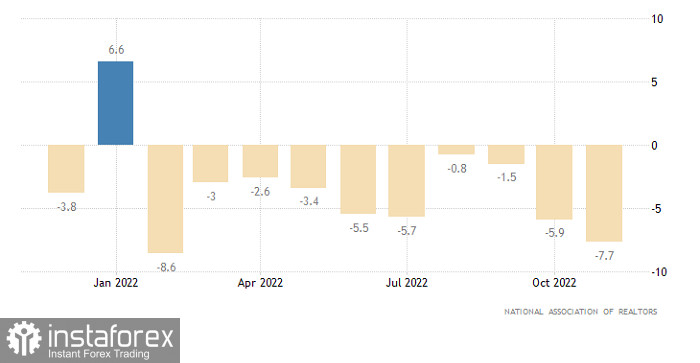

At first glance, the market has been moving as expected. The euro logically grew after the US had reported a 7.7% slump in existing home sales. The thing is that these metrics do not matter a lot because they are not able to trigger market moves. In fact, the single European currency began its growth after the closing bell on American markets. In other words, EUR/USD traded higher in the Asian trade. There are no fundamental reasons for the bullish bias. Everything depends entirely on technical factors. After the euro dipped to the lower border of the narrow trading range where it had been stuck since the end of the last week, the instrument climbed to the upper border.

US Existing Home Sales

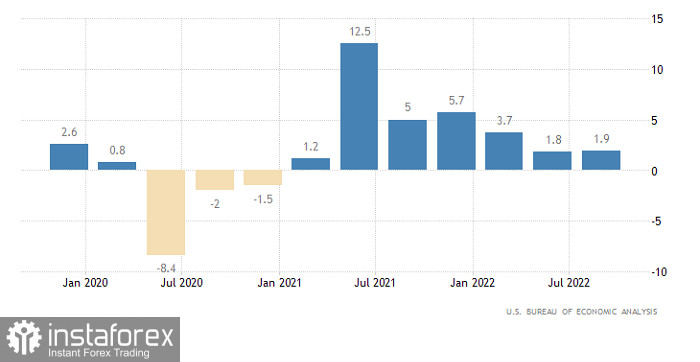

Today, the economic calendar contains a slew of economic data for the US which in theory should set the market in motion. However, strong market moves are hardly possible. Of course, the US GDP data is important, but when it comes to the first and the second estimates. By the moment when the revised data is published, the market already priced in all GDP changes long ago, so the revised data is of secondary importance. The thing is different about US unemployment claims. This time, the consensus suggests a minor change in continuing unemployment claims which are always given priority. The number of Americans who are on the dole is expected to increase just by 2K. The number of first-time jobless claims could have grown by 4K last week. All in all, this data will not be able to change market sentiment. Thus, investors will have to adjust trading decisions to technical charts.

Revised US GDP

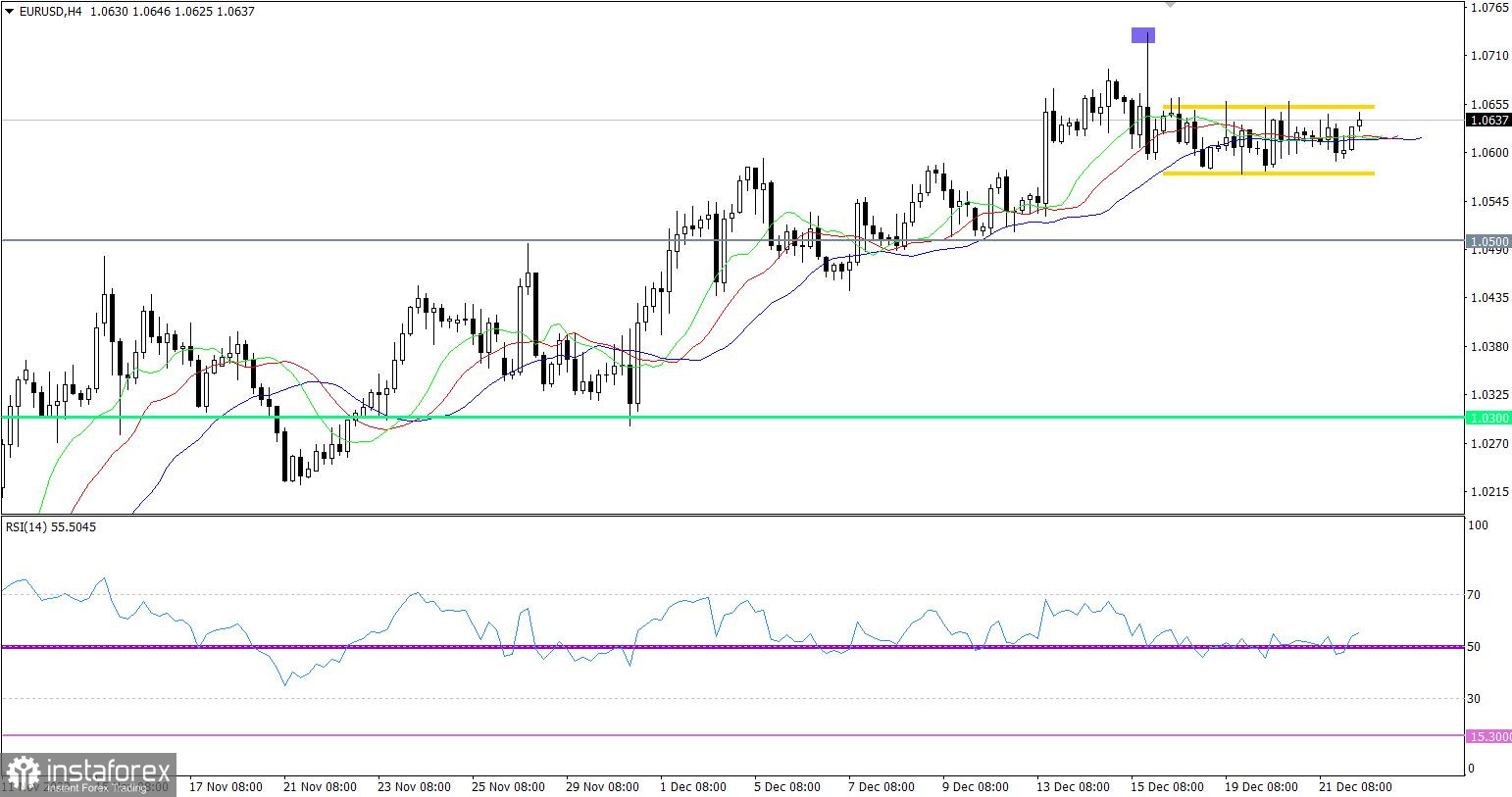

EUR/USD has been trading in the range between 1.0580 and 1.0660 for the fourth day straight. While, being stuck on a flat market, the pair has been accumulating trading forces. Hence, such market conditions could arouse the interest of speculators who trade with a breakout strategy.

The H4 RSI confirms the sideways market because the indicator has been moving along 50. The daily RSI has been trading in the upper area of 50/70. This indicates the bullish interest which has been going on since the autumn.

Moving averages on the H4 Alligator are intersected with each other which also reveals the flat market. The D1 Alligator neglects local price moves and its moving averages are directed upward.

Outlook and trading tips

We could assume that the range-bound market will come to an end soon. The price will gain particular momentum and escape from any of the borders. The reasonable strategy will be planning positions in the direction of a breakout.

Complex indicator analysis generates mixed signals due to sideways trading in the short term and intraday. In the medium term, technical indicators don't take into account local price moves. So, the buy signal is still valid.