US stock index futures rose slightly on Friday after yesterday's big sell-off. The rise was driven by hopes that upcoming inflation data for December will be lower, which could push the Federal Reserve to reduce the pace of monetary tightening.

Nasdaq 100 and S&P 500 futures have recouped their losses, adding 0.3% and 0.2%, respectively. The Stoxx 600 index also traded in positive territory, posting its first gain in three weeks.

As for yesterday, the stock market declined following reports indicating that the US labor market remained strong and consumer spending was resilient. The latest economic data confirmed that the Fed will continue hiking interest rates at their next meetings, albeit at a slower pace of 50 basis points. That pushed tech stocks down.

According to Bank of America Corp, various equity funds lost nearly $42 billion in the week through December 21 in their biggest outflow on record, as the Fed, the European Central Bank and the Bank of Japan continue to signal further rate hikes next year.

Therefore, despite the recent slight uptick, a Santa Claus rally is unlikely this year, and it is best to stay away from the stock market for now. This also includes the bond market, which has been on a losing streak lately and will likely suffer losses in the future as well. Treasury bond yields went up. Japan's benchmark 10-year bond yield fell to 0.37%, remaining well below the central bank's new upper limit of 0.5%. However, the drop in yields was triggered by active BOJ's purchases.

Today investors will focus on the PCE index, a key inflation gauge monitored by the Federal Reserve. Analysts expect the index to rise by 5.5% year-over-year, up from 6% in October.

Crude oil prices continue to rise substantially over the week following Russia's announcement that it may cut crude oil production in response to price caps imposed by the G7 on its exports, highlighting the risks to global supplies in the year ahead.

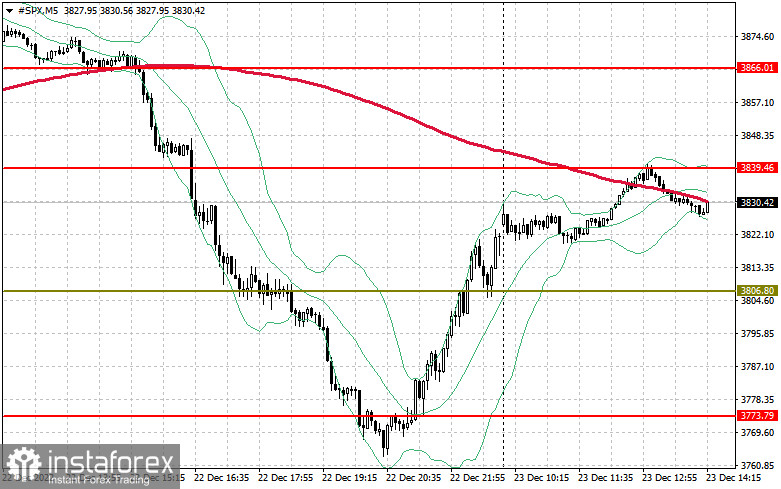

On the technical side, the S&P500 may continue to rise. Defending $3,806 will be top priority for today. As long as the index remains above that level, it is likely to move steadily upwards. This will open the way towards yesterday's resistance level at $3,839. Just above it lies the level of $3,866. Moving beyond that level will be quite difficult. If the S&P 500 falls, bullish traders must hold on to $3,806 - the only remaining key level below it is $3,773, this week's low, which will put downward pressure on the index. A breakout below this level would push the instrument down to $3,735 quickly, and the furthest target is around $3,699.