The bullish expectations of the cryptocurrency market and stock indices ahead of the Fed meeting, were categorically trampled on by Jerome Powell's pessimistic rhetoric. At the moment, major cryptocurrencies decreased to local lows or lost all chances of an upward trend.

In connection with this situation, the restoration of the correlation between Bitcoin and stock indices played a cruel joke on the cryptocurrency. The asset finally broke the structure of the upward trend and returned to the usual fluctuation range of $15.5k–$17.1k.

At the same time, the cryptocurrency managed to stabilize the situation and provoke a decrease in talk about a possible update of the local bottom. However, the situation on the crypto market remains tense, and a series of negative factors can provoke another collapse of digital assets.

Bitcoin outlook for 2023

Before the passions around the Binance crypto exchange subsided, a new cause for concern appeared. One of the largest Bitcoin miners, Core Scientific, has filed for Chapter 11 bankruptcy. Insiders report that the company is still managing to generate profits, but management is confident that it will not be enough to pay off debts.

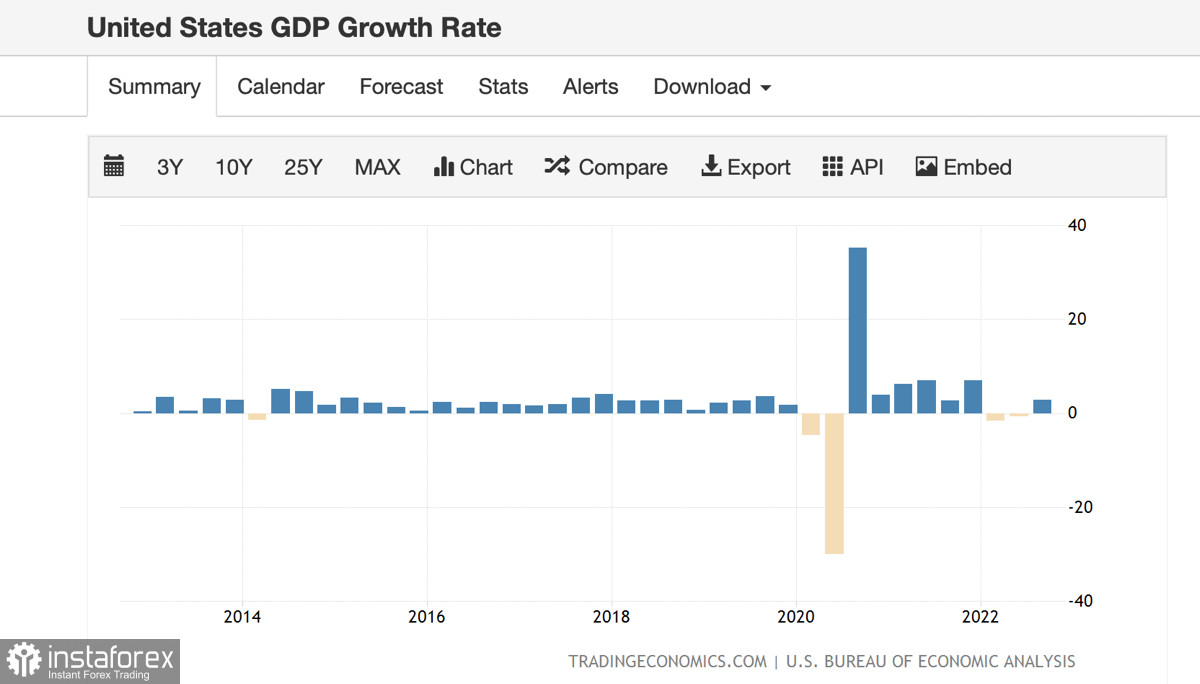

In addition, blockchain analytics firm Nansen is confident that the crypto market is waiting for the next stage of decline, provoked by the consequences of the Powell's speech. Recall that the head of the regulator said that the U.S. economy will face a protracted recession in 2023 due to the lack of plans to ease monetary policy.

Due to the upcoming recession in the U.S. economy, analysts expect a significant sell-off in the stock market. However, the growing correlation between Bitcoin and the S&P 500 index may indicate that the crypto market will also suffer from another stock market crash.

In addition, it is important to emphasize that the highest level of correlation between Bitcoin and the stock market occurred during a downward trend in financial instruments. Given the growing level of co-dependence between stock indices and Bitcoin, we can expect another stage of the fall in the price of the crypto market. At the same time, experts suggest that this will be the final chord of the bear market.

Bitcoin and stock indices

As of December 21, Bitcoin maintains a high level of correlation with stock performance. Major indices showed a local rebound after several days of decline.

Given the approach of a local bull period, there is reason to believe that the stock market and Bitcoin will show local growth on the eve of 2023. However, in general, the macroeconomic situation will not change significantly in 2023, and therefore we should expect a parallel and interconnected fall in SPX and BTC.

BTC/USD Analysis

On the daily chart of Bitcoin, there is a final weakening of the local bullish momentum that allowed the cryptocurrency to hold the $16.4k level. However, sellers will have to work hard to turn the tide this week, as buying volumes over the past two days give buyers a head start.

Despite this, the bears are gradually taking over the initiative on the 1D timeframe, which indicates a retest of the $16.4k level in the near future. The main BTC metrics are gradually becoming bearish: RSI and stochastic are decreasing, which indicates growing selling pressure, and MACD continues its flat move below zero.

All of these factors point to a high probability of a decline over the next few days. The main area of selling pressure will be the $16k–$16.4k area, where large volumes of BTC purchases are concentrated. However, we are also waiting for the opening of the American markets, and therefore a local rebound or an attempt to realize a full-fledged bullish impulse is possible.

Results

Equality remains in the Bitcoin market with varying success for each sides. However, the truth is that both bulls and bears don't have sufficient volumes to realize a full-fledged price movement. Given this, the consolidation movement of Bitcoin will continue in the near future with attempts to implement local targets.

The initiative is gradually moving to the bears, so the probability of a retest of the $16k–$16.4k area is growing. At the same time, it is impossible to exclude a positive effect from the correlation of BTC and funds, as well as the New Year rally. Given this, we can assume a sharp activation of buyers with an attempt to gain a foothold above $17k.