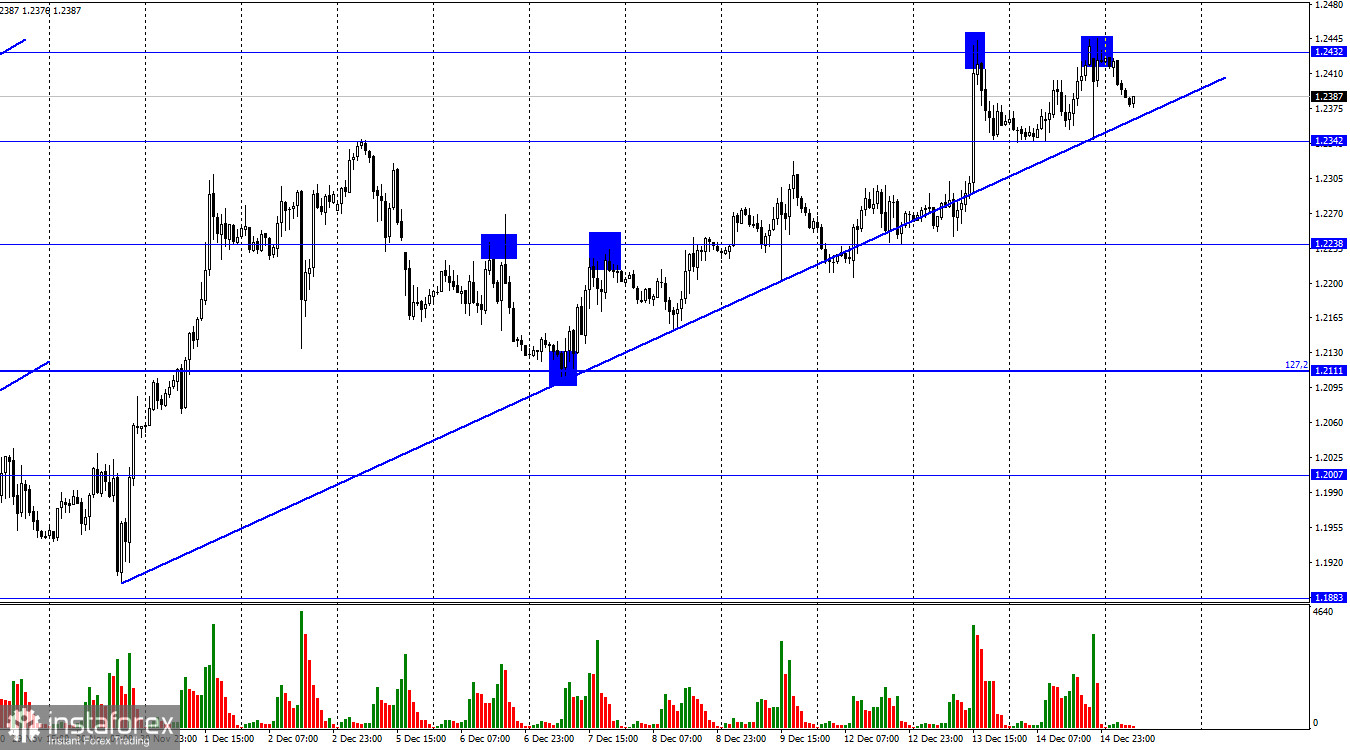

Hello, dear traders! According to the 1-hour chart, yesterday the GBP/USD pair advanced to the correction level of 1.2432, bounced off it, and then turned around towards the downside. Currently, the quotes are sliding to the level of 1.2238. Yesterday's meeting of the Fed had almost no impact on the pair's dynamic. The ascending trendline still indicates a bullish mood. However, if the price closes below it, the British currency will most likely head towards the 1.2111 mark.

In addition to the Fed meeting, yesterday's macroeconomic calendar included data on UK inflation. However, market participants ignored the report, and the British pound continued to gain value. Now the focus of traders is on the BoE meeting, the outcome of which will be known in a couple of hours. The Bank of England is also expected to raise the key interest rate by only 50 basis points. Judging by losses posted by the pound sterling in early trade, traders consider this scenario to be the most likely one. Although today's calendar is full of important releases, they will hardly have a severe effect on market sentiment. Yesterday, Jerome Powell did not provide traders with any new information, with the dollar rising and falling after his speech. Today, the situation may repeat itself as I do not expect a major change in Andrew Bailey's rhetoric. If the British regulator does not lift the rate by 0.75%, market sentiment will remain unchanged. Nevertheless, trading activity may increase, and the market will see price swings.

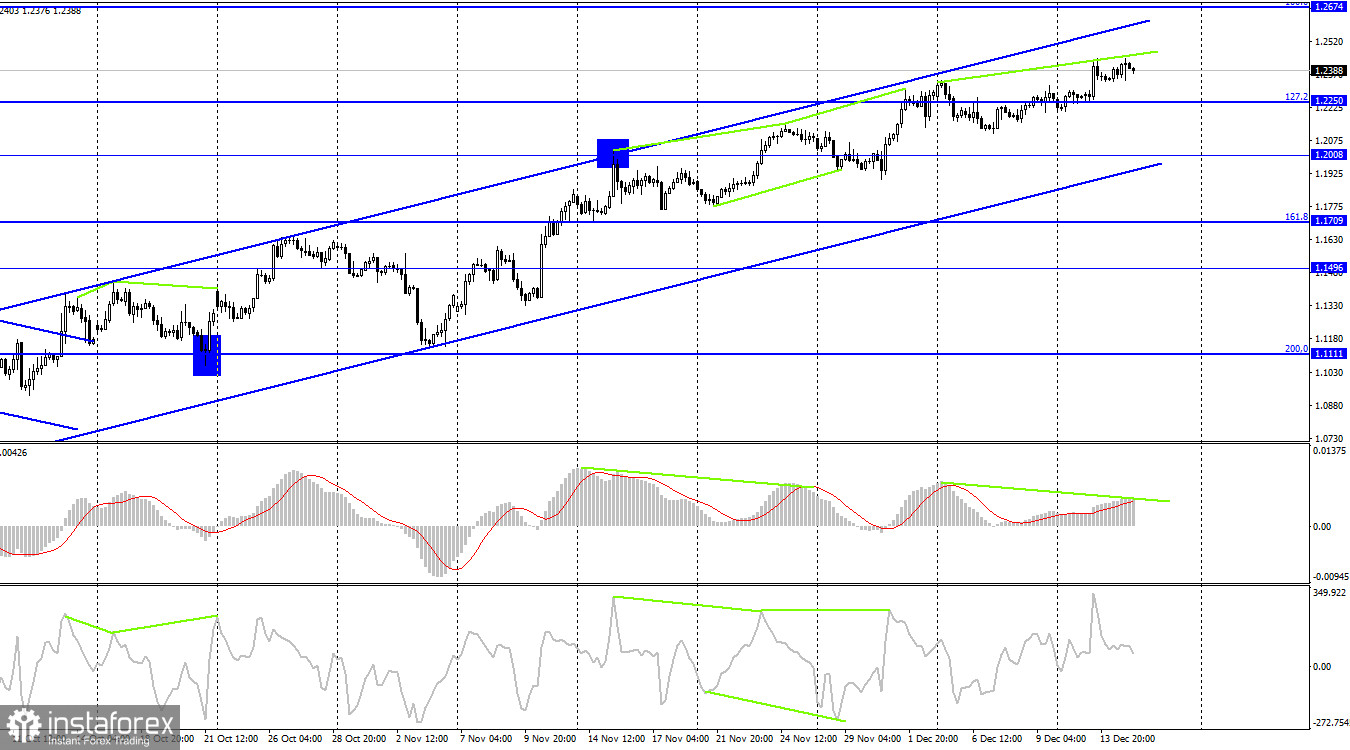

In my view, a drop in the British currency by 200-300 pips is long overdue. The ascending trend channel on the 4-hour chart speaks in favor of this assumption. Strong fundamental factors can contribute to this downward move. Besides, the weak rhetoric of the head of the Bank of England may also add to pressure on the pound sterling.

On the 4-hour chart, the pair has consolidated above 1.2250, the 127.2% Fibonacci retracement level. At the same time, the MACD indicator has a bearish divergence brewing within an uptrend, which may support the US currency and drag the pound sterling down to the lower boundary of the ascending trend channel.

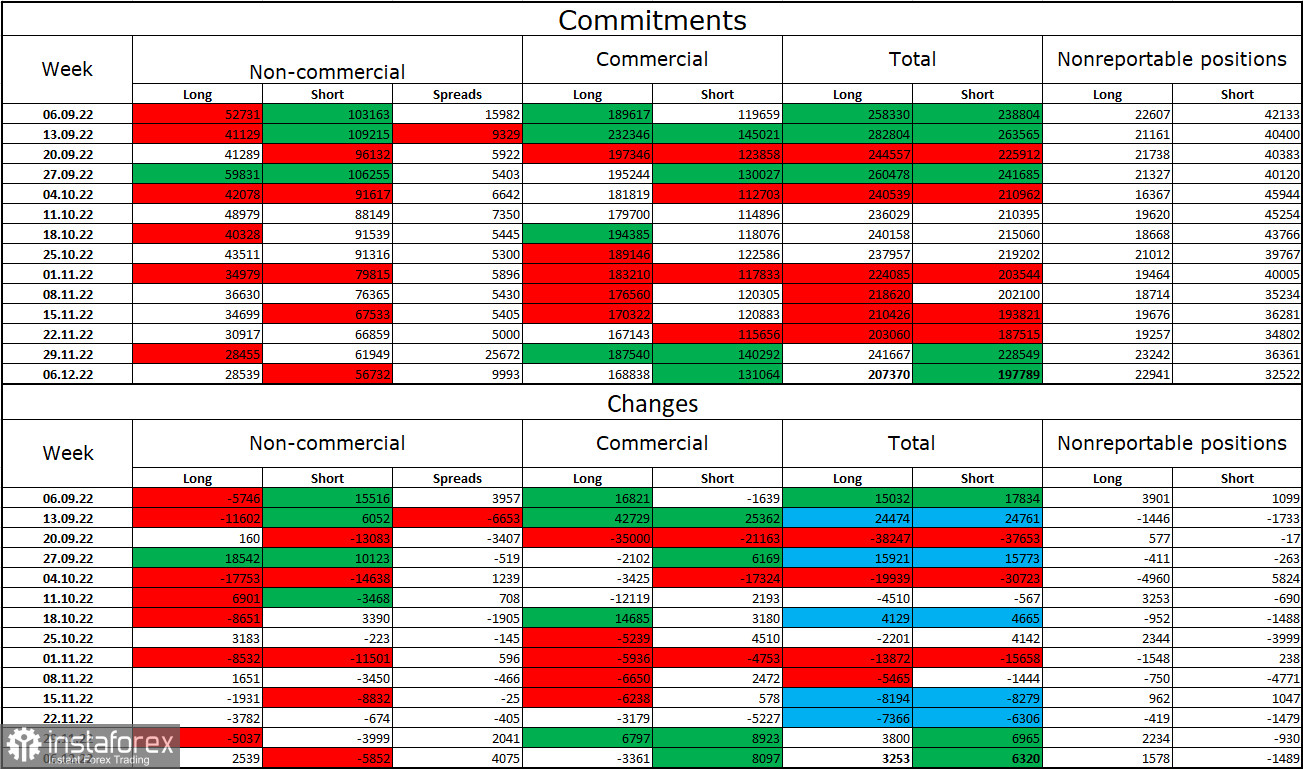

Commitments of Traders (COT) report:

Over the past week, the mood of non-commercial traders has become less bearish than a week earlier. The number of Long contracts has increased by 2,539, while the number of Short contracts has decreased by 5,852. At the same time, the general mood of major market players remains bearish, and the number of Short contracts is still well above the number of Long ones. Thus, the majority of big traders continue to sell the British pound. Their sentiment has been slowly turning to bullish in recent months, but this process is too prolonged. It has been going on for a few months now. Still, the number of Short positions is twice as high. The pound sterling may extend gains as graphical analysis speaks in favor of this scenario, in particular, the trend channel on the 4-hour chart. However, according to fundamental analysis, the situation is uncertain since there are also conditions for a rally in the US currency or they may appear as early as this week. Nevertheless, the pair is currently gaining value, but this rally seems a bit contrary to the COT reports. On the other hand, the net position of professional players is growing along with the pound sterling.

News releases from US and UK:

UK - Interest rate decision

UK - Minutes from the FOMC meeting

US - Retail Sales

US - Initial jobless claims

US - Industrial production

On Thursday, the macroeconomic calendar is full of important releases from both the US and UK, but the focus of market participants will be on the BoE meeting. Today's statistics may have a severe impact on market sentiment.

GBP/USD forecast and trading tips:

I recommend going short on the British pound with a view to reaching the target levels of 1.2238 and 1.21111 in case of a rebound from the level of 1.2342 on the 1-hour chart. Now these positions can be kept open. In my view, long positions in the British pound are risky.