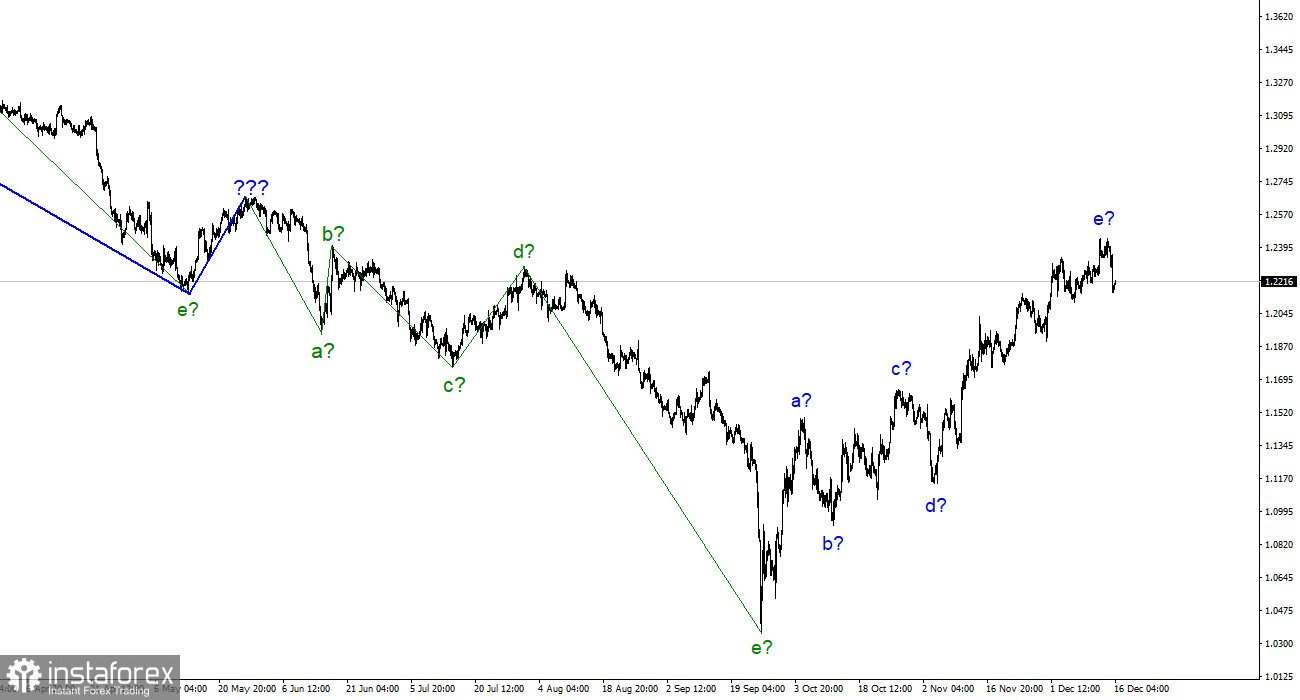

The wave marking for the pound/dollar instrument appears quite complicated, but it does not require any clarifications. We have a five-wave upward trend section that looks like a-b-c-d-e and may be finished. As a result, the instrument's quotes will continue to rise for some time. Both instruments are still constructing an upward trend segment, after which a mutual decline will begin. In recent weeks, the British news landscape has been so diverse that it is difficult to categorize it in a single word. The British had more than enough reasons to rise and fall. As you can see, it chose and continues to prefer the first option. The rise in quotes in recent weeks has added to the complexity of the proposed wave e. It has now grown to a size that will allow it to be completed in the near future. Because the wave marking on both instruments allows the completion of the ascending section at any time, I am still waiting for the decline of both instruments, but these trend sections may take an even longer form.

The Bank of England has outpaced inflation in the United Kingdom.

The pound/dollar instrument's exchange rate fell by 250 basis points on Thursday. It was also the only time this week that the pound finished in the red. Remember that the Fed met earlier this week, and the UK and US inflation reports were released. Because the wave marking still assumes the formation of a downward trend section, even three of these events could cause the pound's demand to fall significantly further. However, the market believed that reducing demand for the pound was optional. Yesterday, the Bank of England disappointed everyone by using inappropriate language about interest rates and slowing the pace of monetary policy tightening.

However, a report on retail trade volumes was released a little earlier in November, and they fell by 0.4% every month and 5.9% annually. The market was expecting more upbeat data, so it's good that the pound didn't fall further today. More specifically, it is bad because the continuation of the decline in quotations would give reason to believe that the instrument has begun to build a downward trend section.

Conclusions in general.

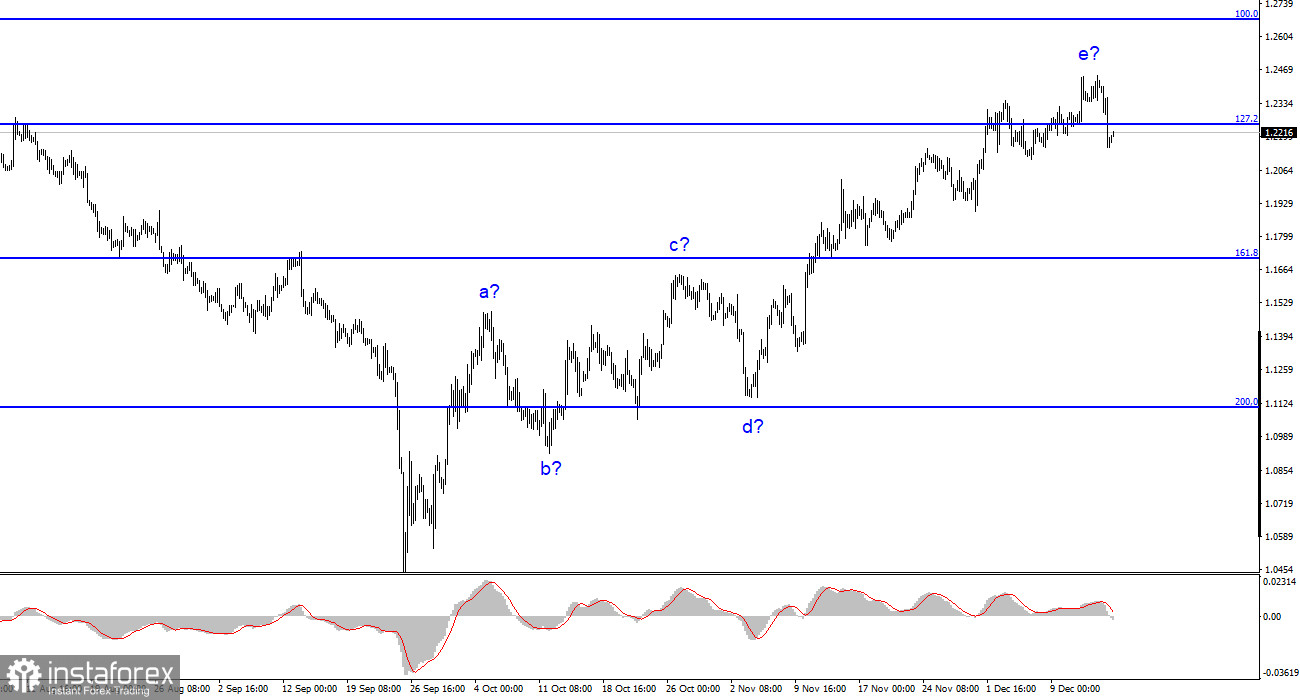

The pound/dollar instrument's wave pattern assumes the formation of a new downward trend segment. I cannot recommend purchasing the instrument because the wave marking allows the construction of a downward trend section to begin. Sales are now more accurate, with targets around 1,1707, corresponding to 161.8% Fibonacci. The wave e, on the other hand, can take on a more extended form.

The picture is very similar to the euro/dollar instrument at the higher wave scale, which is good because both instruments should move similarly. The upward correction section of the trend is nearing completion at this time. If this is the case, we will soon start a new downward trend.