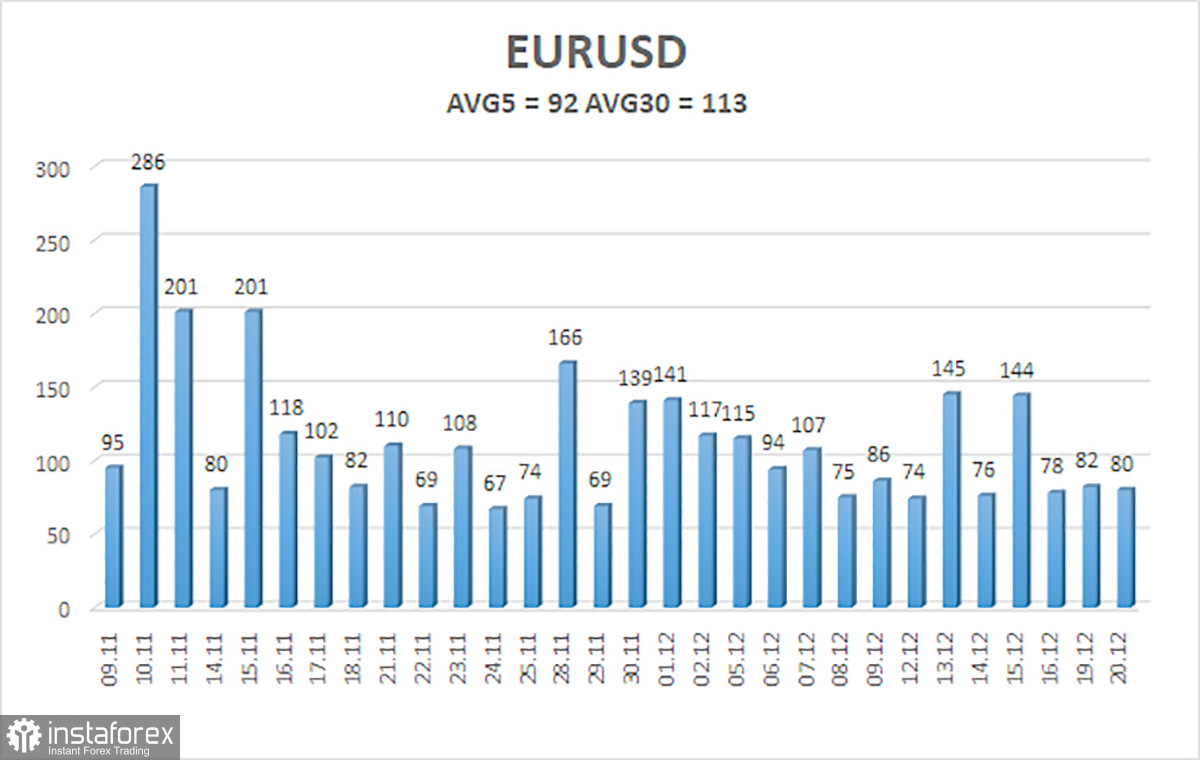

On Tuesday, the EUR/USD currency pair continued to trade with low volatility and virtually no trend change. A week and a half before the New Year and a few days before Christmas, as we already stated in yesterday's article, it is very challenging to anticipate that the market will trade normally. In theory, the first indications of "vacationing" were seen last week, when the pair's movements were only moderately prompted by the background's crazy volume and significance. No, the volatility varied greatly from day to day, but the illustration below amply demonstrates how this indicator has been declining over the past few weeks. Even a few weeks out from the holidays, it appears that traders have already begun to take their Christmas vacations.

Of course, we have no control over how the majority of market participants feel or what they want. No publications or events will compel the market to trade if it chooses not to. Furthermore, no publications-related events are currently scheduled. The first thing to remember is that the pair can stay in a flat or on a "swing" for several weeks. Due to the lack of trend movements, trading the pair will be very challenging in both scenarios. We also anticipate a downward correction, which we have been anticipating for three weeks, to start in the near future. Even inexperienced investors can see that the European currency is unjustly positioned so high and cannot even slightly adjust downward. In terms of the dollar, this situation is utterly unfair.

The ECB's signals are being awaited by the market.

We have brought up the issue of whether it is necessary to strengthen the euro several times in recent weeks. The dollar fell due to market expectations of a slowdown in the pace of monetary policy tightening, though there are always possible explanations for why the pair moves in one direction or the other. When we contrast the beginning of the dollar's decline with when these rumors first started to circulate, we find that the timing is almost exact. Therefore, the market has most likely already determined the Fed rate of 5.25%. So the current query is: when will the ECB start to tell the market that the rate is not going to rise indefinitely? Although they haven't announced it, they have already slowed down the tightening pace, and the EU's inflation rate is still very high, clearly indicating that the rate hike will not be slowed down. Then, in the upcoming months, they might lower the step to 0.25% or even declare that the tightening cycle in monetary policy is coming to an end. Who claimed that the rate would be increased to 5% or more by the European regulator? And the market might start to stop making more purchases of the euro once it realizes that the ECB is not chasing the Fed. In addition to this, a downward correction has been developing for a few weeks. On the eve of the New Year, we can only come to the same conclusion as before: you should buy since the technique continues to indicate that the upward trend will continue, but at any time the euro currency could begin to fall, which could be both strong and prolonged.

As of December 21, the euro/dollar currency pair's average volatility over the previous five trading days was 92 points, which is considered to be "high." So, on Wednesday, we anticipate the pair to fluctuate between 1.0518 and 1.0703 levels. A potential continuation of the upward movement will be indicated by an upward turn of the Heiken Ashi indicator.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Suggestions:

The EUR/USD pair is still moving in the right direction. With targets of 1.0703 and 1.0742 in the event of a price reversal from the moving average, we are currently thinking about new long positions. No earlier than the price being fixed below the moving average line with targets of 1.0518 and 1.0498 will sales become relevant. There is currently a very good chance that it will be flat.

Explanations for the illustrations:

Determine the present trend with the aid of linear regression channels. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

The CCI indicator's entry into the oversold (below -250) or overbought (above +250) areas indicates that the trend is about to reverse.