Overview of Fridays' trading and tips on GBP/USD

The UK PMIs gave the pound sterling a helping hand. Thus, GBP/USD remained in a trading range on Friday. This enables traders to reckon a larger upward correction today. Unfortunately, the economic calendar doesn't contain macroeconomic data on Monday. Don't be surprised if the currency pair carries on trading sideways. The UK industrial orders by the CBI are due today. The data will hardly trigger higher volatility. No economic data will be published in the US in the second half of the day. So, if GBP/USD makes a failed attempt to grow above 1.2189, the bulls are likely to give up and take the wait-and-see approach.

Buy signal

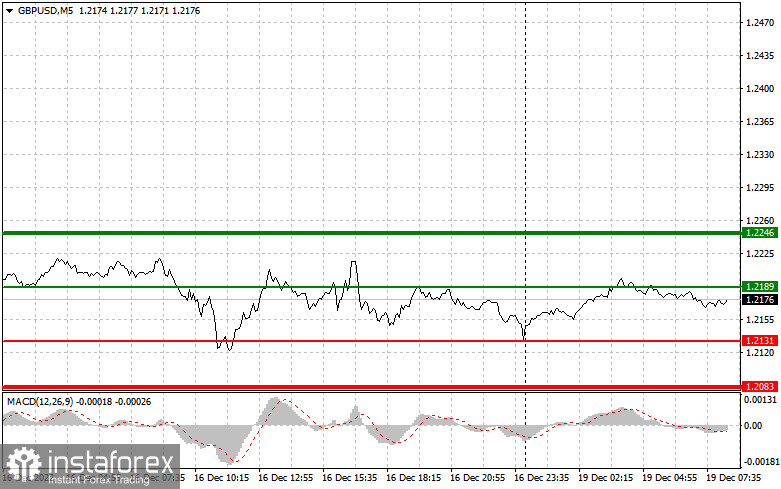

Scenario 1. We could buy the pound sterling today after GBP/USD reaches the market entry point at 1.2189 plotted by the green line on the chart with the target at 1.2246 plotted by the thick green line on the chart. I would recommend exiting long positions at about 1.2246 and opening sell positions in the opposite direction, bearing in mind a 30-35-pips move in the opposite direction. We could expect the sterling's growth on the condition of the buyers' activity in the first half of the day. Importantly, before going long on GBP/USD, make sure that the MACD indicator is above the zero mark and is going to begin its growth from it.

Scenario 2. We could also buy GBP/USD after the price reaches 1.2131. At that moment, MACD should have entered the oversold zone, which will cap the downward potential of the pair and will cause the opposite reversal of the trajectory. Traders could expect the price growth to the opposite levels of 1.2189 and 1.2246.

Sell signal

Scenario 1. We could sell the sterling today only after the price updates the level of 1.2131 plotted by the red line on the chart. This will push the price down rapidly. The sellers' key level will be 1.2083 where I recommend leaving sell positions and opening right away long positions in the opposite direction, bearing in mind a 20-25-pips move in the opposite direction. If GBP/USD fails to settle at intraday highs, the pound sterling will come under selling pressure again. Importantly, make sure MACD is below the zero level and is going to begin its decline from it.

Scenario 2. Sell positions are also possible today after the price reached 1.2189, but at that moment, MACD should be in the overbought area which will put a lid on the price growth and will lead to the move in the opposite direction. The pair is expected to slide to the opposite levels of 1.2131 and 1.2083.

What's on the chart

The thin green line is the key level at which you can open long positions on the GBP/USD pair.

The thick green line is the target price, since the price is unlikely to move above this level.

The thin red line is the level at which you can open short positions on the GBP/USD pair.

The thick red line is the target price, since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.