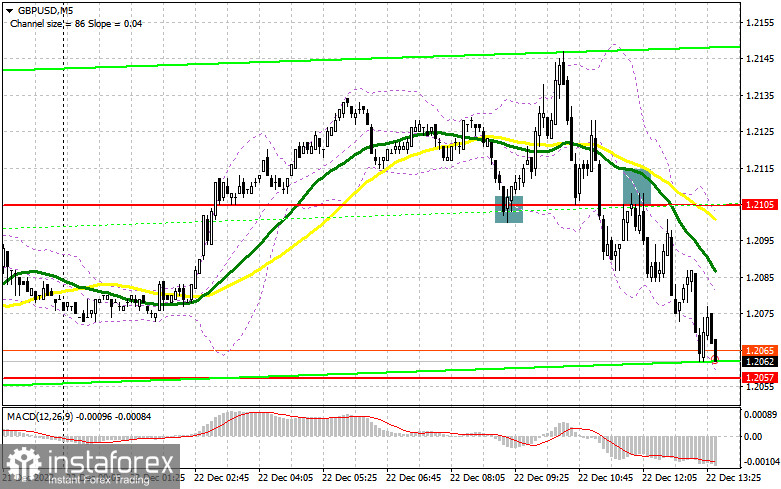

Long positions on GBP/USD:

UK GDP was revised downwards, which prevented bulls to fix the price above 1.2161. As for now, they have failed to protect the level of 1.2105. They need to prevent the price from falling below the weekly low of 1.2057. Weak US GDP data and rising jobless claims are what bulls need now. During the reports, a false breakout formation near 1.2057, even if the pair reaches yesterday's low, will be a good signal for the British pound. If it does not happen, GBP is likely to continue falling. Following a bullish scenario, we can expect a pullback to 1.2105, where the moving averages are located. The MAs support bears now. A top-down test of this range may create another buy signal with the target at 1.2161. Breaking through this level, bulls may receive a significant boost, creating a buy signal with the target at a new high of 1.2219, where traders may take profits. If bulls are not successful in the second half of the day and fail to protect 1.2057, the market will be taken by bears again. In that case, it is better to buy GBP from 1.2003 after a false breakout. One may also open long positions on a pullback from 1.1955 or lower near 1.1904, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Bulls are trying to drag the pair to yesterday's low at 1.2057. Weak US GDP data may slow down the decline, so a false breakout near the former support (and now resistance) at 1.2105 may create an opportunity to sell the British pound. A sell signal might take the pair down to 1.2057. If the price pierces this level and makes a downward test of it, it may give an additional sell signal, which is likely to strengthen the bear market, pushing the price to 1.2003. Bears may face some difficulties at this level again. A breakthrough and a downward test of this level may open the way to the area of 1.1955, where traders may lock in profits. If the pair does not go down from 1.2105, bulls are likely to reverse the market, dragging the price to the up area of 1.2161. A false breakout at this level may create an entry point into short positions. If we see no activity at this level, it is better to sell GBP on a rebound from 1.2219, allowing an intraday correction of 30-35 pips.

Indicator signals:

Moving averages

Trading is carried out below the 30-day and 50-day moving averages, indicating that bears are trying to regain control over the market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the level of 1.2140 will offer resistance in line with the upper band.

Description of indicators:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

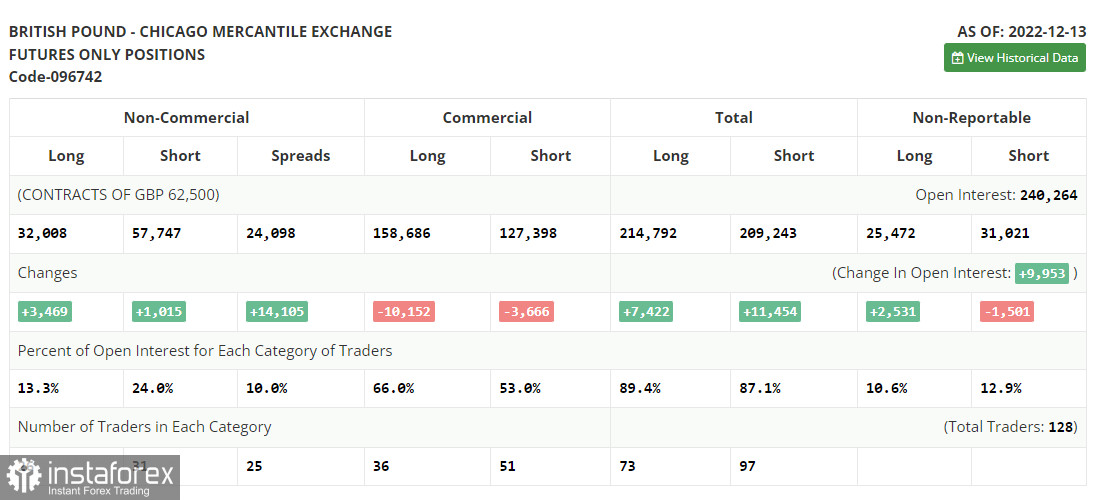

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Short non-commercial positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.