The British pound has been losing ground against the US dollar in recent weeks, as the Fed signaled a potential policy shift amid higher inflation expectations.

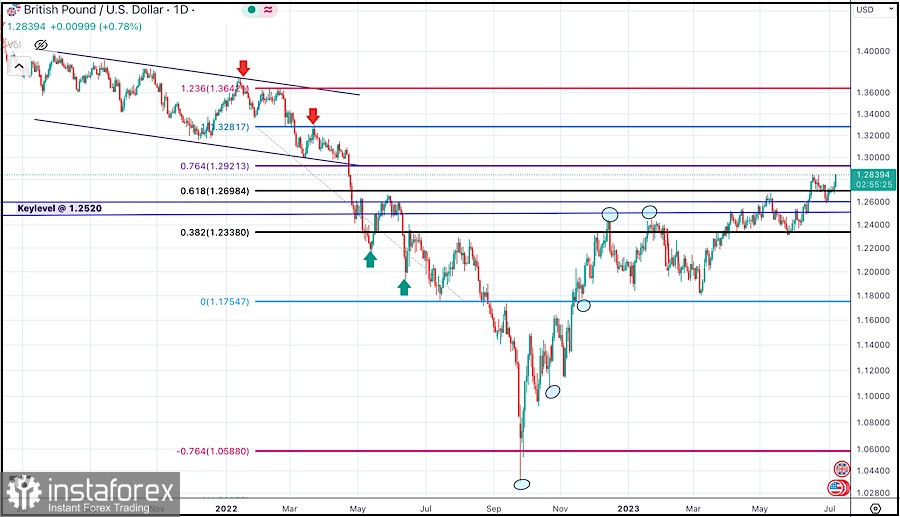

The GBPUSD pair is now hovering around 1.2700, just below a key resistance level at 1.2900, with a mixed market sentiment.

The USD still benefits from the higher inflation expectations and the possibility that the Fed may reduce its asset purchases.

The GBPUSD pair managed to climb above 1.2600 and tried to bounce back toward 1.2900 and the next target around 1.3100, but it did not have enough bullish momentum to maintain it.

Meanwhile, a short-term bearish correction is underway. If the pair closes below the price level of 1.2500 on a H4 candlestick, it may continue to fall toward 1.2200 and 1.2000.