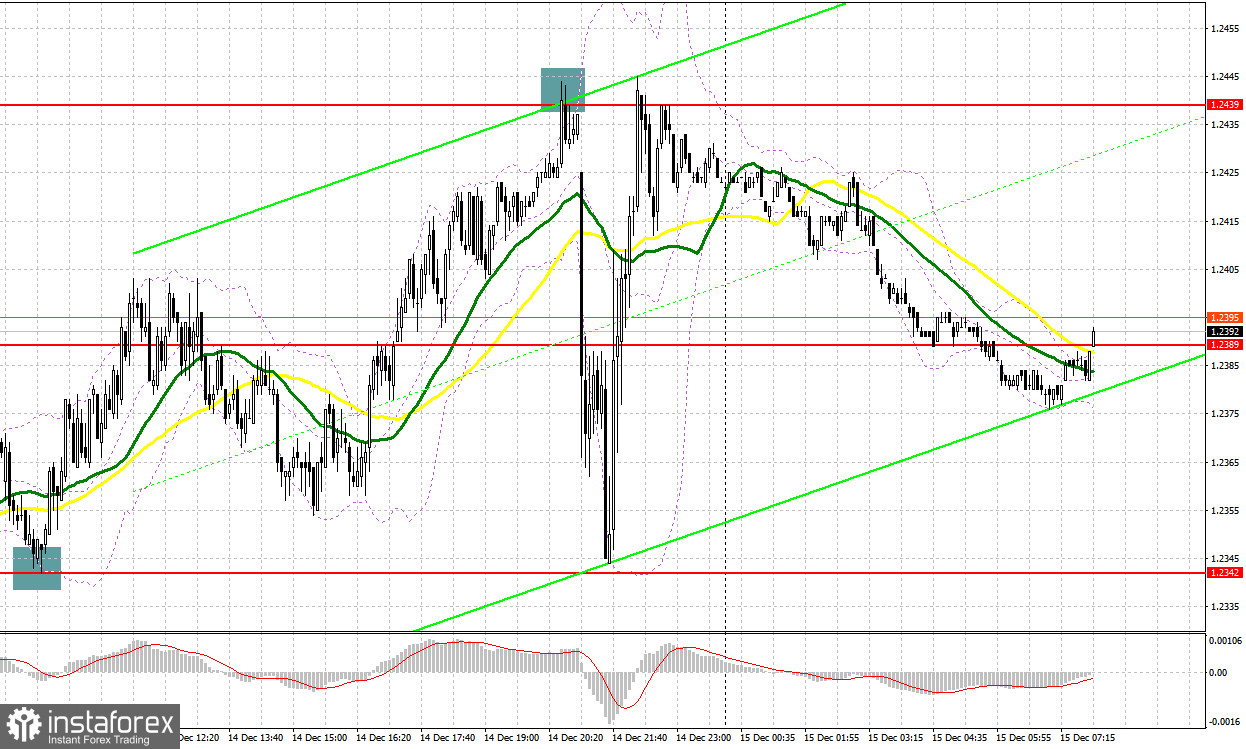

Yesterday, there were several excellent entry points. Let's look at the 5-minute chart and figure out what actually happened. In the morning article, I turned your attention to 1.2342 and recommended making decisions with this level in focus. A decline and a false breakout of this level after a positive UK inflation report created excellent entry points into long positions within the uptrend. The pair went up by about 60 pips. In the afternoon, the pound sterling reached the resistance level of 1.2499 followed by a false breakout and a sell signal. However, the pound sterling slid sharply by 100 pips from the entry point due to the Fed's rate decision.

When to open long positions on GBP/USD:

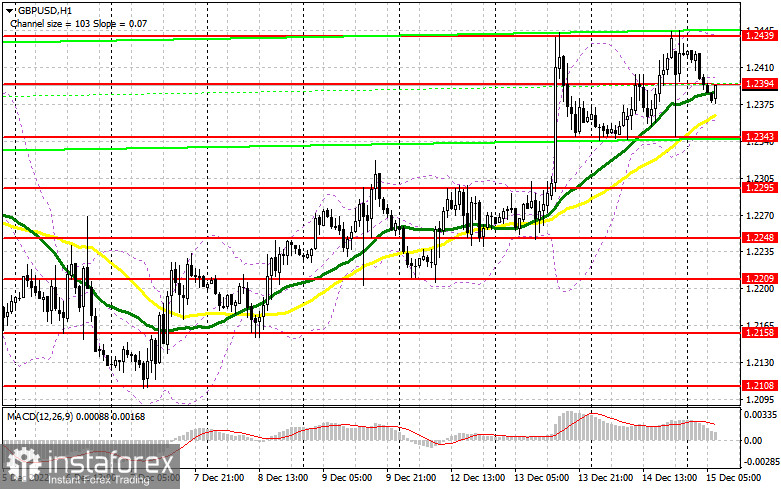

The pound sterling snapped its winning streak following the Fed's decision to stick to monetary tightening. Hence, its further prospects are vague. Today, the Bank of England will hold its meeting. Its decision may deliver a severe blow to the bullish momentum as the regulator is likely to choose less aggressive tightening due to a looming recession and the cost of living crisis. BoE Governor Andrew Bailey has mentioned such a scenario more than once. If the pair drops, only a false breakdown of a strong support level of 1.2343 will help it return to 1.2394, the middle of the sideways channel. So, the bulls need to ensure a breakout above this level. If they succeed, the pair could reach a monthly high of 1.2439. If the quotes climb above this level, it will open the way to 1.2484 where I recommend locking in profits. If the bulls fail to push the pair to 1.2343, I would advise you to postpone long positions until a false breakout of 1.2295 takes place. At this level, moving averages are passing in positive territory. You could buy GBP/USD immediately at a bounce from 1.2248, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Sellers asserted strength yesterday, taking advantage of Jerome Powell's comments at the press conference. Today, bears need to take control of the resistance level of 1.2394 if they want to cement a downward movement. Therefore, only a false breakout of 1.2394 will give a good sell signal with the prospect of a decline to the support level of 1.2343. Bulls and bears are likely to fight hard for this level as it was yesterday. Only a breakout and an upward retest of this level will provide selling opportunities. The pair could slip to 1.2295. However, it will hardly decrease lower ahead of the BoE meeting and the US retail sales report. A more distant target will be the 1.2248 level where I recommend locking in profits. If GBP/USD grows in the European session and the bears show no energy at 1.2394, which is also likely, the bulls will regain the upper hand. Only a false breakout of 1.2439 will give a sell signal with the prospect of a further downward movement. If bears show no activity at that level, you could sell GBP/USD immediately at a bounce from a high of 1.2484, keeping in mind a downward intraday correction of 30-35 pips.

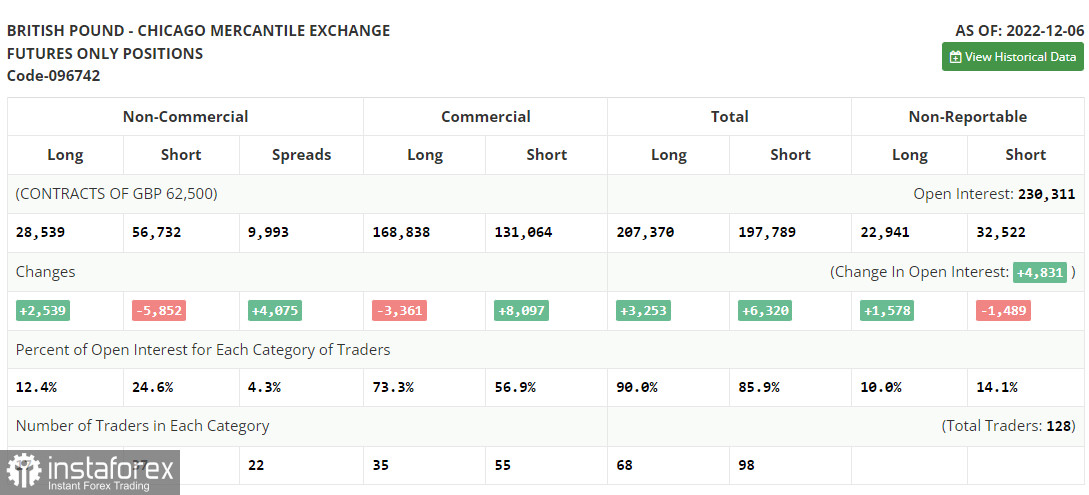

COT report

The COT report (Commitment of Traders) for December 6 logged an increase in long positions and a drop in short ones. Apparently, GBP bulls are confident that the uptrend will persist as the Fed is widely expected to shift to a less hawkish stance. It means that the rate gap between the BoE and the Fed could narrow in the near future. However, the UK Business activity data released last week turned out to be rather disappointing. It clearly indicated a looming recession in the economy. The UK GDP report was slightly better than expected. However, the third straight month of a contraction in economic activity confirms growing recession concerns. Given that the Bank of England is strongly committed to taming inflation and raising the interest rate, the economic prospects are rather grim. It explains why traders are cautious when buying the instrument despite the short-term uptrend. According to the latest COT report, short non-commercial positions dropped by 5,852 to 56,732 and long non-commercial positions grew by 2,539 to 2,8539. Consequently, the non-commercial net position came in at -28,193 versus -36,584 a week ago. The weekly closing price of GBP/USD grew to 1.2149 against 1.1958.

Indicators' signals:

The GBP/USD pair is trading above the 30 and 50 daily moving averages. It indicates that bulls are trying to carry on with the uprend.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD rises, the indicator's upper border at 1.2439 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.