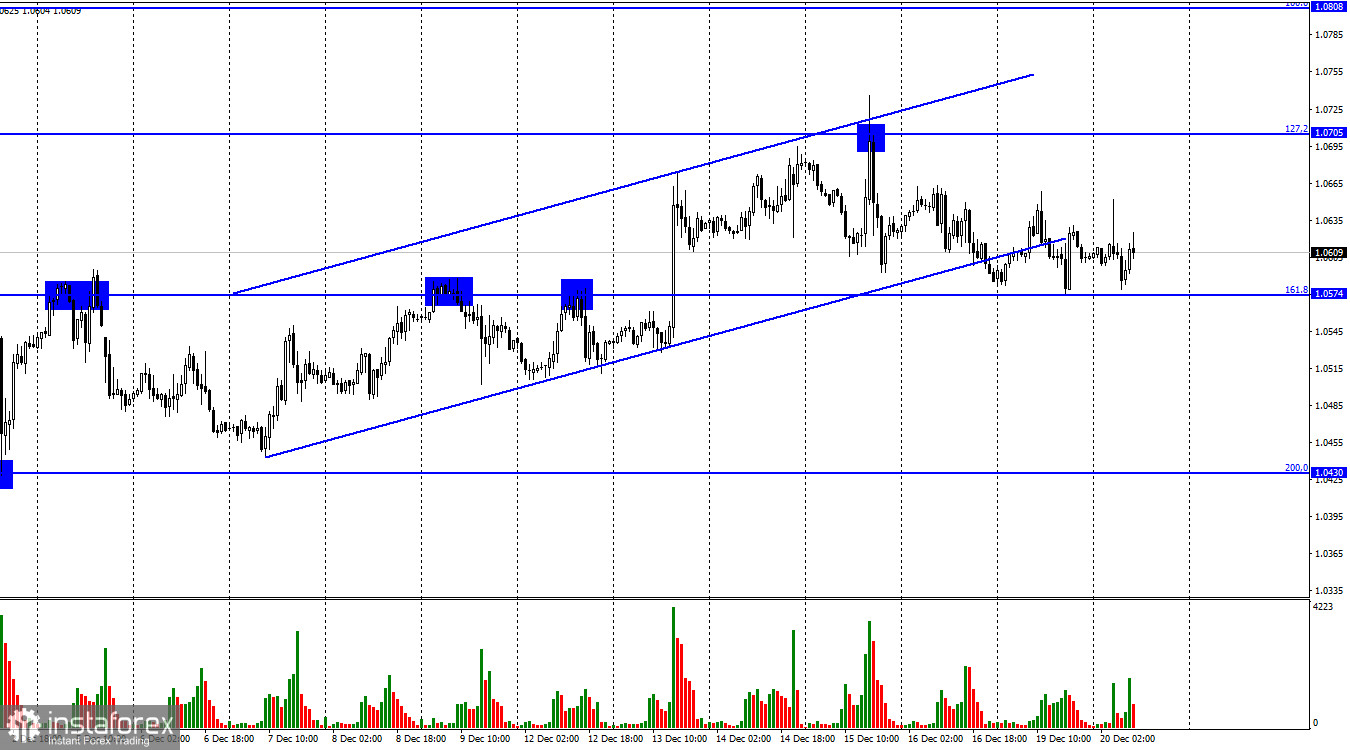

On Monday, the EUR/USD pair rebounded from the correction level of 161.8% at 1.0574 several times. Each time the euro rose by 60-70 pips. Anyway, the price was moving sideways. The activity of traders is falling down, though there are still 10 days before the New Year. However, this week has almost no reports to offer, so traders will have nothing to digest. The most important reports and events were released last week. Notably, traders did not use the news factor as expected, but it's too late to think about it now. At the moment, there is no news for the euro-dollar pair.

Thus, the market is likely to move sideways until the New Year and a few days after it. Even if this prediction is false, traders will need buy or sell signals, and then it will be possible to talk about the resumption of the trend. The current trend is very difficult to define as the pair has consolidated below the uptrend channel. However, it failed to close below 1.0574. If a strong signal will be formed, for example, after closing below 1.0574, it will be possible to consider a new fall in the euro. If not, then it is better to refrain from trading until such a signal appears.

Meanwhile, the more traders leave the market, the thinner the market may become. During a thin market, volatility can increase if one or more big players suddenly begin to actively trade. The pair may start to move sharply if big players begin to open large trades.

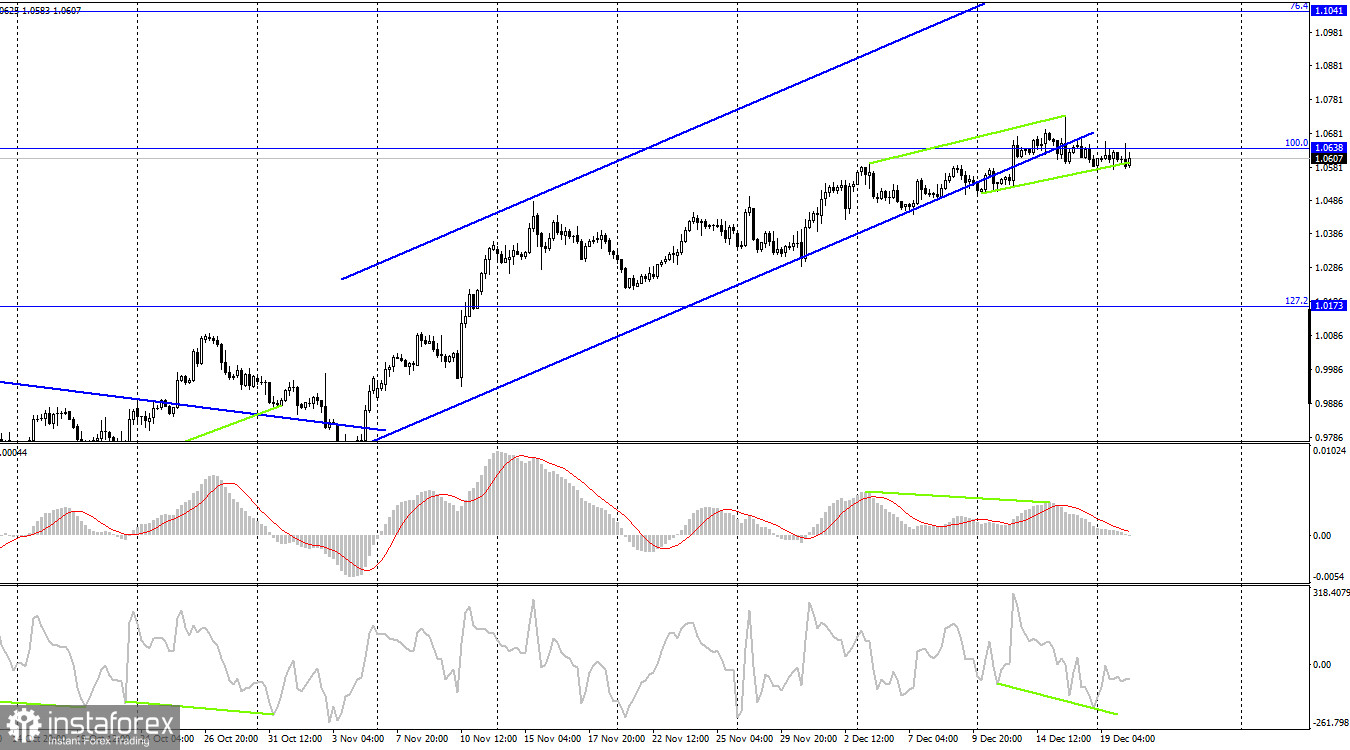

On the 4-hour chart, the pair performed a reversal in favor of the US dollar after the MACD indicator showed a bearish divergence. After that, it has fixed below the Fibo level of 100.0% which may drag the price lower. It also closed below the ascending channel. Today, the CCI indicator shows a bullish divergence, which could bring the bulls back to the market. As for now, the pair is moving sideways.

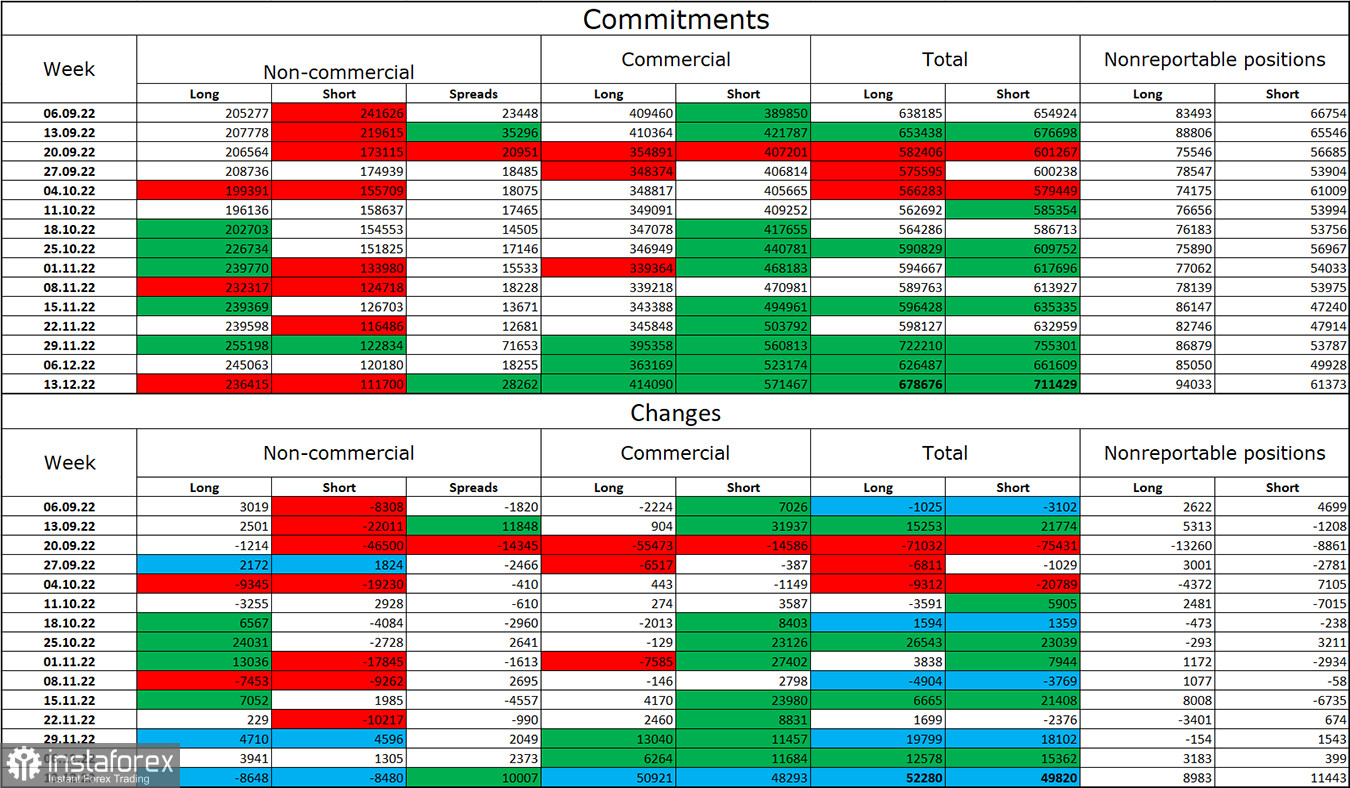

Commitments of Traders report:

Last reporting week, speculators closed 8,648 long positions and 8,480 short positions. That is almost an equal amount. Large traders remain bullish and their sentiment did not change during the reporting week. The total number of speculators' long positions stands at 236,000, and short contracts are at 111,000. The European currency is growing at the moment, which corresponds to the COT report. At the same time, I draw your attention that the number of longs is already twice as high as the number of shorts. In the last few weeks, the euro has been growing steadily, but the euro may have grown too much. The situation continues to become more favorable for the euro after a long period of decline. Its prospects remain positive. However, going beyond the ascending channel on the 4h chart might mean a strengthening of bearish positions in the nearest future.

US and EU economic calendars:

On December 20, the EU and US economic calendars do not contain any interesting reports. Market sentiment is unlikely to be influenced by information background today.

Forecast on EUR/USD and recommendations for traders:

One may sell the pair on a rebound from 1.0705 on the hourly chart with a target of 1.0574. This target has been reached. New shorts can be opened after the price fixes below 1.0574 on the hourly chart with the target at 1.0430. It is better to buy the euro on a rebound from 1.0574 on the hourly chart with the target at 1.0430. However, the growth can be limited by 60-70 pips.