The previous trading week was the most contradictory and volatile. On the one hand, the markets saw further evidence of falling inflation. On the other hand, backed by positive CPI dynamics, investors were shocked by Fed Chairman Jerome Powell's pessimistic rhetoric.

Powell said there were no plans to ease monetary policy or lower the key rate in 2023. As a result, the stock market closed with a record fall since September 2022. Cryptocurrencies followed the example of the stock market, and Bitcoin finally buried its chances of an upward movement.

As a result, the main buying markets for Bitcoin began to sell off the cryptocurrency. European traders joined American investors and triggered the formation of a large red candle on Bitcoin's daily chart.

This week also promises to be tense for the crypto market as the negative backdrop persists around the industry's biggest player, Binance. In addition, several major crypto exchanges reported problems with withdrawals. Representatives of the platforms cited technical problems as the reason.

Despite the Fed's negative rhetoric and the fall of the markets adjacent to Bitcoin at the end of last week, a New Year's rally is still possible. The cryptocurrency market maintains a close relationship with the stock market, which gives hope for a bullish chord at the end of 2022.

BTC/USD Analysis

At the end of last week, Bitcoin finally buried the chances of an upward movement towards the $19k–$20k area. The cryptocurrency made a false breakout of the $18k level and subsequently began to decline towards the $17.4k local support level.

However, Powell's negative rhetoric triggered a major sell-off in European and U.S. markets. As a result, Bitcoin formed the largest bearish candle since November 9 and finally broke the structure of the upward trend.

The cryptocurrency spent the weekend in relative calm. The price remained near the $16.7k level, where the BTC support level passes. As of December 19, the period of redistribution of volumes that were thrown into the market on Friday continues.

BTC/USD technical metrics confirm further price consolidation. The RSI and MACD are moving sideways, indicating a lack of buying interest. At the same time, the stochastic has reversed in the bearish zone and may rise above 20 at the end of the current trading day.

In the absence of third-party factors, we should expect further downward movement of Bitcoin. The immediate target of the cryptocurrency will be the $16k level, and if we do not see the reaction of buyers, then the likelihood of further decline increases.

Results

The prospects for the upward movement of Bitcoin depend on the mood of investors in the stock market. The next two days will show the intentions of the crowd and, accordingly, form the basis for analyzing the further movement of the price of Bitcoin.

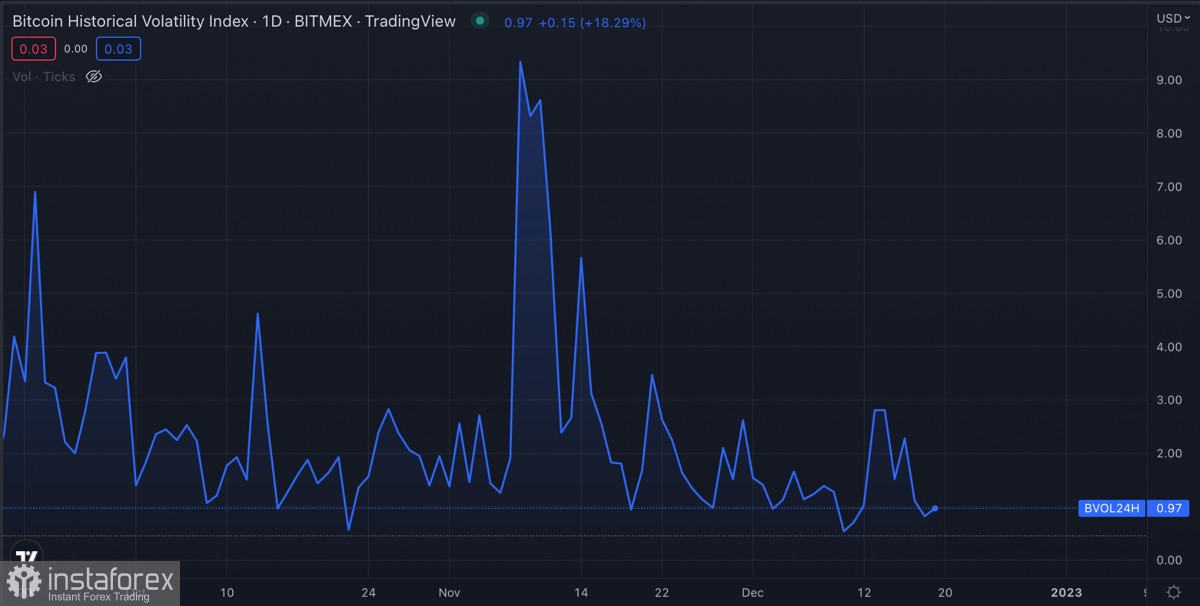

Negative rumors and news are pumped around the crypto market, and the level of volatility and trading volumes are falling. This is a classic situation, which will end with a sharp surge in volatility and further removal of the price in one of the directions.

Price movements in the stock market will tell you in which direction the BTC/USD price impulse is likely to take place. In the coming days, the lull in the market will continue, followed by a sharp surge in volatility and an impulse price movement.