By the looks of it, it took investors a day to fully digest and react to the FOMC statement and updated economic forecasts for 2023-2025. On Wednesday, Chairman Jerome Powell did not mince words, making an extremely tough and hawkish written statement, and also answered questions from reporters.

The reaction to all the hawkish information provided by the Federal Reserve was relatively tepid at first. This was reflected only in a partial decline in gold. While stock prices and precious metals traded lower, the decline was muted and insignificant. Major U.S. indices were down less than a percent. Gold futures were down only $8 an ounce.

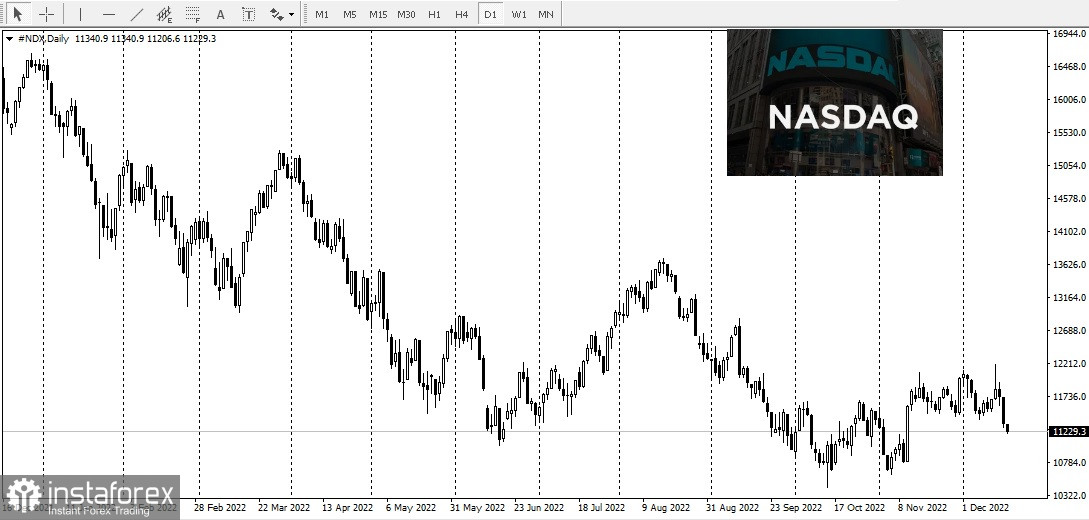

The next day, the scale of the message expressed by the Federal Reserve even more powerfully reflected in the financial markets. The dollar strengthened, and all major stock indices experienced deep declines. The NASDAQ Composite Index lost 3.23%:

Dow fell 2.25%:

S&P 500 fell 2.49%:

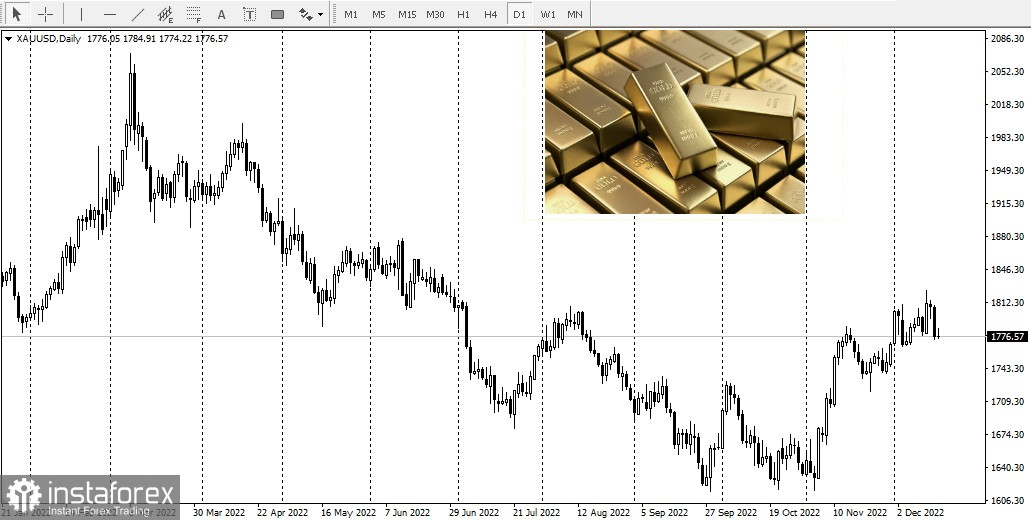

Gold futures lost 1.75%:

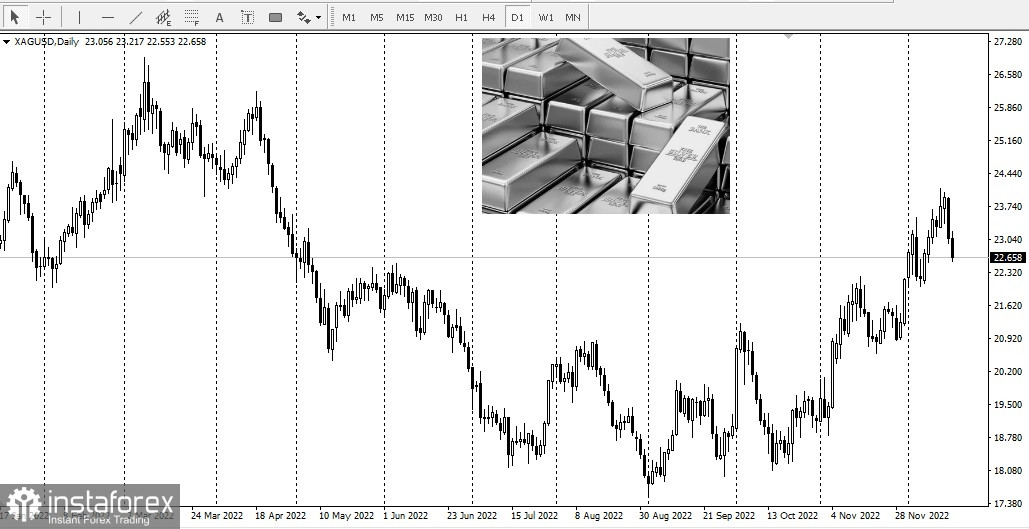

Silver is down 3.55%:

Silver is down 3.55%:

At the same time, the dollar added 0.80%:

It is puzzling that it took the investment community a full day to digest the implications and potential outcomes of the Federal Reserve's latest economic forecasts. The Fed issued a written statement as always but included a separate PDF file entitled "Federal Reserve Board and Federal Open Market Committee release economic projections from the December 13-14 FOMC meeting."

The PDF contained the most recent Fed dot plot. This chart shows the most recent estimates made by each Federal Reserve official. This chart showed that there is consensus on keeping the Fed's base rate high throughout 2023. In addition, they expected that the first rate cut would probably not occur until the second quarter of 2024.

Combining the extremely aggressive nature of the Federal Reserve's monetary policy with recent reports pointing to a severe economic downturn raises the possibility of a major recession next year or early 2023.

Investors who are involved in gold are reacting to higher and more sustained high rates next year, which creates bearish market sentiment. And if the Federal Reserve's actions lead to a recession, then the market sentiment will change because gold usually moves higher during a recession.