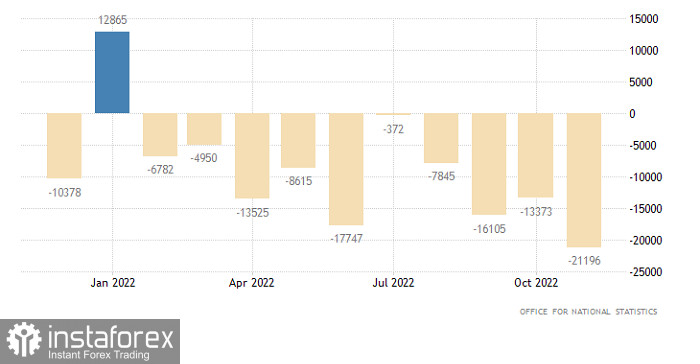

Both euro and pound have been fluctuating quite strongly in the past days. For the former, this can be due to some delayed reaction, but for the latter, such a dynamics is a bit perplexing. This is because a £21.2 billion decrease was seen in the UK's public sector borrowing data, which is very good as it means that the debt burden in the public system is reduced. However, instead of rising, the pound fell for a long time and even went under 1.21.

Public sector net borrowing (UK)

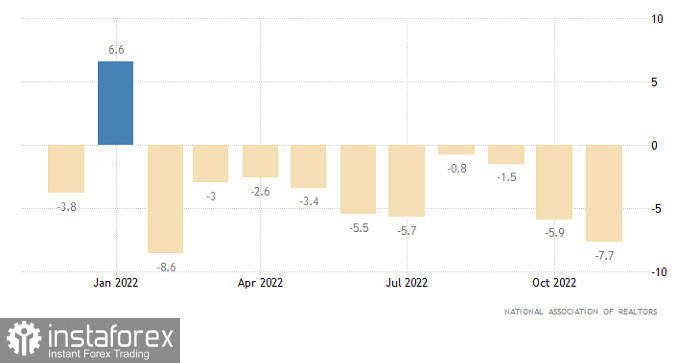

For euro, it was not surprising that there was an increase as the 7.7% decline in secondary home sales in the US naturally led to the decline of dollar demand. However, the reaction was really delayed because it happened hours after the release of the data, when the US trading session already ended. It rose upon reaching the bottom of the range, where it had been stuck since the end of last week, and went up just to the upper boundary.

Secondary market home sales (United States)

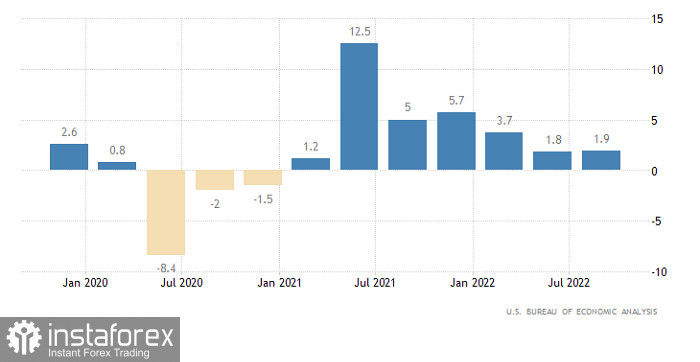

All in all, both currencies were guided by technical factors, which means that it does not have a significant impact on investor sentiment. This is why the market continues to stagnate, moving from one range boundary to another. It is unlikely that the situation will change today even though ahead are reports on US and UK GDP, as well as weekly jobless claims in the US.

GDP (United States):

EUR/USD has been trading within 1.0580/1.0660 for four days already. Thus, there is a chance that there will be a breakout one of these days.

GBP/USD is in a correction. Its quotes are currently at the area of the psychological level 1.2000/1.2050, which is likely to put pressure on sellers, leading to a decrease in the volume of short positions in the pair. If that happens, the correction will either end or slow down.