The ECB has warned that aggressive interest rate hikes are far from over, suggesting that rates for the eurozone will remain increasing just as recession begins. This statement is quite striking because even though each rise in borrowing costs helps contain inflation, it risks a more severe damage to the economy.

And now that inflation is in double digits and officials predict it will remain above the 2% target in the coming years, this week's meeting set the tone for further tightening of monetary policy.

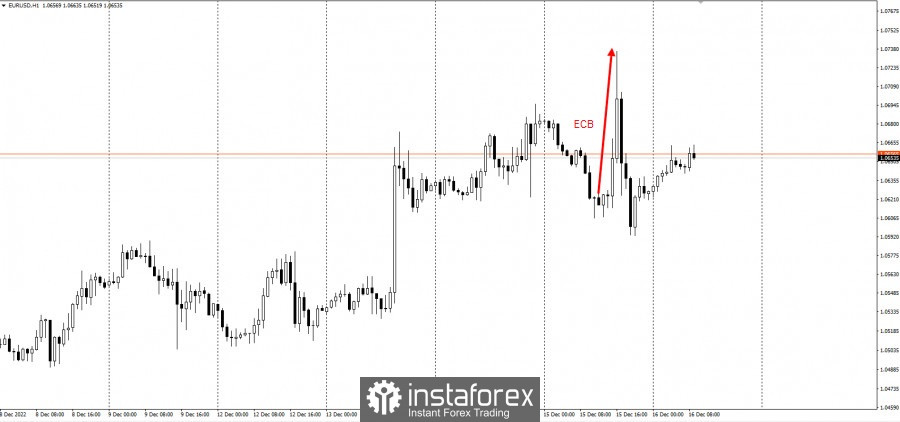

Unsurprisingly, EUR/USD surged by 1,200 pips after the ECB press conference.

Although the accompanying rate hike is slower than the previous ones, ECB President Christine Lagarde insisted that there are still a few half-point moves ahead. This is despite an economic slowdown that is probably taking place already.

Officials are now expecting a 0.5% increase in GDP next year, following the contraction in the current quarter and another in the next three months. It could recover, but it will not go beyond 2%.

Even so, the ECB did not let such a weak outlook to discourage itself from achieving price stability.

The ECB plans to raise the rate by another 75 basis points, but there may be disagreements among officials next year, which will make the task of reaching consensus in the Governing Council more difficult.