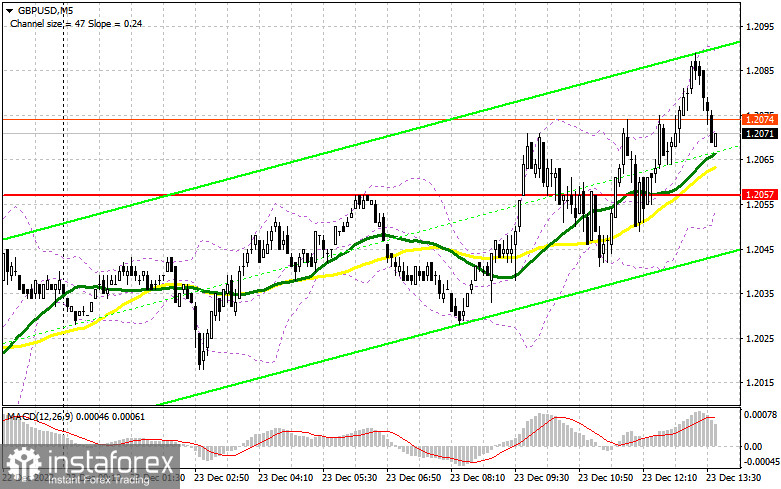

In the morning article, I turned your attention to 1.2057 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. As expected, the bulls entered the market and pushed the pair above 1.2057 as the economic calendar remained empty. However, there was no clear signal as trading was carried out either above or below 1.2057. For the afternoon, I did not revise the technical outlook, as well as the trading strategy.

When to open long positions on GBP/USD:

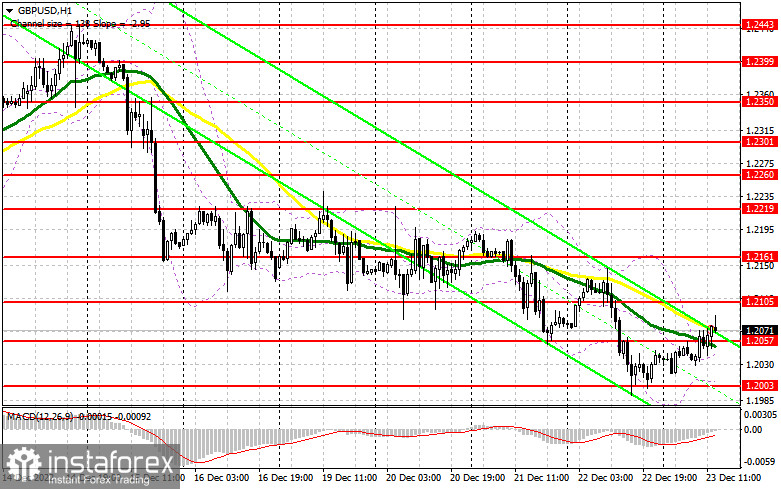

The American session is going to be quite busy. Traders are anticipating a batch of economic reports, namely US personal income and spending, the PCE index which is closely watched by the Fed, as well as new home sales data. If these reports are strong, the pound sterling could return to the support level of 1.2057, which acted as resistance in the morning. A false breakout there will create a good buy signal with the prospect of a sharp rise to 1.2105. This is the target level for buyers today. A downward retest of this level will give another buy signal. The price may approach 1.2161, which will undermine the bearish sentiment. A breakout of this level, which is unlikely, will help bulls assert strength. They could open long positions betting for an increase to a high of 1.2219 where I recommend locking in profits. If the bulls fail to push the pair above 1.2057, the bears will regain the upper hand. In this case, I would advise you to open long positions only if a false breakout of 1.2003 takes place. You could buy GBP/USD immediately at a bounce from 1.1955 or lower at 1.1904, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Sellers tried really hard to protect 1.2057 but failed. In case of weak US data, bulls will increase long positions on the pound sterling. Thus, before opening short positions, it is important to pay attention to the nearest support level of 1.2105 to sell. A false breakout of this level may force the bulls to exit the market. The price could drop to 1.2057. A breakout of this level as well as an upward retest will give a sell signal. The pound sterling will be again in the bears' claws. It is likely to fall to 1.2003. At this level, it will be difficult for sellers to push it lower. After a breakout and an upward retest of this level, the price could decline to 1.1955 where I recommend locking in profits. If there is no large downward movement from 1.2105, the bulls will try to regain control. It may trigger a breakout of 1.2161. A false breakout there will create an entry point into short positions with the prospect of a further drop. If bears show no energy there, you could sell GBP/USD immediately at a bounce from 1.2219, keeping in mind a downward intraday correction of 30-35 pips.

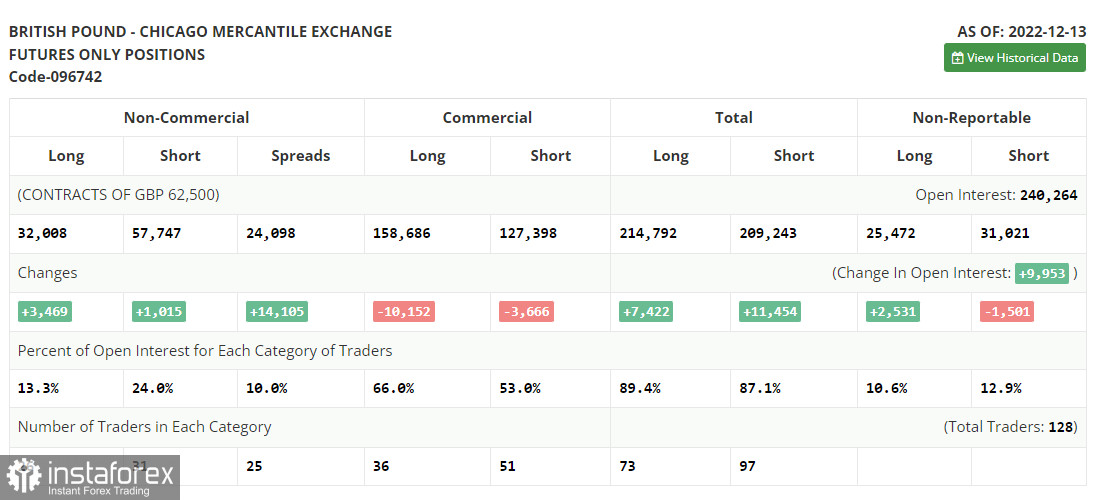

COT report

The COT report for December 13th logged a rise in long and short positions. Given that the number of long positions is higher, it means that the bullish sentiment is strong now. Traders are ready to buy the pair at the current highs. Last week, the Bank of England announced that it would remain committed to aggressive tightening to curb stubbornly high inflation, which slowed down a bit last month. However, many analysts warn that the regulator's decision to stick to a hawkish stance may trigger a recession. It is sure to limit the pair's upside potential. For this reason, it is better to wait for a downward correction in order to buy the instrument. According to the latest COT report, short non-commercial positions rose by 1,015 to 57,747 and long non-commercial positions grew by 3,469 to 32,008. Consequently, the non-commercial net position came in at -25,739 versus -28,193 a week ago. The weekly closing price of GBP/USD increased to 1.2377 versus 1.2149.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages. It indicates that bears are trying to regain the upper hand.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If GBP/USD drops, the indicator's lower border at 1.2005 will serve as support.

- Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.