Growing fears of recession have caused another stock market crash. The 0.50% rate hike by the Fed, Bank of England and ECB was not a surprise, but investors realized that there is no more compelling reason to remain bullish, so they lock in their earlier gains, which led to the two-week drop.

Another reason why the dynamics on Monday was almost completely negative was the failed attempt to start a rally. US stock indices closed very low, and this could continue until today's US session. It is also possible that the downturn will extend up to Thursday, when another revised US GDP data will be released. Forecasts say it should grow by 2.9%.

Also ahead are the personal consumption expenditure price index, which is expected to decline markedly, and the data on orders for durable goods, which is likely to show a slowdown in the month-on-month growth rate.

If the figures turn out to be as expected, the stock market may bounce up as investors will start to buy hard-cheap stocks, hoping to cash in on the rebound. But if the data is below expectations, a new strong downward wave will occur, which could lead to the test of recent local lows. In that case, dollar will strengthen as fears of a global recession will once again prevail.

Forecasts for today:

AUD/USD

The pair dipped below 0.6680 as risk appetite fell due to rising fears of global recession. If this sentiment persists, the quote may continue sliding towards 0.6540.

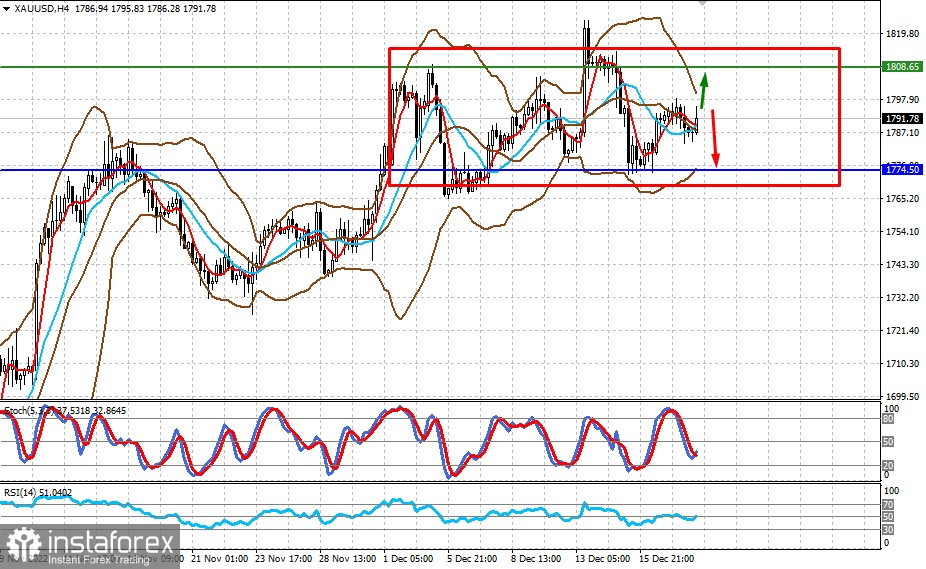

XAU/USD

The continued demand for gold has kept the pair trading within the range of 1774.50-1808.65. Most likely, it will remain in this area for the time being.