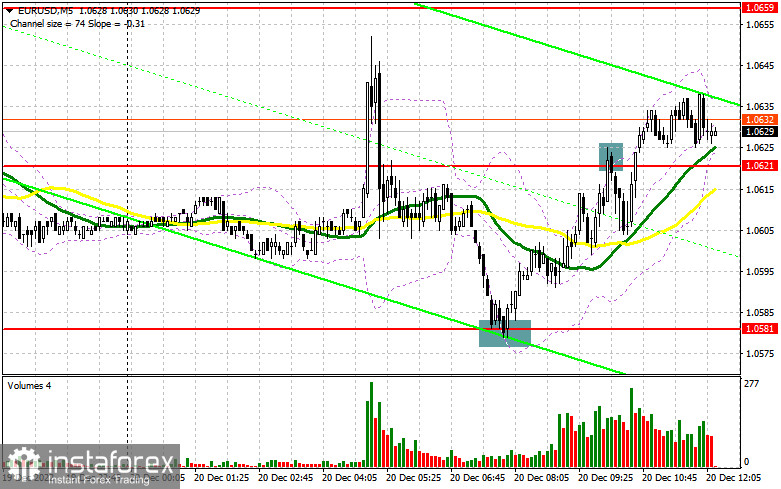

Long positions on EUR/USD:

In the afternoon, the market expects quite important data on the US real estate market. This release may weaken the US dollar and bring the pair back to the upper boundary of the sideways channel at 1.0659. A decline in the number of building permits issued and a decline in new housing starts in the US will indicate the possibility of a recession in the economy next year, which is likely to strengthen the European currency. If we see strong figures, the pressure on the pair may increase and the price may slide down to the middle of the sideways channel at 1.0621. Only a false breakout at this level may give a buy signal, counting on the rise of the euro to 1.0659. A breakthrough and a top-down test of this level may support bulls and reinforce their positions, allowing them to break out of the sideways channel and launch a new uptrend, which opens the way to 1.0703. Meanwhile, if the price manages to break through 1.0703, it is likely to reach the next target at 1.0741, where traders may lock in profits. If the EUR/USD pair declines during the North American session, and we see weak activity from bulls at 1.0621, the pressure on the euro is likely to return. This will trigger bulls' Stop Loss orders. In this case, only a false breakout at the support of 1.0581 will create a buy signal. One may also open long positions on the euro on a rebound from 1.0540 or lower near the low of 1.0495, allowing an upward intraday correction of 30-35 pips.

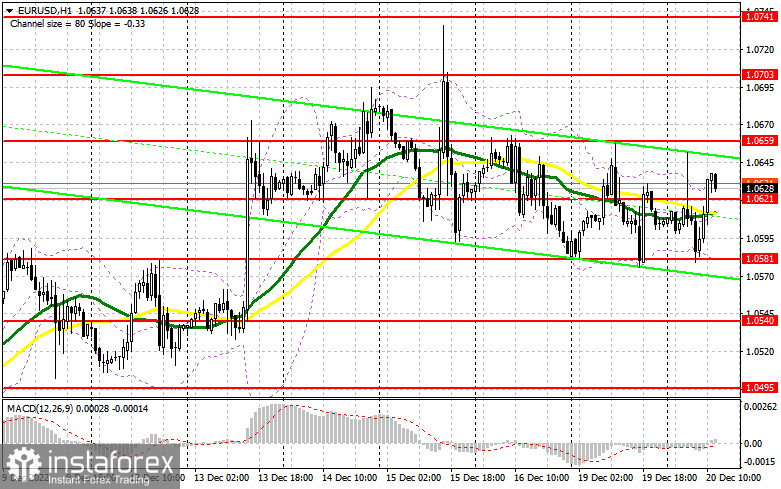

Short positions on EUR/USD:

Bears didn't manage to push the price lower from the weekly low as well as the middle of the sideways channel at 1.0621. The pair is likely to hover near this level in the afternoon. Before the euro starts to move near 1.0621, most likely, after the weak US statistics, bears will have to protect the upper boundary of the channel at 1.0659. Notably, the price fell from this level yesterday. Only a false breakout formed at this level may give an entry point into short positions with the target at the middle of the channel at 1.0621. If the price breaks through and fixes below this level along with a downward test, this may give an additional signal, triggering bulls' Stop Loss and dragging the euro to 1.0581. However, this is unlikely to lead to significant changes in the market. The next target is located at 1.0540, where bulls may become active again and try to buy the euro near the bottom. If the EUR/USD pair increases during the North American session, and if we see weak bearish activity at 1.0659, bears may lose confidence, while buyers may have a good chance to hit new highs near 1.0703. One may sell the euro from this level only after a false breakout is formed. Short positions on the euro can also be opened from the high of 1.0741, allowing a downward correction of 30-35 pips.

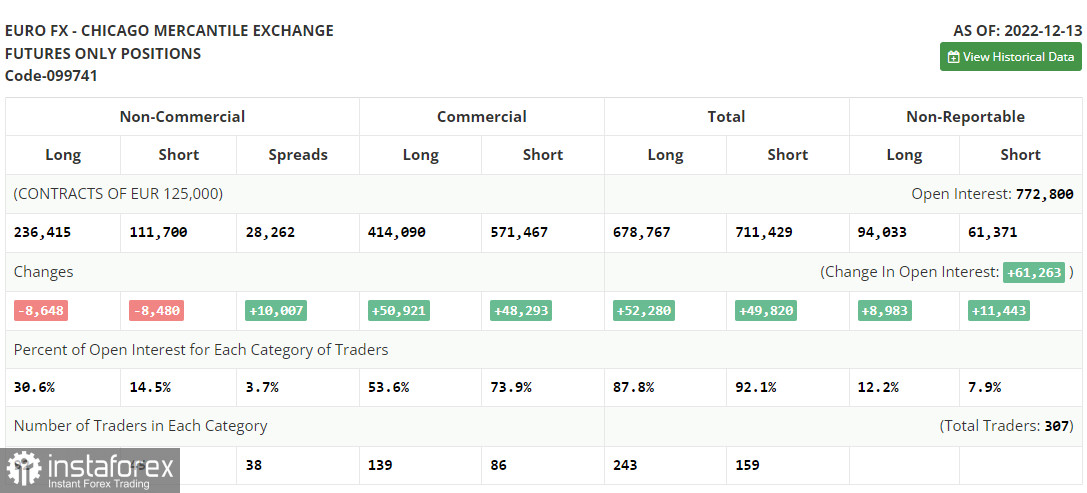

The COT report for December 13 logged a decrease in both long and short positions. Many preferred to lock in profits before last week's global central bank meetings, which led to a reduction in positions. Obviously, the hawkish policies signaled that the Fed and the ECB would continue to affect the growth prospects for risky assets. Eventually, regulators' battle against inflation may lead to a recession in both the USA and Europe. The focus is now shifting to next year, as nothing interesting will happen in December and the markets are unlikely to show anything out of the ordinary. The COT report indicates that long non-commercial positions fell by 8,648 to 236,415, while short non-commercial positions declined by 8,480 to 111,700. At the end of the week, the total non-profit net positioning was down slightly to 122,247 against 123,113. This indicates that investors keep the balance and despite the lack of purchases of euro, no one is in a hurry to dump risky assets even at the current prices. The euro needs support from new fundamental data to continue growth. The weekly closing price rose to 1.0342 against 1.0315.

Indicators' signals:

Moving averages

The pair is trading slightly above the 30- and 50-day moving averages, indicating that bulls are trying to reverse the trend.

Note: The period and prices of the moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

If the price increases, the upper band of the indicator near 1.0636 will offer resistance.

Description of indicators

- A moving average defines the current trend by smoothing out market volatility and noise. Period 50. Marked in yellow on the chart.

- A moving average defines the current trend by smoothing out market volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator. Fast EMA 12. Slow EMA 26. SMA 9

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short Noncommercial positions represent the total short open position of noncommercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.