So, let's try to puzzle out what exactly happened yesterday. Interestingly, during Christine Lagarde's press conference, the single European currency spiked to 1.07 and rapidly tumbled to 1.06. If we level off these gyrations, the market literally remained flat. How come? What to expect from EUR/USD?

In a widely expected move, the ECB raised the key policy rate by 50 basis points. Basically, the market gave no response to the decision because it was ready for this. The single European currency began its rally during the press conference of the ECB President. The reason for the rally is not only Lagarde's comments but also the red-hot economic outlook where the regulator significantly upgraded its inflation expectations for the year ahead. Christine Lagarde commenced her speech by confirming such revisions and openly stated that the ECB would proceed with rate hikes at the same pace. It was enough to assure investors that the ultimate level of interest rates in Europe would be higher next year than in the US. Notably, the ECB leader didn't answer the question of how long the regulator intends to increase the refinancing rate.

The euro retraced instantly and lost all its impressive gains. The decline was even more rapid than the previous rally. Apparently, most market participants digested the new economic outlook which is full of inconsistencies and contradictions. In particular, the unemployment rate is expected to remain at 7.0% for the next 3 years. It is rather high.

Under such employment conditions, rate increases are a risky venture as this might unleash a profound economic crisis. The tool for fighting against unemployment is exactly the opposite policy of decreasing interest rates.

In other words, the ECB has to solve a tough dilemma. The first option is to raise interest rates. Alternatively, the regulator might have to lower interest rates. It turns out that the ECB will have either to go ahead with its monetary tightening, albeit in a moderate and cautious manner, or neglect the labor market. The second option is lame. The first one means that the hawkish rhetoric of Christine Lagarde should be taken with a pinch of salt. There is a slim chance that interest rates in Europe will end up at higher levels than in the US.

Another thing that arouses questions is energy prices. Judging by the ECB forecasts, gas prices are set to go down year after year. Eventually, in 2025, gas prices could be almost twice lower as now. Curiously, the forecast doesn't explain what exactly will push gas prices down. At the same time, Japan's Ministry of Economy, Trade and Industry said recently that all LNG available worldwide had been invoiced until 2025. In other words, there are no other sources of natural gas. That said, the point about gas prices sounds unrealistic and looks like a cherished dream. If so, all other predictions, especially regarding economic growth rates, arouse serious doubts. Besides, jobless rates could be also way above the forecast.

Bottom line

The market is obviously puzzled about the striking discrepancy between the remarks of the ECB President and the forecast presented by her analysts. Therefore, the market is still in suspense because of growing uncertainty. While market participants are trying to figure out the ECB's further policy moves, EUR/USD is going to trade sideways for a while. More and more arguments signal that the ECB will hardly raise interest rates at least to catch up with the Federal Reserve. Moreover, the same factors indicate that the ECB will be the first to begin scaling back its interest rates.

ECB's interest rate on main refinancing operations

As for the EUR's prospects, the single European currency is set to weaken. This could happen already today due to preliminary PMIs. All PMIs for the Eurozone without exception are likely to go down whereas the PMIs for the US are expected to improve.

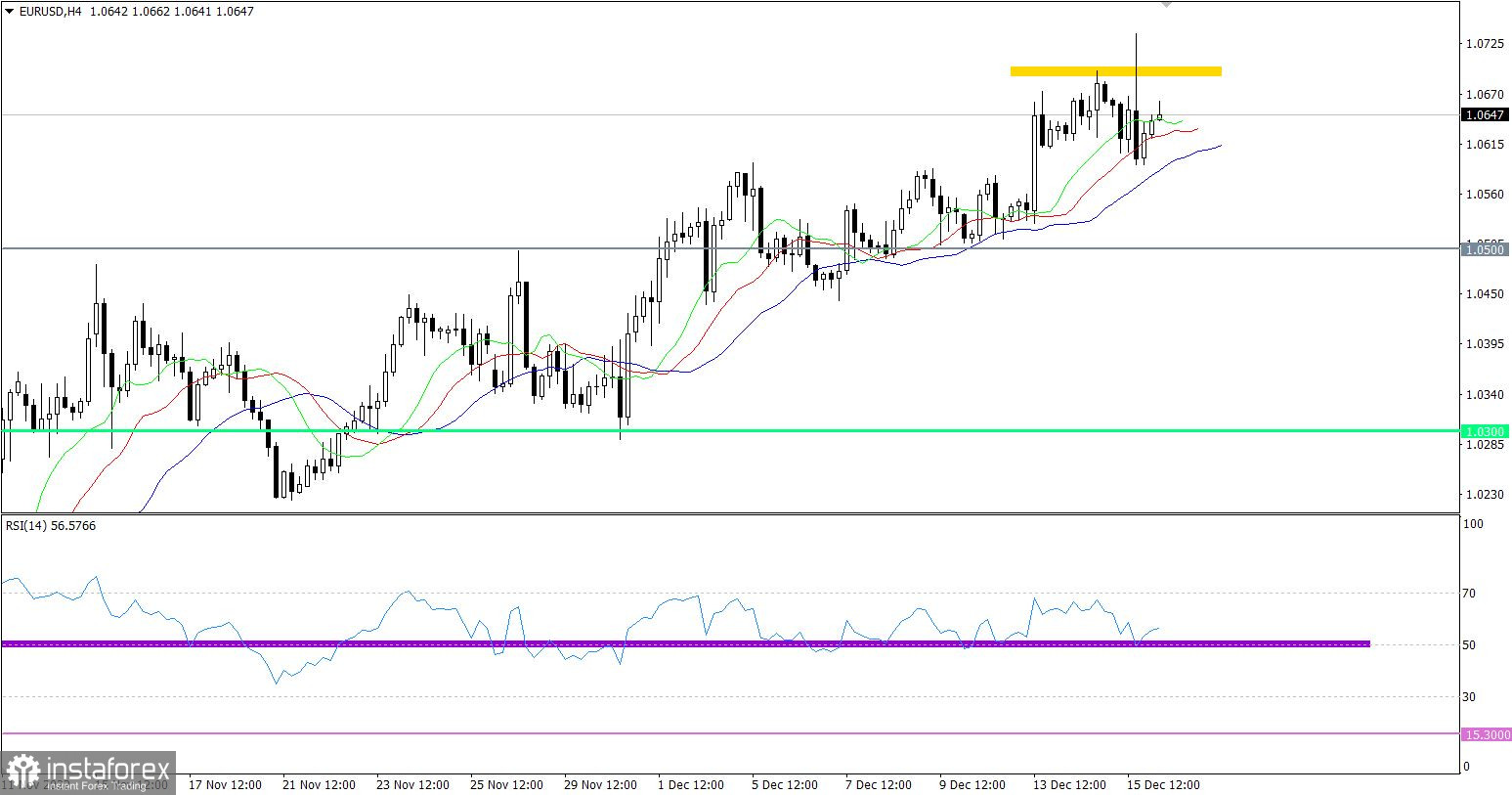

The euro gained ground against the US dollar amid speculative bets opened in light of the ECB policy update. Such speculative activity didn't cause radical changes. EUR/USD topped out above 1.0700 and rapidly dropped to previous levels. In fact, the currency pair has been stuck sideways at the peak of the ascending cycle.

The H4 RSI has been moving at the upper area of 50/70. It means that traders are mainly interested in long positions.

Moving averages of the H4 and D1 Alligator are directed upwards. This technical signal proves the bullish sentiment among traders.

Outlook and trading tips

If EUR/USD settles above 1.0700 at least in the 4-hour timeframe, the ongoing upward cycle is likely to extend. In this case, the euro could climb to 1.0800 as the first target.

The alternative scenario suggests that the flat market could set the stage for a correction on the condition that the price fails to settle above 1.0700.

Complex indicator analysis provides mixed signals for short-term and intraday trading because of the range-bound market. Technical indicators generate a buy signal for the medium term.