The Bank of England raised interest rates for the ninth straight time to a 14-year high of 3.5%, continuing efforts to rein in inflation.

The nine-member Monetary Policy Committee shared three views on the decision as officials tried to balance the risk of inflation taking root and too much pressure on growth as the economy enters recession.

Six members, including BoE Governor Andrew Bailey, voted for a half-point hike. Catherine Mann favored a three-quarter point, while Silvana Tenreyro and Swati Dhingra supported keeping rates unchanged.

"The majority of the committee judged that, should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank rate might be required for a sustainable return of inflation to target," the Bank said.

Money market traders cut bets on a rate hike, with interest rates rising to 4.52% by August, up from 4.61% before Thursday's half-point hike.

In a Treasury Department statement after the decision, Treasury Chancellor Jeremy Hunt acknowledged that higher rates would be difficult for many households.

The minutes of the meeting showed that the Monetary Policy Committee (MPC) believed that "the labor market remained tight across the month. There are also signs that inflationary pressures could stick around for longer than thought" and thus justify drastic monetary policy action.

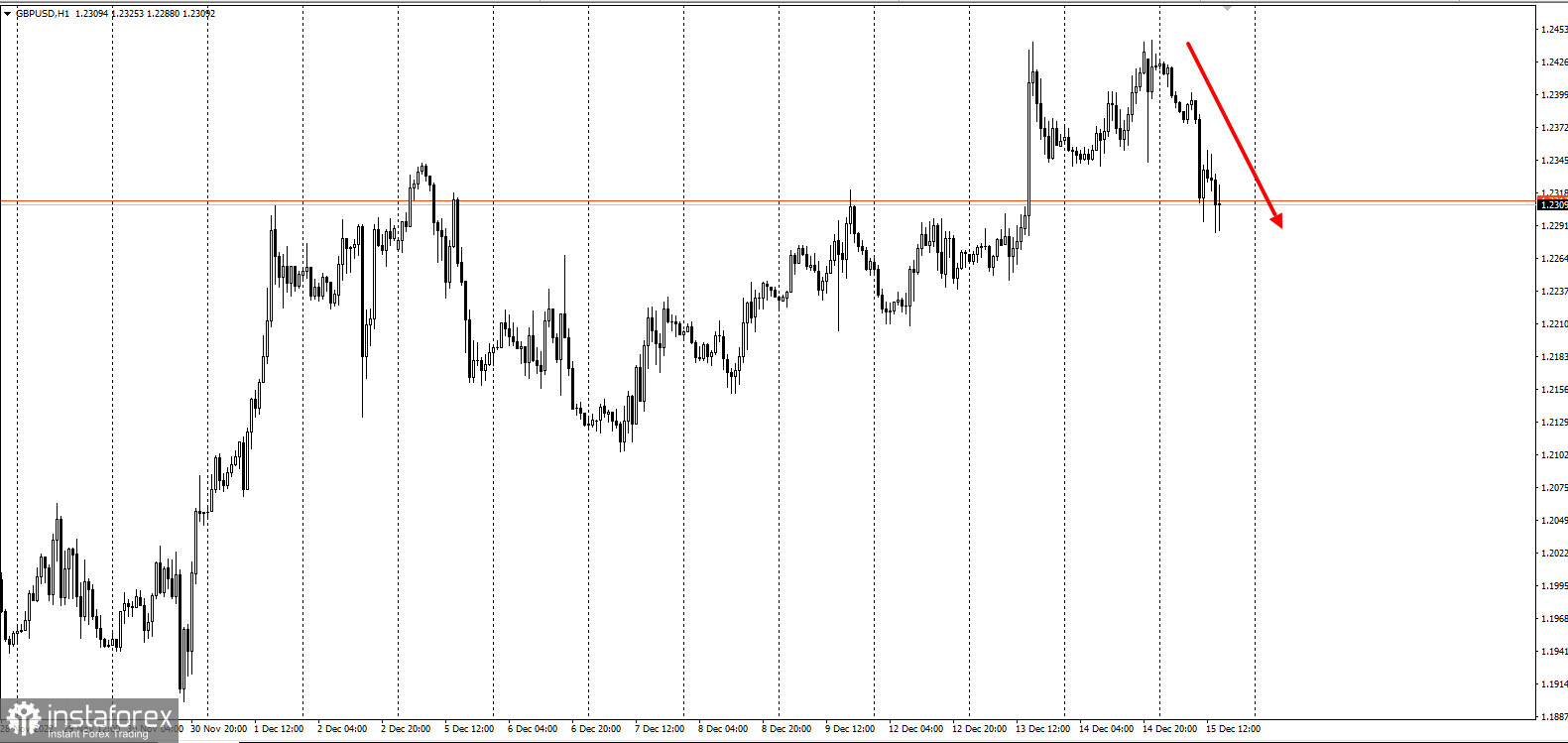

GBPUSD met the rate with a fall in the correction:

The Bank estimates that the U.K. is now in recession, although the economy was slightly stronger than expected in November. According to the BoE, gross domestic product is likely to fall 0.1% in the fourth quarter after a 0.5% decline in the third quarter.

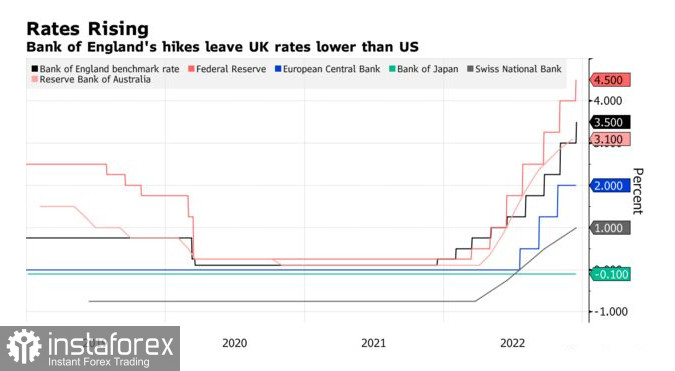

The BoE's decision, which raises rates to their highest level since November 2008, comes after the U.S. Federal Reserve softened its tightening plans by raising rates by half a point Wednesday, bringing its target range from 4.25% to 4.5%.

The BoE is facing its highest inflation rate in four decades and shows that it is becoming an integral part of the wage-setting system. This has led to the fastest cycle of monetary tightening since the late 1989s. However, official data this week showed that inflation has already passed its peak.

The central bank will publish a market notice at 6 p.m. Friday outlining the progress of gilt sales under its quantitative tightening program and the operational arrangements for the first quarter of 2023.

The BoE said the pace of gilt sales is ahead of schedule, which will reduce the portfolio earlier than initially anticipated. The central bank reduced the stock of gilts in its portfolio by by 44 billion pounds compared to 2022 as a whole, bringing government bonds in its Asset Purchase Portfolio to 831 billion pounds.