The euro bulls' optimism about yesterday's Federal Reserve meeting turned out to be in vain. The U.S. central bank raised the rate by the expected 0.50%, but retained the sentiment for a longer period of the tightening cycle, raising the average expectation for the final rate of the FOMC committee members from the previous 4.6% to 5.1%. Apparently this is what Fed Chairman Jerome Powell had in mind when he warned the market about a likely longer period of tightening than expected. As we expected in yesterday's review, the stock market did not survive the 0.50% rate hike and was down 0.61% (S&P 500). Yesterday's events marked the beginning of a mid-term stock market decline.

Also as we expected, eurozone industrial production in October came in worse than expected: -2.0% versus expectations of -1.5% and versus a downward revision from 0.9% to 0.8% for September.

The European Central Bank will announce its decision on monetary policy today. This is probably the only reason why investors did not sell off the euro, expecting support from the ECB. The European economy needs support. Germany has planned to raise its debt issuance by 540 billion euros to fight the energy crisis (in the pandemic year of 2021, Germany borrowed about 490 billion). As a consequence, the ECB will be pessimistic.

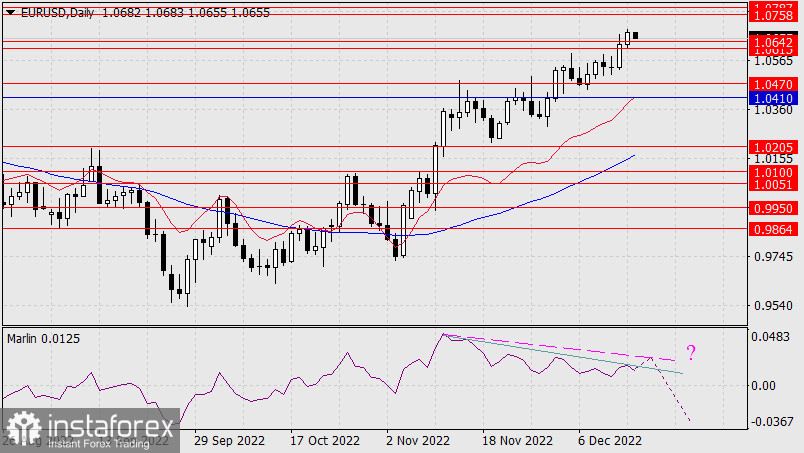

The technical picture has changed. On the daily chart, the divergence acquires a more classic appearance, though for a traditional appearance it needs to form closer to the dashed pink line, which will be another growth wave to the target range of 1.0758/87. But the price can also go down now, settling under the 1.0615/42 range, and then yesterday's exit above it will turn out to be false.

On the four-hour chart, the divergence, which was extremely weak yesterday because of the Fed meeting, remained and became stronger. Now it is in force, pushing the price down. The reversal option from the current levels becomes the main scenario. If the ECB and the market "correctly understand" the mutual goals and objectives, then after settling under 1.0615 we expect the price to fall to 1.0470.