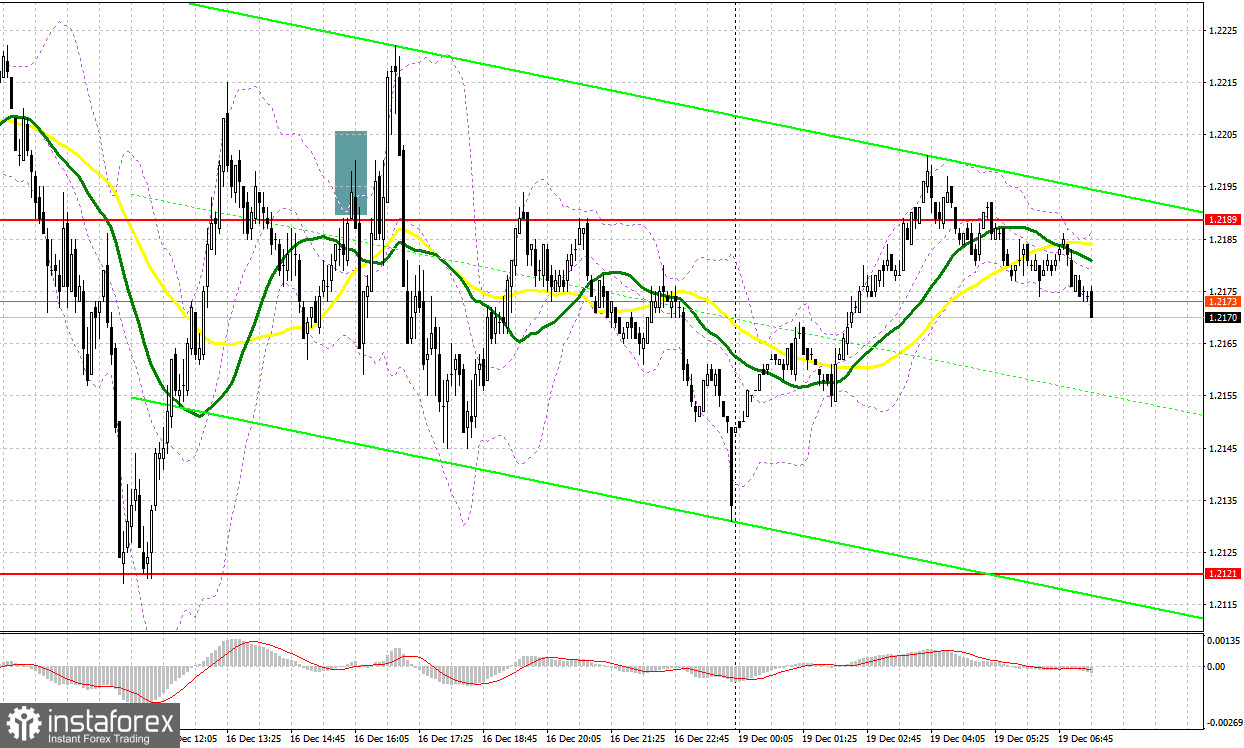

Last Friday, there was only one entry point. Let's look at the 5-minute chart and figure out what actually happened. The GBP/USD pair made an upward retest after a drop below 1.2189 in the afternoon. It created a sell signal although there was no big downward movement. The pair declined by only 25 pips.

When to open long positions on GBP/USD:

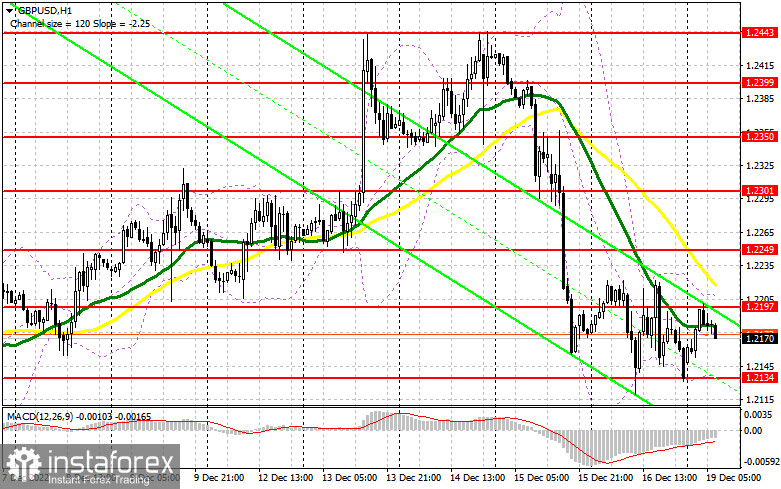

The UK PMI Indices released last Friday helped the pound sterling maintain a bullish bias. GBP bulls opened long positions each time when the price slipped to intraday lows. Today, the trading strategy remains the same as it was last Friday. It is better to open positions when the pair starts declining as there are no crucial reports today. The UK Industrial Production Index will hardly cause a strong market reaction. It means that bulls will try to regain control. It is recommended to open long positions if a false breakout of the support level of 1.2134 takes place. If so, the pair could recover to the resistance level of 1.2197 formed last Friday. A breakout above this level is the top priority for buyers. If they succeeded, the pair is likely to reach 1.2249. After that, bulls are sure to take the upper hand. A rise above this level will also open the way to 1.2301 where I recommend locking in profits. If the bulls fail to push the pair to 1.2134, I advise you to postpone long positions until a false breakout of 1.2070 takes place. You could buy GBP/USD immediately at a bounce from 1.19999, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

At the end of last week, sellers made an attempt to initiate a new large sell-off of the pound sterling but failed because of weak US PMI data. Today, bears need to take control of the resistance level of 1.2197 where the moving averages are benefiting them. Only a false breakout of 1.2197 will give a good sell signal with the prospect of a decline to the support level of 1.2134. If so, bulls and bears will fiercely fight for this level. A similar situation occurred last Friday. Only a breakout and a downward retest of this level will create a sell signal, pushing the pair to 1.2070. A more distant target will be the 1.19999 level where I recommend locking in profits. If GBP/USD climbs and bears show no energy at 1.2197, which is also likely, bulls will get the chance to cement an upward movement. Only a false breakout of 1.2249 will generate a sell signal. After that, the pair is sure to slide. If bears show no activity there, you could sell GBP/USD immediately at a bounce from 1.2301, keeping in mind a downward intraday correction of 30-35 pips.

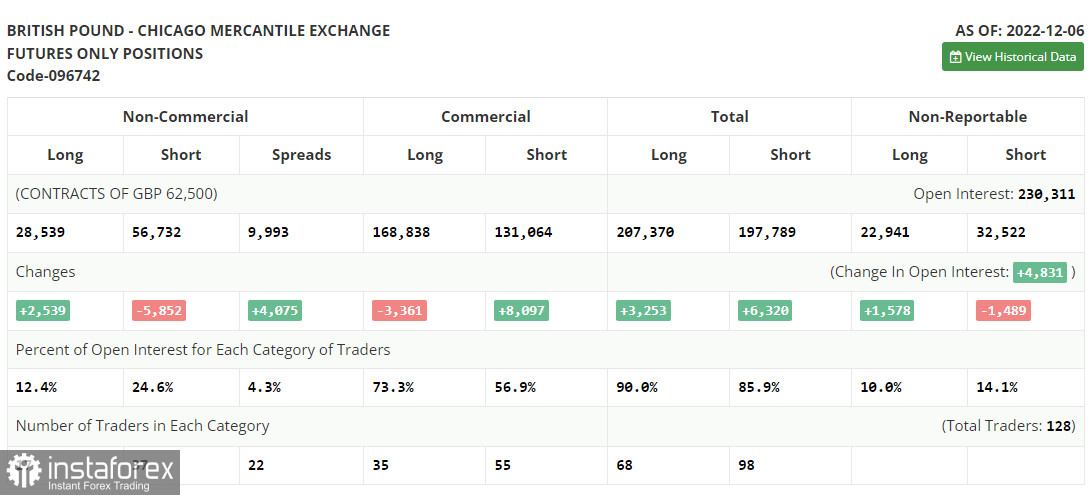

COT report

The COT report (Commitment of Traders) for December 6 logged an increase in long positions and a drop in short ones. Apparently, GBP bulls are confident that the uptrend will persist as the Fed is widely expected to shift to a less hawkish stance. It means that the rate gap between the BoE and the Fed could narrow in the near future. However, the UK Business activity data released last week turned out to be rather disappointing. It clearly indicated a looming recession in the economy. The UK GDP report was slightly better than expected. However, the third straight month of a contraction in economic activity confirms growing recession concerns. Given that the Bank of England is strongly committed to taming inflation and raising the interest rate, the economic prospects are rather grim. It explains why traders are cautious when buying the instrument despite the short-term uptrend. According to the latest COT report, short non-commercial positions dropped by 5,852 to 56,732 and long non-commercial positions grew by 2,539 to 2,8539. Consequently, the non-commercial net position came in at -28,193 versus -36,584 a week ago. The weekly closing price of GBP/USD grew to 1.2149 against 1.1958.

Indicators' signals:

Trading is carried out slightly below the 30 and 50 daily moving averages, signaling bears' attempts to keep the market under control.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD grows, the indicator's upper border at 1.2250 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.