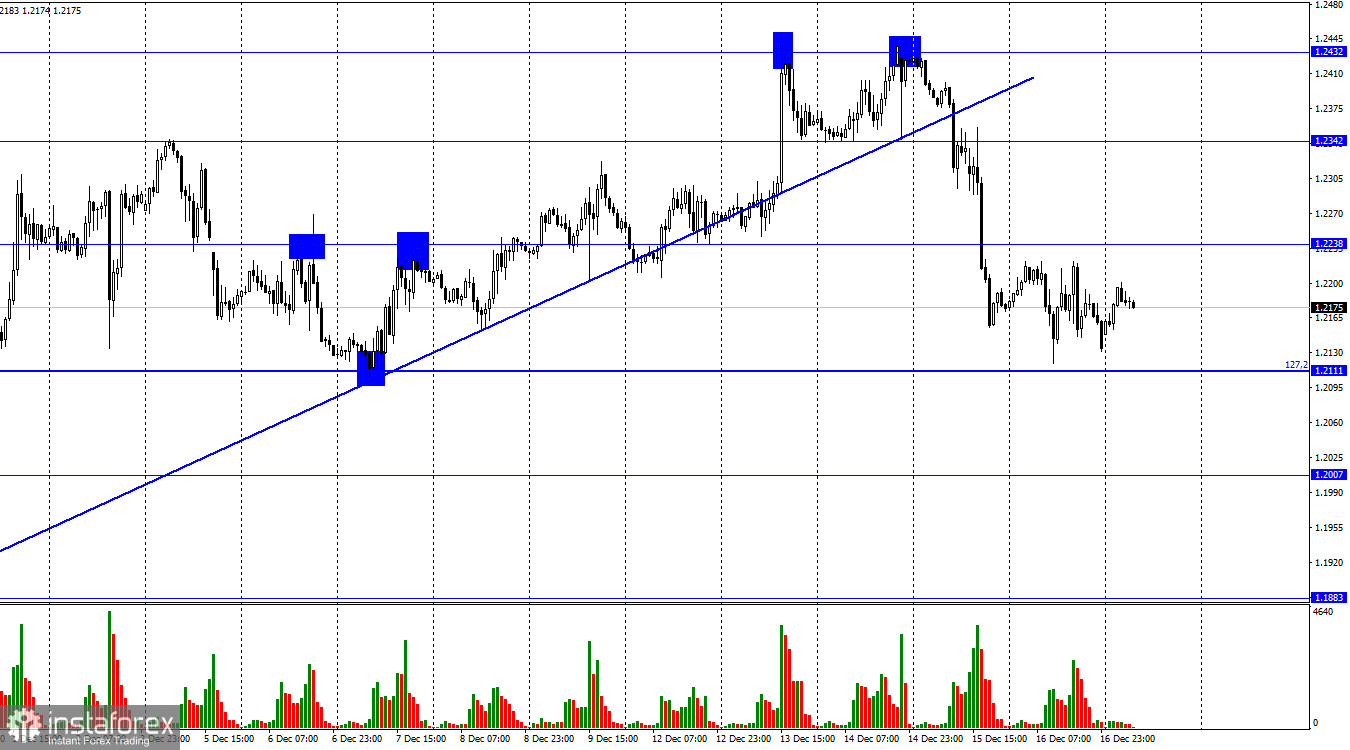

Hello, dear traders! The 1-hour chart shows that GBP/USD fell to the 127.2% retracement level of 1.2111 last week. The pair is still hovering around this mark. It has failed to rebound from the level, and no bearish movement is currently taking place. The pound was bearish only last Thursday after the Bank of England announced its interest rate decision. In fact, the ECB and the US Fed made similar decisions. Anyway, both the euro and the pound are now retracing down. On Friday, the quote traded between 1.2111 and 1.2238. Therefore, consolidation below 1.2111 may lead to a continuation of the downtrend. Meanwhile, growth may extend if the price closes above 1.2238. This week, due to the lack of significant events in the macroeconomic calendars of the US and the UK, we will have to focus solely on price charts.

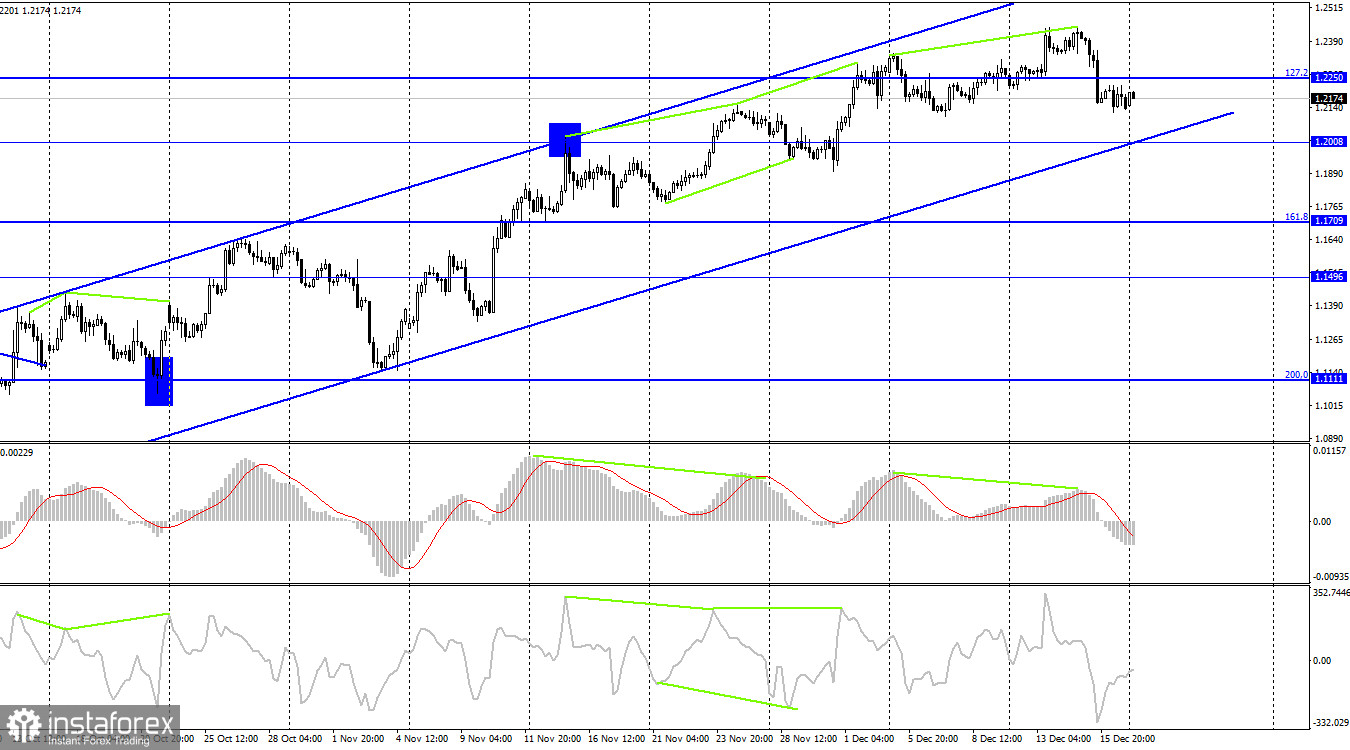

With the holiday season approaching, traders may start closing their buy trades, accumulated in recent months. Therefore, the pound may go south. Interestingly, the bears stayed away from the market last week when there were enough reasons for selling the instrument. The ascending corridor on the 4-hour chart is currently seen as the key graphic pattern for the pair. The quote may plunge once it closes below the corridor.

On the 4-hour chart, the pair settled below the 127.2% retracement level of 1.2250 when the MACD divergence occurred. The quote may extend the fall to the lower limit of the corridor. Consolidation below the line may increase the likelihood of a downtrend continuation. In case of a rebound, the price may head towards the 100.0% retracement level of 1.2674.

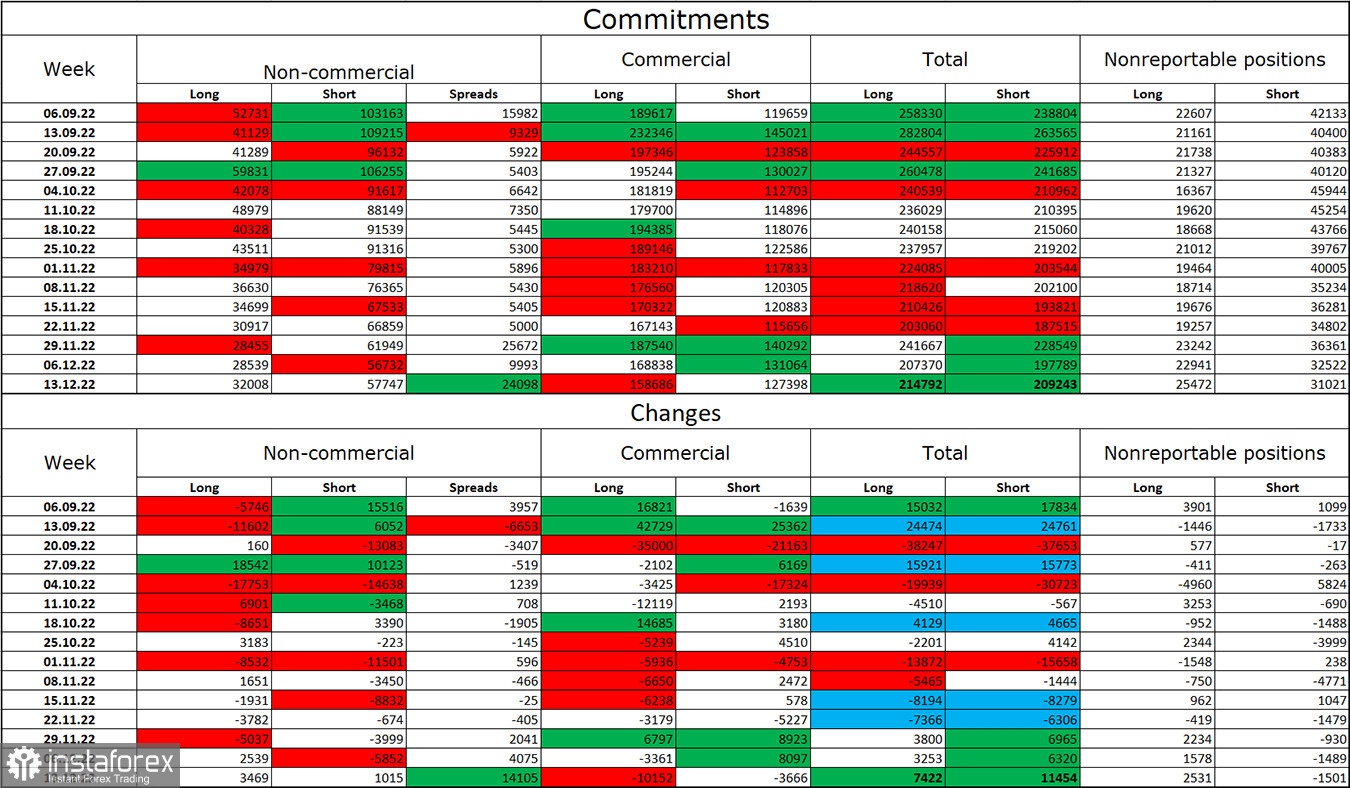

Commitments of Traders:

The bearish sentiment of non-commercial traders decreased last week. Speculators opened 3,469 new long positions and 1,015 short positions. Overall, sentiment is still bearish with a wide gap between shorts and longs. Traders continue selling the pair although bullish sentiment has started to grow in recent months. Nevertheless, it is a long and slow process. It has lasted for several months now, but the number of shorts still twice exceeds that of longs. Graphic analysis of the 4-hour chart shows that the pound may continue strengthening against the dollar. Still, there are factors that may boost the greenback. Anyway, we now see the long-awaited growth.

Macroeconomic calendar:

The macroeconomic calendar contains no important releases this week. Therefore, fundamental factors will hardly influence market sentiment today.

Outlook for GBP/USD:

It will become possible to open short positions after consolidation below 1.2111 on the 1-hour chart or below the corridor on the 4-hour chart. The targets are seen at 1.2007 and 1.1883. Meanwhile, if the pair closes above 1.2238, it will become possible to go long with the target at 1.2432.