The European Central Bank meeting was held yesterday. The rate was raised by 0.50%, and the ECB decided to reduce its holdings in the APP program. The decline will amount to €15 billion per month on average until the second quarter of 2023. The Committee expects at least two more raises of 0.50%. The euro jumped more than 100 points on such news. But then active investors saw oil falling, the U.S. stock market going down a bit late for the previous Federal Reserve meeting, and the euro closed the day with a loss of 53 points.

The market went with our scenario, as the stock market fell and the euro along with it. The S&P 500 is down 2.49%. Take note that the European stock indices started falling right from the opening, which means that they showed even more weakness for the rate hike (as representatives of the weaker economy) than the U.S. market. The European Euro Stoxx 50 collapsed by 3.51%.

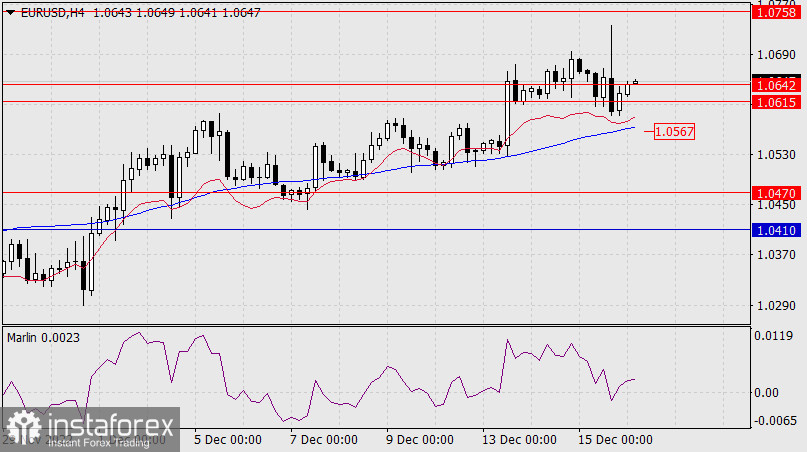

The reversal of the single currency is coming hard. It has not reached the target range of 1.0758/87, but the readings of the Marlin oscillator, which is persistently declining, confirming the divergence, suggests a new historical extreme of 1.0736. The price is now pondering in the range of 1.0615/42. A consolidation under it opens the way to 1.0470, the low of April 28.

On the four-hour chart, the price is settling in the range of 1.0615/42. A reverse consolidation above the range will complicate and slow down the reversal. The MACD line, which is just below this range (1.0567), is also slowing the decline. The Marlin oscillator did not get ahead of events this time and returned to the positive area. We are waiting for the euro to complete its preparation for the downward movement.