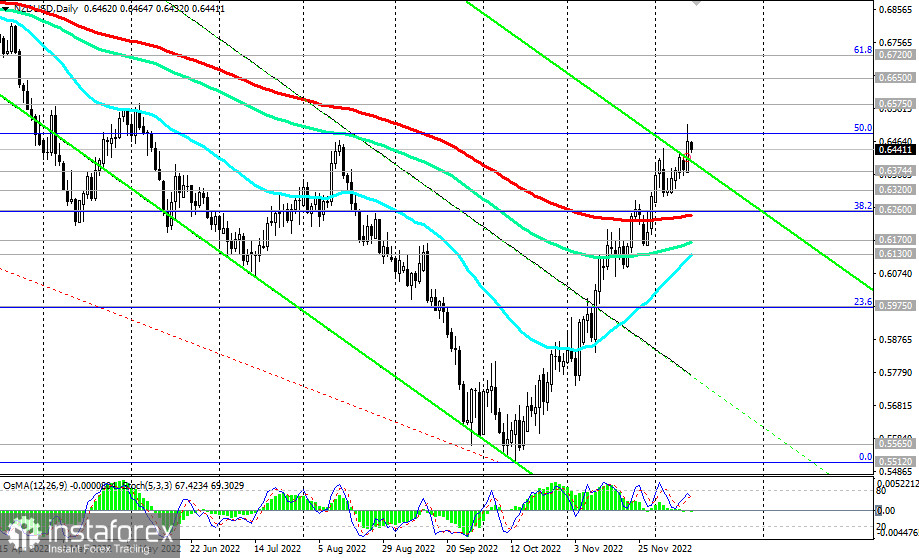

As of writing, NZD/USD is trading near the 0.6440 mark, maintaining a positive trend. Last month, NZD/USD broke through the key resistance levels 0.6260 (200 EMA on the daily chart and the 38.2% Fibonacci retracement of the upward correction in the wave of decline from 0.7465 to 0.5512), 0.6320 (50 EMA on the weekly chart), and continues to move towards the resistance levels 0.6575 (144 EMA on the weekly chart), 0.6650 (200 EMA on the weekly chart).

Whether the price will reach these levels or not, and in the coming days, a lot will depend on today's Fed decision on interest rates and the rhetoric of accompanying statements.

In the event that the Fed's super-tight cycle of monetary policy continues and the same tough decision is made, it is logical to assume that the USD will resume growth, or at least stop its fall. In this case, we are waiting for a rebound from current levels and a decrease in NZD/USD.

If Powell fails to dissuade the sellers of the dollar and his hawkish comments look more like just attempts to slow down the accelerated weakening of the US currency, then a further fall of the dollar cannot be avoided. In this case, further growth of NZD/USD will push the pair to the above resistance levels 0.6575, 0.6650.

A breakdown of the long-term and key resistance level 0.6720 (200 EMA on the monthly chart and the 61.8% Fibonacci retracement level) will mean the exit of the NZD/USD pair into operational space in a long-term bull market zone.

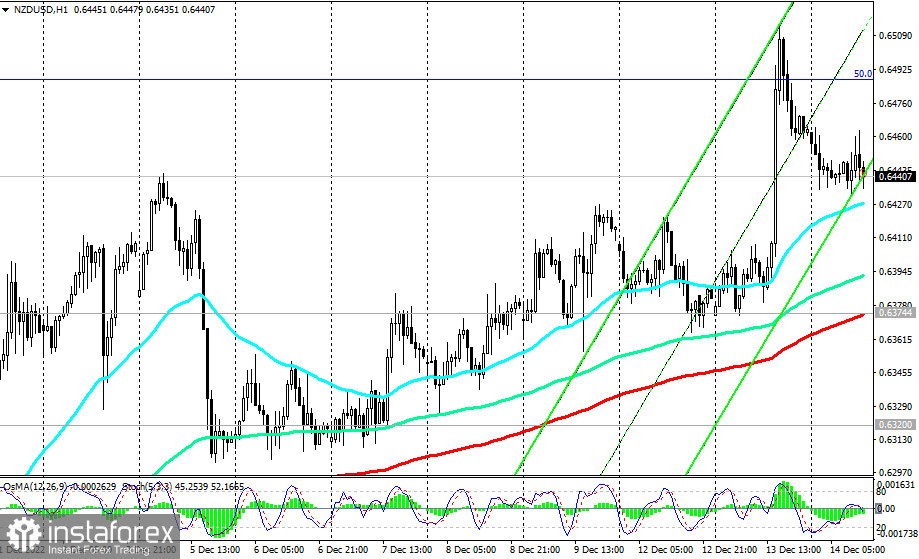

The first signal for the resumption of short positions will be a breakdown of the important short-term support level 0.6375 (200 EMA on the 1-hour chart). A break of the 0.6260 support level will return the pair to the global bear market zone.

Support levels: 0.6374, 0.6320, 0.6300, 0.6260, 0.6200, 0.6170, 0.6130

Resistance Levels:0.6495, 0.6575, 0.6650, 0.6720

Trading Tips

Sell Stop 0.6390. Stop-Loss 0.6515. Take-Profit 0.6320, 0.6300, 0.6260, 0.6200, 0.6170, 0.6130, 0.6080, 0.6050, 0.5975, 0.5940, 0.5900, 0.5860, 0.5600, 0.5565, 0.5512, 0.5470

Buy Stop 0.6515. Stop-Loss 0.6390. Take-Profit 0.6575, 0.6650, 0.6720, 0.6800