The Federal Reserve is starting to frown, and the European Central Bank is ready to face its fears from the past. These are the results of the meetings of central banks that rocked the EURUSD boat. Having soared to the highest level since the beginning of June, the main currency pair is ready to return below the 1.06 mark. If the Fed is dissatisfied with the behavior of financial markets, should they continue to play on the nerves of the central bank?

Investors should have been surprised by how immune the Fed was to the slowdown in November inflation from 7.7% to 7.1%. The text of the accompanying statement has not changed much. The FOMC still "anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time." At the same time, Fed Chairman Jerome Powell said that more evidence is needed to show that price increases are coming down in the long term.

Even more important is the almost unanimous decision of the FOMC members to raise the forecast for the ceiling on the funds rate to 5%, with the futures market expecting it at 4.8%. Powell noted that the current financial conditions were not tough enough and the central bank, when making decisions in the field of monetary policy, will take into account their dynamics in the future. This means that if stock indexes continue to rise and Treasury yields and the US dollar fall, the Fed will be forced to accelerate rate hikes.

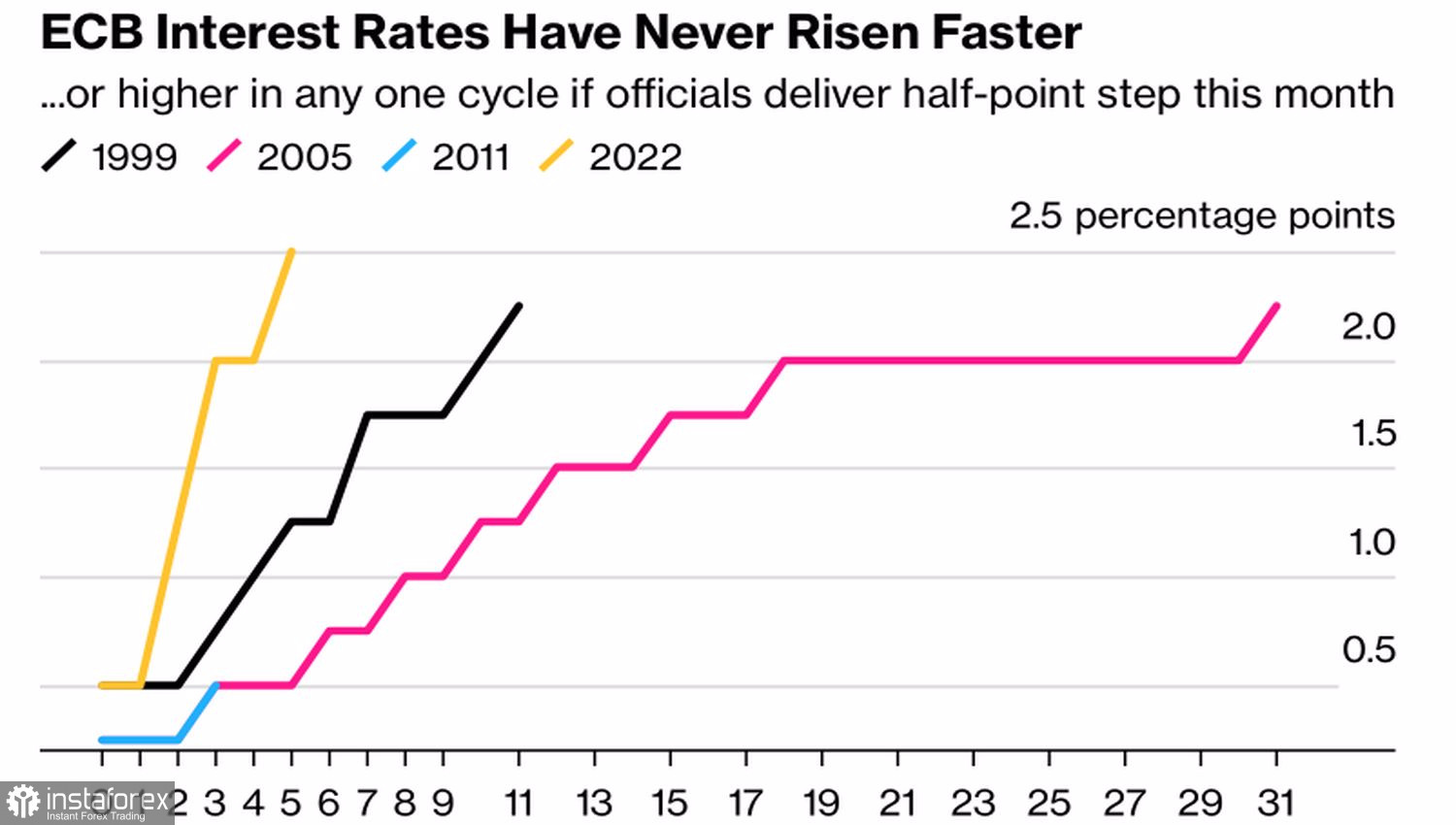

Thus, the manifestation of discontent is more than enough for investors to fall in love with the greenback again. Moreover, the ECB is unlikely to be able to surprise with anything. 48 of 51 Bloomberg experts predict an increase in the deposit rate by 50 bps, as a result of which it will rise to 2.5%. This is the fastest tightening of monetary policy and the level that in the past caused turmoil in the financial markets of the eurozone and forced the ECB to make adjustments to monetary policy.

ECB monetary tightening cycles

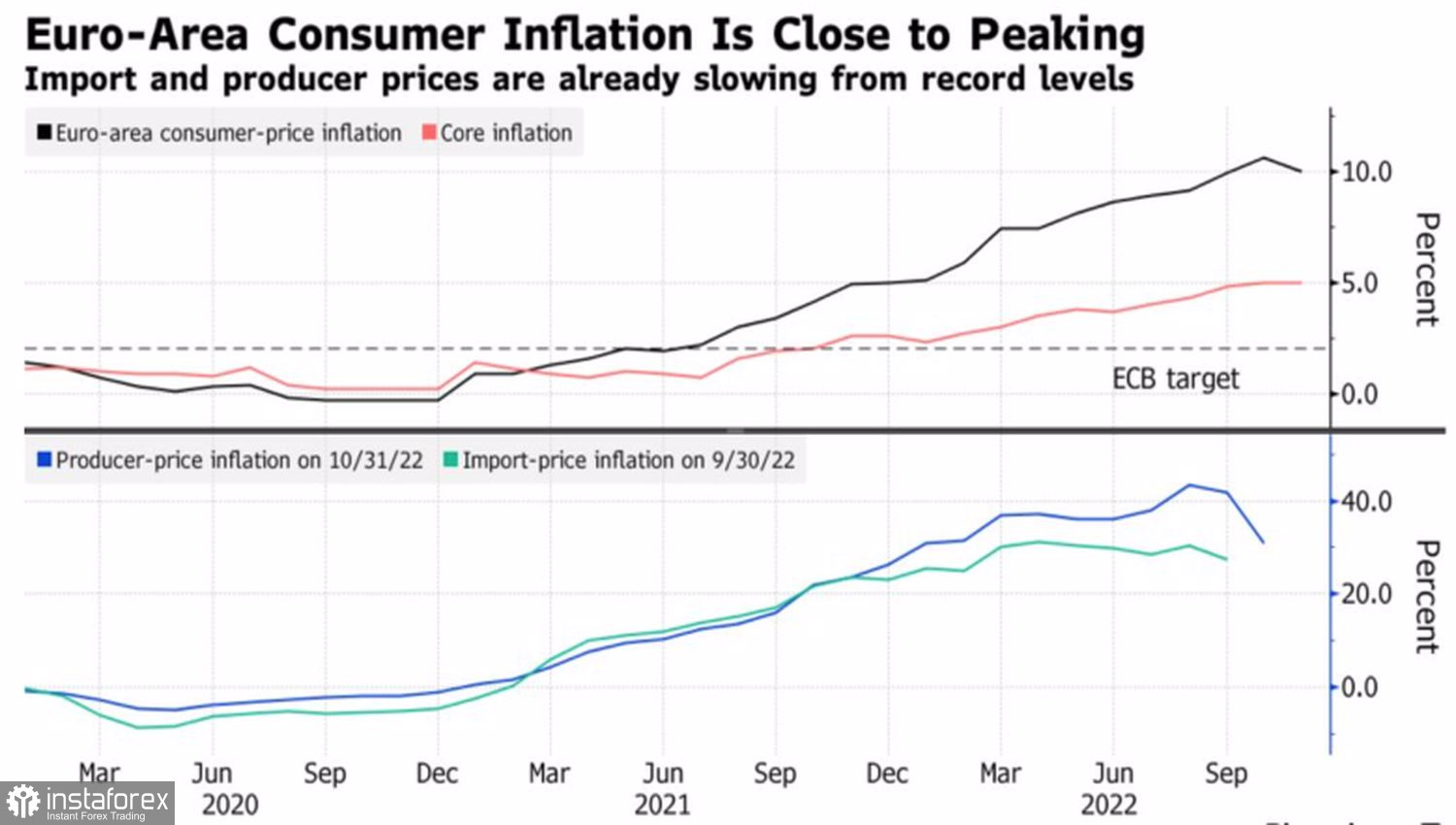

Given the pent-up effect of higher rates on the economy, the concern of the Governing Council's doves is understandable. In addition, the eurozone labor market is significantly less strong than in the U.S., so it will be easier for the ECB to cope with inflation. Especially since it is already starting to slow down. This can be seen not only in consumer prices but also in other indicators.

European inflation dynamics

So the idea that the ECB simply cannot raise the cost of borrowing too high because the economy cannot handle it, and it doesn't need to, is starting to look more plausible. At the same time, the return of U.S. inflation to growth could bring back the fading investor interest in the U.S. dollar.

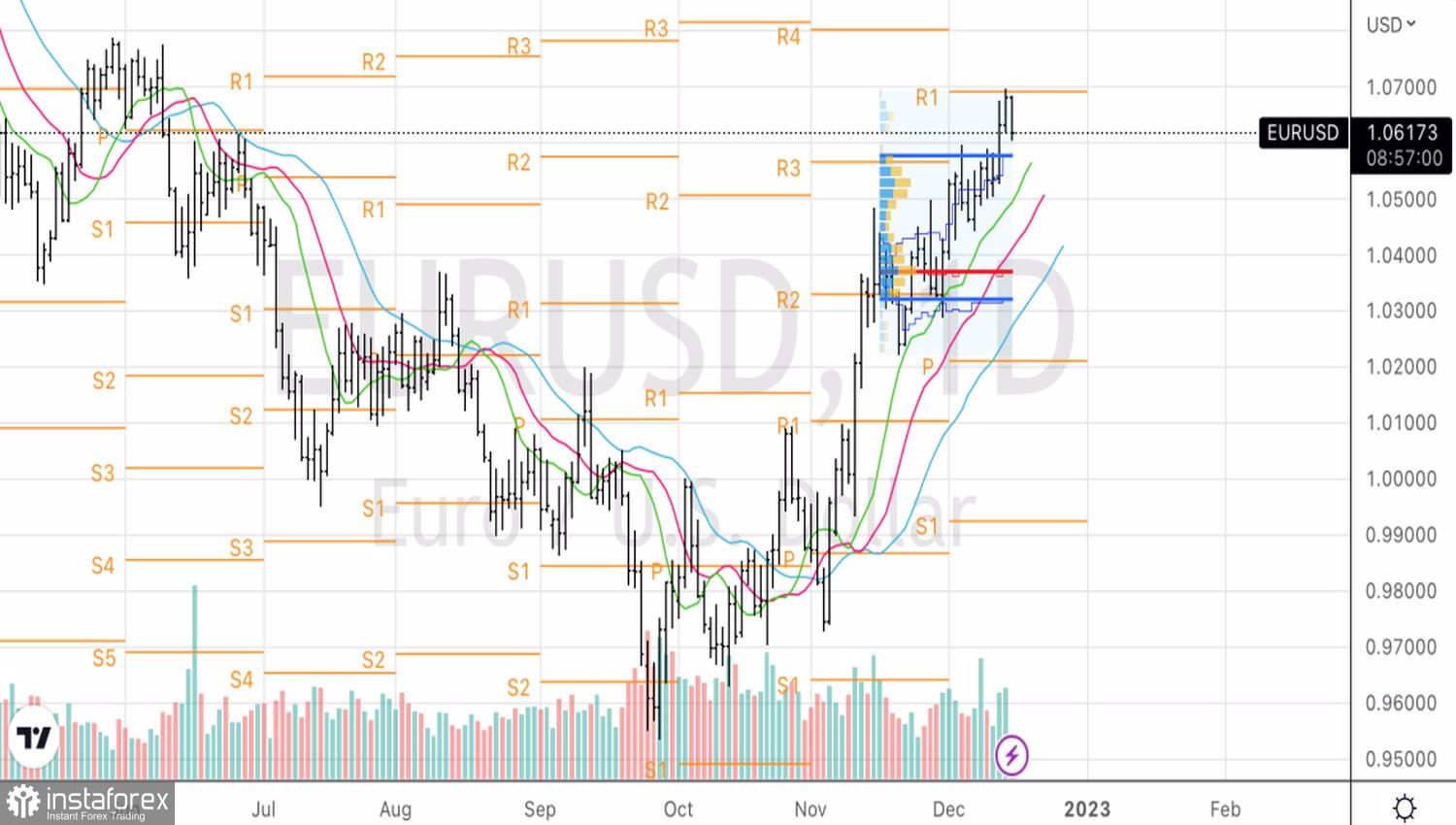

Technically, on the daily chart, EURUSD clearly worked out the strategy that was presented in the previous article, to buy the pair at 1.067, with a subsequent reversal from the pivot-level at 1.0695. Shorts are kept and built up in case of a successful attack on supports at 1.061 and 1.0575.