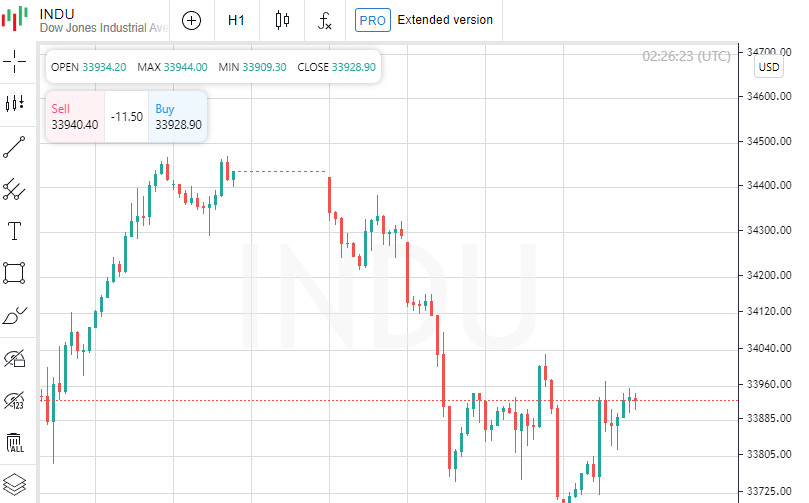

Like a mirror of sparkling New York, the Dow Jones index reflected positive trends, adding 0.62%. In its rapid growth, it was not alone - the S&P 500 index shot up 0.24%, and the NASDAQ Composite did not lag behind, adding 0.18%.

Analysts' views forecast interesting shifts in the US economy. Their expectations show a slowdown in annual inflation in June to 3.1%, down from 4% in May. At the same time, monthly inflation seems to be picking up, rising to 0.3% from 0.1%. Core inflation also confirms forecasts of a slowdown in June to 5% from 5.3% a month earlier. More will be known on Wednesday when the relevant data will be published.

The winners of the day among the Dow Jones index components were Intel Corporation (NASDAQ:INTC) shares, which noticeably perked up, adding 0.89 points (2.79%) and reaching 32.74. Amgen Inc (NASDAQ:AMGN) did not lag behind, increasing its value by 6.08 points (2.78%) and ending the day at 224.73. Home Depot Inc (NYSE:HD) shares also joined the rising trend, adding 7.47 points (2.47%) and closing the day at 310.28.

But not everyone had such a lucky day. Verizon Communications Inc (NYSE:VZ) shares became an example of this, losing 0.76 points (2.12%) and ending the trading session at 35.14. On the contrary, Microsoft Corporation (NASDAQ:MSFT) shares gained momentum, adding 5.39 points (1.60%) and closing at 331.83. The Travelers Companies Inc (NYSE:TRV) shared Verizon's fate, dropping 2.58 points (1.50%) and leaving the market at 169.07.

Monday's S&P 500 index trading ended on a high note, with shares of Wynn Resorts Limited (NASDAQ:WYNN) acting as bright leaders, jumping 5.69% to 107.09. MGM Resorts International (NYSE:MGM) shares did not lag behind in terms of dynamics, increasing by 5.59% and closing at 45.50. Enphase Energy Inc (NASDAQ:ENPH) shares made it into the top three, showing growth of 5.60% and ending the trading day at 175.47.

However, as in any drama, there were those who went against the tide. Thus, shares of FMC Corporation (NYSE:FMC) closed at 92.63, losing 11.15% in price. Corteva Inc (NYSE:CTVA) shares followed them, giving up 5.57% and ending the session at 54.11. DISH Network Corporation (NASDAQ:DISH) shares decreased in price by 2.75%, reaching the mark of 7.08.

While the S&P 500 index stands on the threshold of further growth, experts from Bank of America (BofA) are anticipating its successes in the coming years. They predict that the index will reach the 5000 point mark, refreshing its record indicators. From the current perspective, this means growth potential of over 13%.

The market structure is also encouraging: "The S&P 500's rise of 24% since October 2022 brings the current "bull" market closer to the growth cycles of 1950-1966 and 1980-2000," noted BofA technical analyst Steven Suttmeier.

If history repeats itself, the S&P 500 index could break the 6000 level by 2026. Such an optimistic scenario implies a growth potential of around 36% over three years. Suttmeier even believes that the positive dynamics of the S&P 500 index may continue at least until 2028.

The "presidential cycle" in the US, which testifies to the connection between stock market trends and four-year presidential terms, also supports the rise of stock indexes. Historical data confirms: the third year of the presidential term is usually the most favorable for the stock market, and the fourth year is also characterized by positive dynamics.

Trading of the NASDAQ Composite index led to noticeable growth of some components. Thus, shares of Mobilicom Ltd ADR (NASDAQ:MOB) surged ahead, appreciating 88.00% to 2.82. They were followed by shares of Jupiter Wellness Inc (NASDAQ:JUPW), which gained 50.27% and closed at 0.55. Alpine 4 Holdings Inc (NASDAQ:ALPP) shares also showed active movement, increasing by 40.48% and ending the trading at 2.36.

But there were also exceptions: shares of Tivic Health Systems Inc (NASDAQ:TIVC) lost 35.98% in price, closing at 0.07. Neonode Inc (NASDAQ:NEON) followed them, losing 35.20% and ending the session at 4.75. Better Therapeutics Inc (NASDAQ:BTTX) shares also showed negative dynamics, declining by 19.64% to 0.90.

Against this background, on the New York Stock Exchange, the majority of stocks closed in the green (2048), exceeding those that stayed in the red (898). The shares of 93 companies didn't show any notable change. Whereas on the NASDAQ exchange, 2291 companies showed growth, 1210 marked a decrease, and the quotations of 151 stocks remained stable.

The CBOE Volatility Index, which is determined based on the parameters of S&P 500 options trading, increased by 1.62%, reaching 15.07. This indicates an increase in market uncertainty.

In the field of commodity assets, the August gold futures fell by 0.08%, or 1.55, to the level of 1.00 dollar per troy ounce. As for oil futures, the August contract for WTI crude oil decreased by 0.91%, or 0.67 dollars, to 73.19 dollars per barrel. The September contract for Brent crude fell by 0.78%, or 0.61 dollars, to 77.86 dollars per barrel.

There were no significant fluctuations in the currency market. The EUR/USD pair was virtually unchanged, increasing by 0.31% to 1.10. The USD/JPY rate decreased by 0.52%, reaching the mark of 141.32.

Meanwhile, the futures on the dollar index fell by 0.32% to 101.62. The dollar index tracks the US dollar relative to a basket of six major currencies. A decline in the index typically indicates a weakening of the dollar relative to these currencies.