After the tumultuous movements associated with the meetings of the world's leading central banks, it would be nice for the main currency pair to take a break. And we need to speculate on its prospects. Let's imagine them as an equation with three unknowns—inflation, economy, and monetary policy. Let's look at several scenarios and formulate strategies for working with EURUSD for each of them.

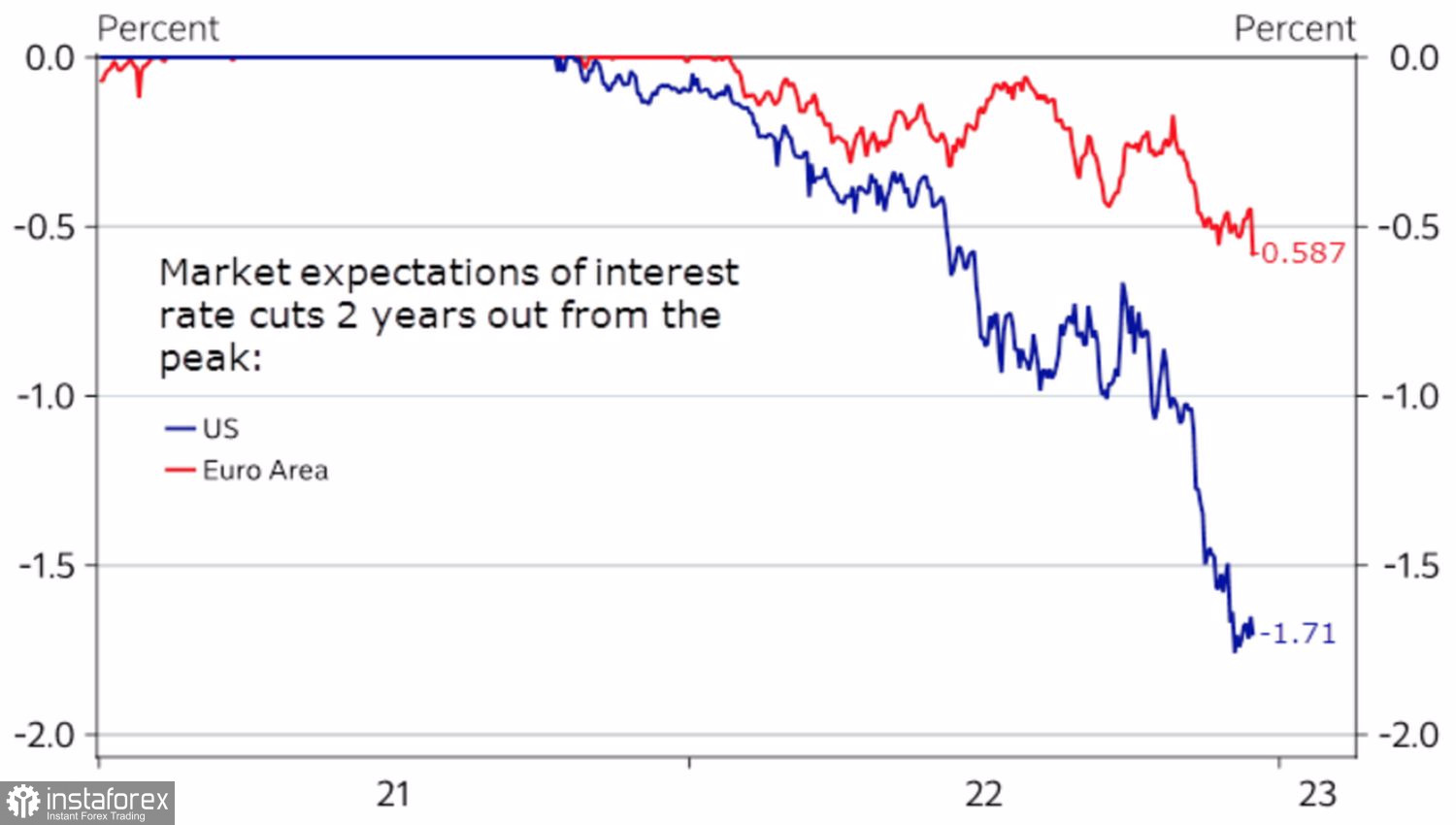

Scenario one. Market. Investors are seriously betting that an aggressive tightening of monetary policy will trigger a recession. This will force the Fed to cut the federal funds rate as early as the second half of 2023 rather than wait until 2024, as the FOMC forecasts suggest. This is the dovish reversal that the markets dream of. Amid a slower ECB monetary expansion, when the deposit rate will fall only by 55–60 bps, and not by 170–175, like the Fed rate, this option assumes EURUSD rally in the direction of 1.1–1.12 by the end of next year.

Dynamics of market expectations of ECB and Fed rate cuts in 2023

Scenario two. What if the Fed is right after all? The central bank slows the pace of monetary tightening and provides a soft landing for the U.S. economy. Nevertheless, high inflationary pressures are entrenched in the U.S. for the long term. It is only realistic to reduce it to 3%–4%, but not to 2%, as required by the target. As a result, the federal funds rate rises to 5.25% and then the Fed pauses until at least early 2024. The EURUSD dynamic turns out to be torn next year. The pair remains highly sensitive to consumer price data. Their slowdown is a reason to buy the euro against the U.S. dollar and vice versa. Most likely, EURUSD will first rise to 1.07–1.08 amid the Christmas rally in the U.S. stock market, and then it will sink to 1.04, after which it will start to recover and rise towards 1.09–1.1.

Finally, the third scenario. Apocalyptic. New troubles are hitting the global economy in the form of an escalation of the armed conflict in Ukraine or a new wave of COVID-19, and U.S. inflation, which is starting to rise again after slowing down in October–November. The Fed has no choice but to accelerate the process of tightening monetary policy. This turns into a global recession and an increase in demand for the U.S. dollar as a safe haven asset. It again takes this status away from the Japanese yen as the Fed's rate hike turns into a rally in the yield of U.S. Treasury bonds. Even against the backdrop of a downturn in the economy. In this case, EURUSD risks returning to parity.

We choose which scenario of the development of events you like best and build a long-term trading strategy for the analyzed pair.

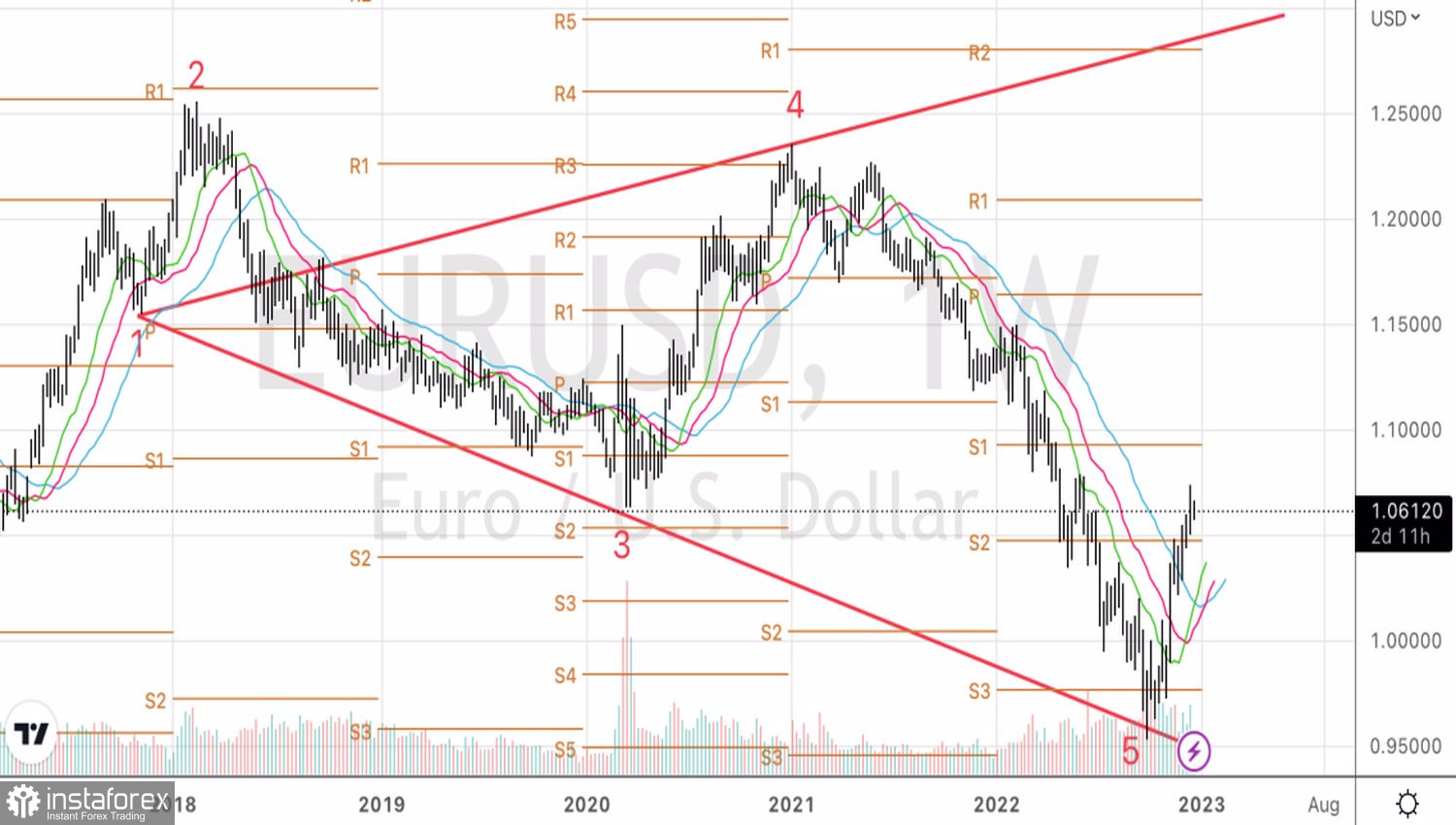

Technically, the implementation of the reversal pattern of the Wolfe Wave continues on the EURUSD weekly chart. The main currency pair stubbornly does not want to fall below the supports in the form of pivot points 1.0535 and 1.0475. This means that the bulls retain control over it. We continue to buy euros with a medium-term target of $1.087.