USD/CAD is falling this week, demonstrating a downtrend after five weeks of consecutive growth. So, the loonie was near 1.3250 in the beginning of November, but last Friday, the bulls tested the 37th figure.

The 500-point march was accompanied by corrective pullbacks, but in general, the uptrend was clearly visible. Conflicting results on the Bank of Canada's December meeting only fueled the bullish sentiment. Despite the greenback's shaky position, the USD/CAD bulls were rising, eventually climbing to the 37th figure. But their confidence ran out in this price area. Obviously, the bulls need a source of information to boost them so they can work on a bullish attack. However, bears also need some informational boost to develop a bearish pullback to 1.3550 (upper limit of the Kumo cloud on D1), and then to 1.3460 (lower limit of this cloud on the same chart).

Today's report may "rattle" the pair. At the start of Wednesday's U.S. trading session, Canada will release key data on the country's inflation growth. And in light of the controversial results of the Bank of Canada's December meeting, this report is particularly significant to the Loonie.

Two weeks ago, the Canadian central bank raised its interest rate by 50 basis points. Bank of Canada Governor Tiff Macklem lamented the high inflation rate and positively assessed the dynamics of the national economy growth in the third quarter. On the one hand, the formal results of the December meeting were in favor of the Canadian dollar. On the other hand, a closer look at these results suggests opposite conclusions. By the way, the Canadian dollar reacted negatively to the stance of the accompanying statement, falling in many currency pairs.

And here's why. Behind the central bank's statement that inflation in Canada is still at an unacceptably high level is an inherently opposite clarification. The Bank of Canada said in an accompanying statement that the three-month rates of change in core inflation have come down - and according to central bank economists, this is "an early indicator that price pressures may be losing momentum." In other words, the central bank saw the first signs of a slowdown in inflationary growth, with all the consequences that this implies. In fact, the possible consequences of a further decline in inflation are also mentioned in the text of the final communique. The phrase in question is worth quoting in full: The "Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target".

Such preceding statements add value to an already significant macro report. This suggests that today's release has the potential to trigger price turbulence in the USD/CAD pair, especially if the final numbers deviate from projections.

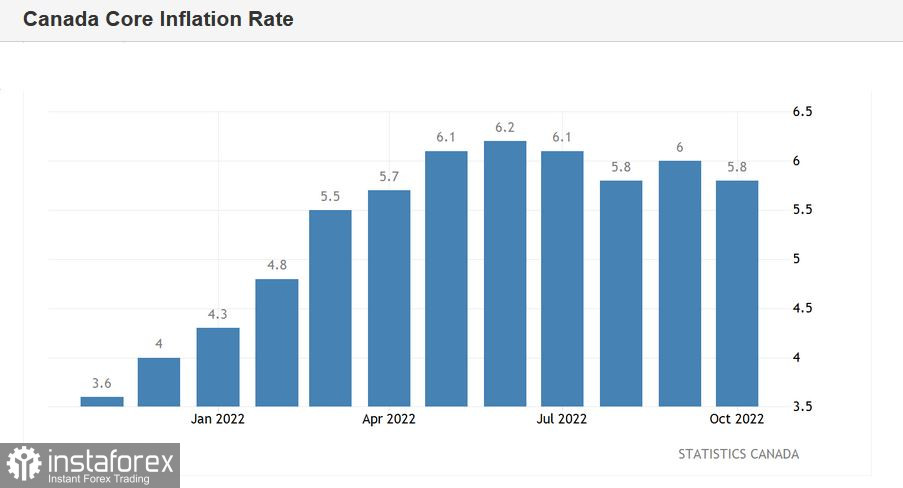

Let me remind you that in October, the core consumer price index (which excludes volatile food and energy prices), in annualized terms, declined to 5.8% from the previous 6% value. Instead of a decline, most experts expected an increase to 6.3%.

According to preliminary forecasts, the downtrend will develop in November. Thus, according to the majority of experts, the core CPI will come out at 5.6% (y/y): this could be the weakest growth rate of the indicator since March 2022. As for overall inflation, a decline in indicators is also expected - both in monthly and annual terms. In particular, in monthly terms, the index should decline into negative territory (-0.1%) after growth to 0.7% in October. On a year-on-year basis, the index is likely to come out at 6.6% (the weakest growth rate since February of this year).

As we can see, the forecasts are rather weak, so if the report turns out to be in the red zone, the Canadian dollar will be under a lot of pressure. In such a case, the pair might retest the 37th figure again, updating the current week's high (1.3702). Take note that the resistance level is slightly higher, at 1.3760 (the upper line of the Bollinger Bands indicator on the daily chart), so the USD/CAD bulls have a good chance to break through the 37th figure, if the current inflation report turns out to be a disappointment. However, an alternative scenario is also possible: if the report is in the green zone, the bears could develop a bearish rollback to 1.3550 (Kumo cloud upper limit at D1) and then to 1.3460 (Kumo cloud lower limit on the same chart).

At the moment, it would be best to maintain a wait-and-see attitude on the pair: the inflation report will determine the price movement vector in the medium term.