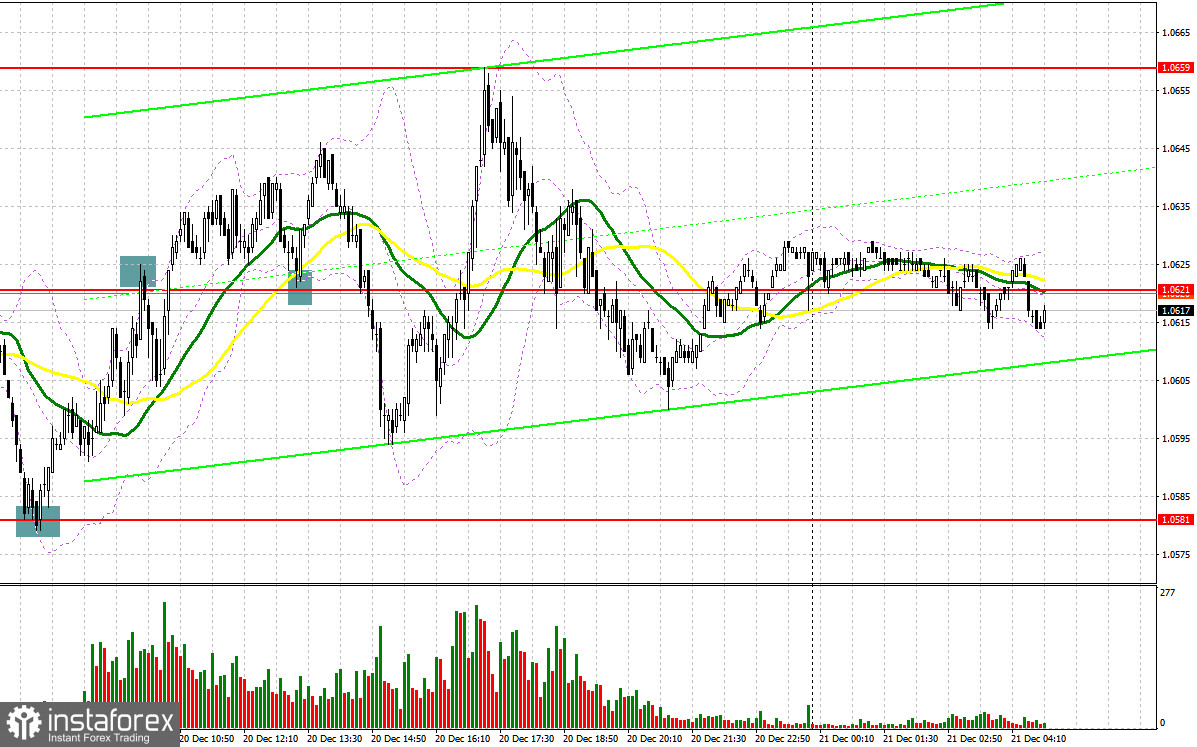

Yesterday, a few entry signals were created. Let's take a look at the M5 chart to get a picture of what happened. In the previous review, we focused on the mark of 1.0581 and considered entering the market there. A fall and a false breakout through the level generated a buy signal. The quote went up by 40 pips. It failed to settle at 1.0621, which triggered a false breakout and a sell signal. However, no significant decrease in price followed. In the course of the North American session, the bulls took the level of 1.0621 under control. A buy signal was made after a downside retest of this level. As a result, EUR/USD rose by 25 pips. By the close of the North American session, the quote reached 1.0659 where a sell signal was generated.

When to go long on EUR/USD:

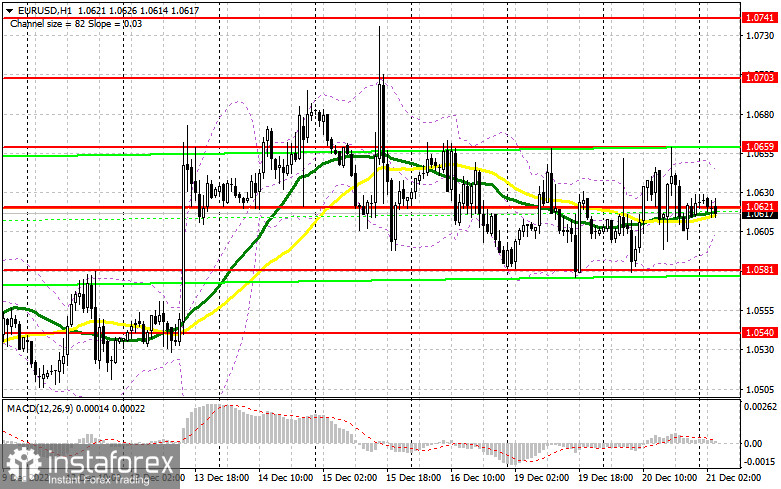

The greenback dropped yesterday, following the release of disappointing data on the US housing market. Meanwhile, an increase in consumer confidence in the eurozone on the contrary instilled optimism in the market. In the course of the European session today, the pair is unlikely to leave the boundaries of the sideways channel. The quote is expected to trade around the level of 1.0621, which is in line with the moving averages. Germany's consumer confidence report will hardly trigger market jitters. In case, the market shows a negative reaction to the results, it will become possible to go long after a false breakout through the nearest support level of 1.0581. This will create an entry signal, allowing the bulls to stay within the limits of the channel. The target will stand at the resistance level of 1.0621, which is in line with the moving averages. An additional buy signal will be created after a breakout and a downside retest of the barrier. The price may then soar to the high of 1.0659. However, the quote is unlikely to go above it today. A test of the level of 1.0659 to the downside will create an additional entry signal and trigger a row of bullish stop orders. The pair may then swell to 1.0703, where it is wiser to lock in profits. Should EUR/USD go down when there is no bullish activity at 1.0581, the pressure on the pair will increase, triggering a deeper bearish correction. In case of a breakout through 1.0581, EUR/USD will plunge to 1.0540 where long positions could be opened after a false breakout only. It will become possible to buy EUR/USD on a rebound from 1.0495 or 1.0446, allowing a bullish correction of 30 to 35 pips intraday.

When to go short on EUR/USD:

Bearish activity is likely to increase near the resistance level of 1.0621. It is important that the bears do not lose control over the barrier. If Germany's macro data comes disappointing, this should limit the pair's growth potential. For that reason, short positions could be considered after a false breakout through 1.0621. This will lead to a fall in price to the support level of 1.0581. The pressure on the pair will increase after a breakout and a retest of the barrier, generating an additional sell signal. The quote may retrace down to 1.0540 and then fall to 1.0495 if it consolidates below this mark. This will also instill hope in traders for a bear market at the end of the year. The most distant target is seen at 1.0445 where it is wiser to lock in profits. If EUR/USD goes up during the European session when there is no bearish activity at 1.0621, the price will soar to the upper limit of the sideways channel, standing at 1.0659. Both the bulls and the bears will try to take this level under their control. Short positions could be considered there only after a false breakout. Also, it will be possible to sell EUR/USD on a rebound from the high of 1.0703, allowing a bearish correction of 30 to 35 pips.

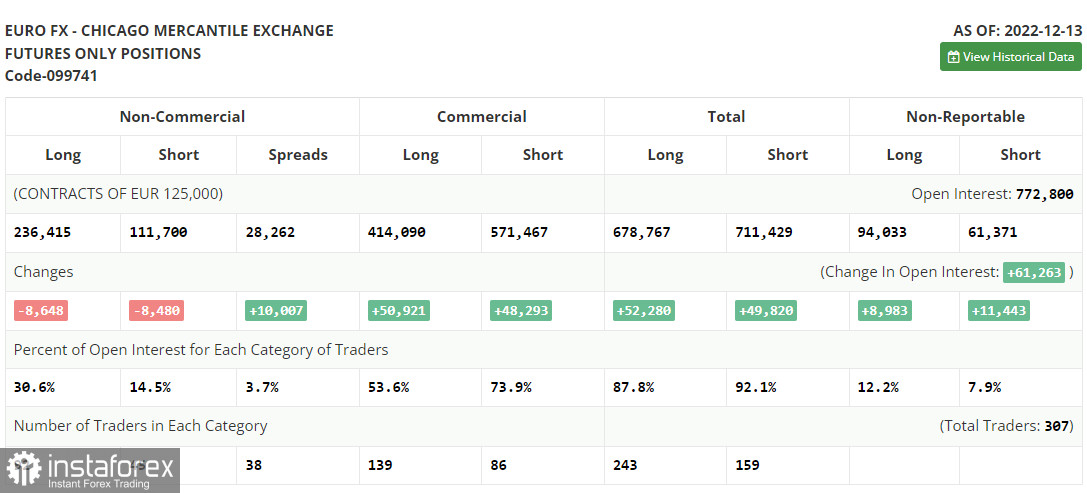

Commitments of Traders:

The COT report for December 13th revealed a drop in long and short positions. Last week, traders preferred locking in profits before the meetings of world central banks. Consequently, it led to a reduction in the number of positions. The Fed's and the ECB's hawkish stance on monetary policy will continue limiting growth prospects for risk assets. The regulators' fight against persistent inflation may trigger a recession in the US and the eurozone. The focus is now shifting to next year, as markets are unlikely to surprise traders in December. According to the COT report, long non-commercial positions fell by 8,648 to 236,415, short non-commercial positions declined by 8,480 to 111,700, and the total non-profit net positioning dropped to 122,247 from 123,113. This indicates that investors are reluctant to dispose of risk assets at the current price even despite the subdued bullish activity. The pair needs support from new fundamental factors to extend growth. The weekly closing price rose to 1.0342 from 1.0315.

Indicator signals:

Moving averages

Trading is carried out in the range of the 30-day and 50-day moving averages.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Resistance stands at 1.0640, in line with the upper band. Support is seen at 1.0610, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.