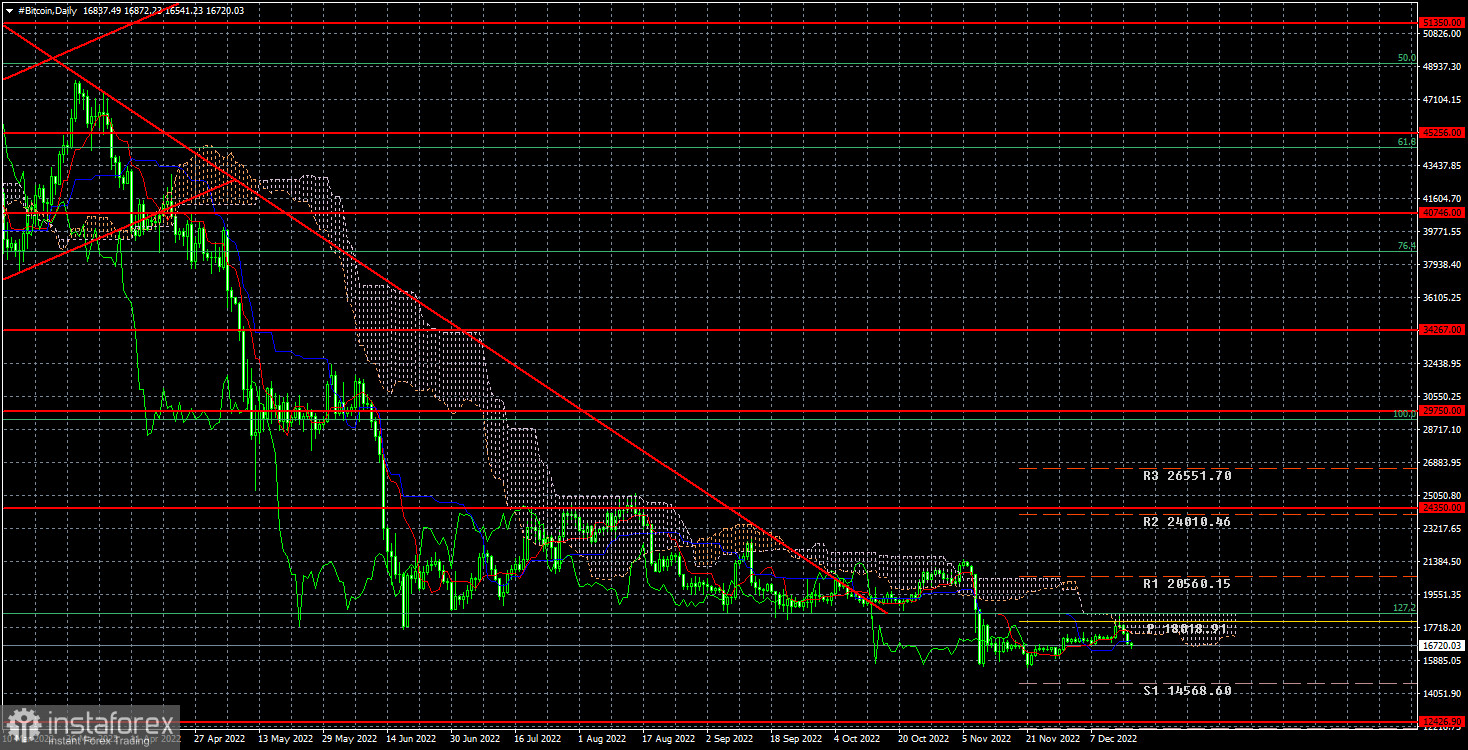

This week, the bitcoin cryptocurrency reached the Fibonacci level of 127.2% ($18,500), but it could not surpass it. Therefore, it is logical to assume that a new round of quote decline will occur soon. In theory, this decline has already started, and numerous cryptocurrency industry experts are again discussing the collapse of the first cryptocurrency in history. Remember that there are two different kinds of industry experts: those who own cryptocurrency themselves and are therefore interested in its growth and consistently forecasting an increase in value, and those who do not. We place more faith in the opinions of those who do not own bitcoin because they are more unbiased and independent. And it is these experts who keep mentioning new drops in cryptocurrency prices.

Three central bank meetings this week included synchronous increases in key interest rates. Despite slowing down the pace of monetary policy tightening, all three central banks are still raising rates and carrying out QT programs, which are the opposite of QE programs. During the pandemic, when the Central Bank was motivated to stimulate economies, QE programs were implemented. In other words, the economies received a financial boost, investments increased, bitcoin increased, and many other financial instruments increased. Almost a year ago, we saw the exact opposite scenario: the money supply is contracting, and borrowing is getting increasingly expensive. As a result, the fundamental backdrop for the cryptocurrency market is negative. As a result, we should anticipate further bitcoin drops.

It should be kept in mind that the longer bitcoin stays "at the bottom," the greater the likelihood of new collapses, as many participants in the cryptocurrency industry are starting to run into liquidity issues due to the low price of BTC. The miners are the first to experience the reduction at this time because it costs even less than the cost price. Simply put, mining bitcoin becomes unprofitable. Exchanges involving money are also having issues. No investments are currently available because nobody wants an "asset without prospects." From our vantage point, we must watch for the time when central bank rates peak and stop rising. At least then, the price of Bitcoin can stop decreasing. However, everything will now depend on whether or not there are any new cryptocurrency industry crashes. The segment's confidence in cryptocurrencies will be further eroded if they do.

The "bitcoin" quotes over the past 24 hours have remained below $18,500. The fall could continue with a $12,426 goal. As we previously stated, since the price was concurrently in a side channel, crossing the downward trend line does not signify the end of the "bearish" trend. Bitcoin is now located below this channel, allowing the quotes to move southward.