Last Friday, the euro lost 38 pips, leaving the target range of 1.0615/42. The euro was pulled down by the stock markets (S&P 500 -1.11%, Euro Stoxx 50 -0.83%) and rising European bond yields with the Greek (4.32% 10-year) and Italian (4.28% 10-year) government bonds leading the way. Of the peripheral eurozone countries, the highest yields are Polish bonds at 6.66%, but their yields have been consistently high since March, and in October they were over 8.5%. If things continue like this, and the European Central Bank plans to raise the policy interest rate by 0.50% at the next two meetings, then Italy and the peripheral eurozone can start a debt crisis again. The media is not yet sounding the alarm on this issue, but there are already discussions about it.

After the Federal Reserve and the ECB meetings, the probability of the euro reaching the 1.0758/87 range, with a milder divergence (the pink dashed line on the daily chart), has fallen considerably. The euro is now aiming for 1.0470. The price will have to struggle with the MACD line on the weekly chart at 1.0385. The victory over it will confirm the euro's development according to the medium-term descending scenario and the next step under parity.

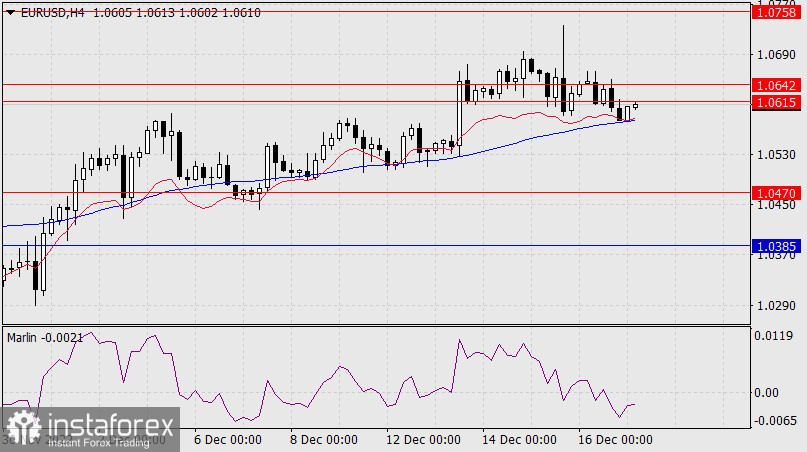

On the four-hour chart, the price reached the MACD line and it is accumulating strength to overcome it. The Marlin oscillator is in the negative territory, it helps the price in this struggle with support. We wait for the price to settle under Friday's low at 1.0585.