The Fed meeting took place (and ended) last night, but the Bank of England meeting, whose outcomes will be made public to the market in a few hours, is now more crucial. How come? Since so many analysts, banks, and businesses in the financial sector had been discussing the Fed meeting's outcomes, the market was prepared for them. Additionally, the FOMC members themselves have stated time and time again that December will see a slowdown in interest rate growth. Only Jerome Powell's performance was intriguing. However, there are now many more uncertainties surrounding the Bank of England, and the direction of future monetary policy is obscured.

A lot of market participants believe that the Bank of England is unable to raise interest rates to a level that is "restrictive." As a result, the UK's inflation rate can return to 2% for a very long time. Given the recent slowdown, it might reach this level in the US within a year. Many people think that the British regulator will need to increase the rate even further, so it might need to be prepared. Andrew Bailey predicts that household debt will rise in the coming year. Real-world mortgage payments will rise. In the UK, wages are increasing much more slowly than other prices. Payments may become a significant issue for 70% of British people with "mortgages" in 2023. Many might start selling their homes, and landlords might raise the rent. The British economy will experience these issues in addition to a two-year recession. Long-term high inflation is expected, so the Bank of England may only raise interest rates by 50 basis points today.

While the British regulator's decision will be good for economic growth, it will also lead to many other inflationary issues. Since there is no discernible difference in the rate of economic growth if people's real incomes are falling by double-digit percentages, economic growth is not currently a top priority. If we use the Fed's strategy to combat inflation, the rate should increase by 75 points for at least another couple of meetings. This might lend the Briton even more support. However, the "hard scenario" cancellation could result in the instrument's long-awaited collapse.

Additionally, I'd like to point out that although British inflation has started to fall, it has only retreated from its 41-year high. Only after three to four months will it be possible to accurately assess this decline and determine how much more the Bank of England should raise interest rates to slow price growth to levels close to 2%. The Bank of England controls the British pound's future in the interim. Due to a rate increase of only 50 points, the market might see a significant decline in demand for the pound sterling. Since both instruments have been circling and creating a descending set of waves for several weeks, this is the scenario I am hoping for. I'm also hoping for a drop in demand for the euro currency after a 50-point increase in the ECB rate.

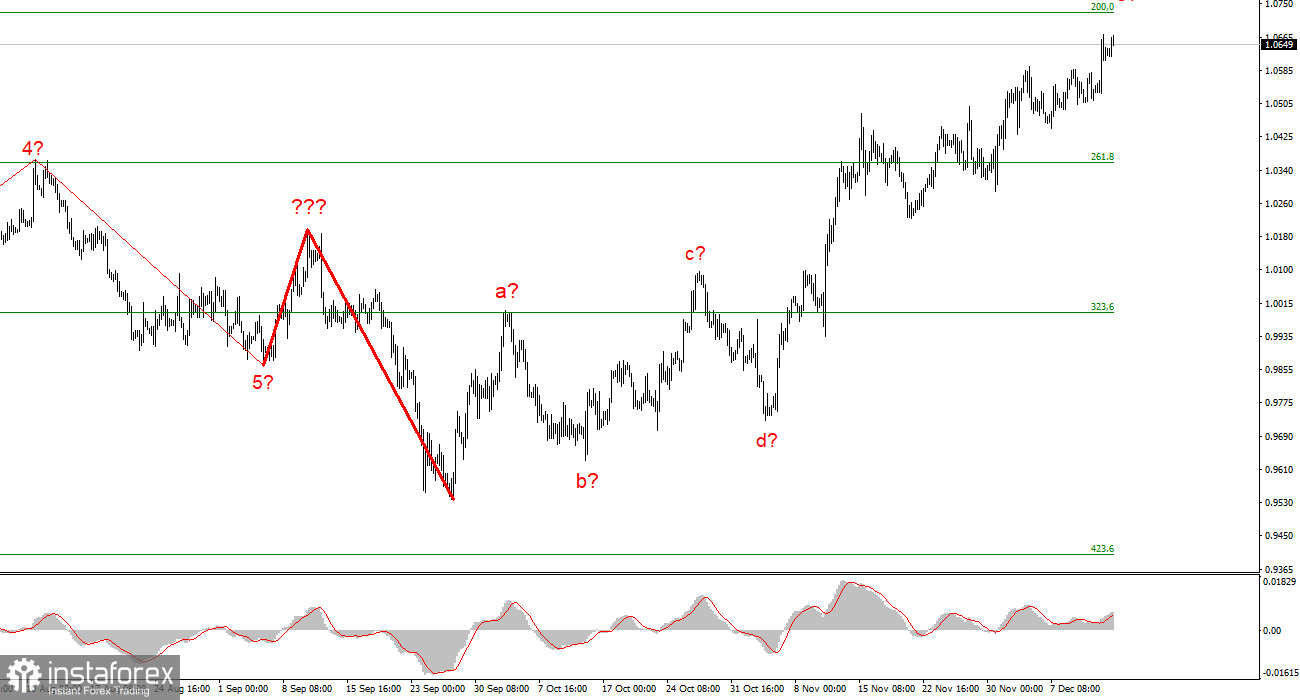

I conclude from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. You should wait for a strong sales signal because the upward section of trend could become even more extended and complicated. The likelihood of this happening is still high.

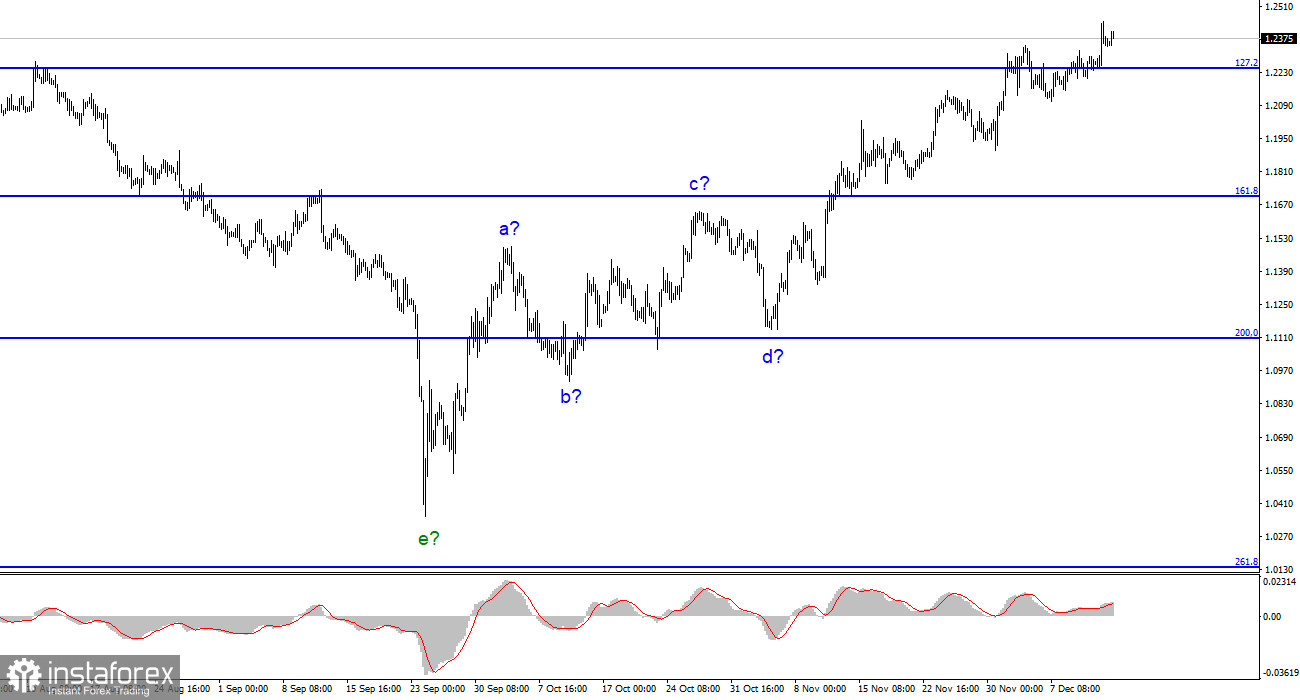

The construction of a new downward trend segment is predicated on the wave pattern of the Pound/Dollar instrument. I cannot advise purchasing the instrument at this time because the wave marking permits the construction of a downward trend section. With targets around the 1.1707 mark, or 161.8% Fibonacci, sales are now more accurate. The wave e, however, can evolve into an even longer form.