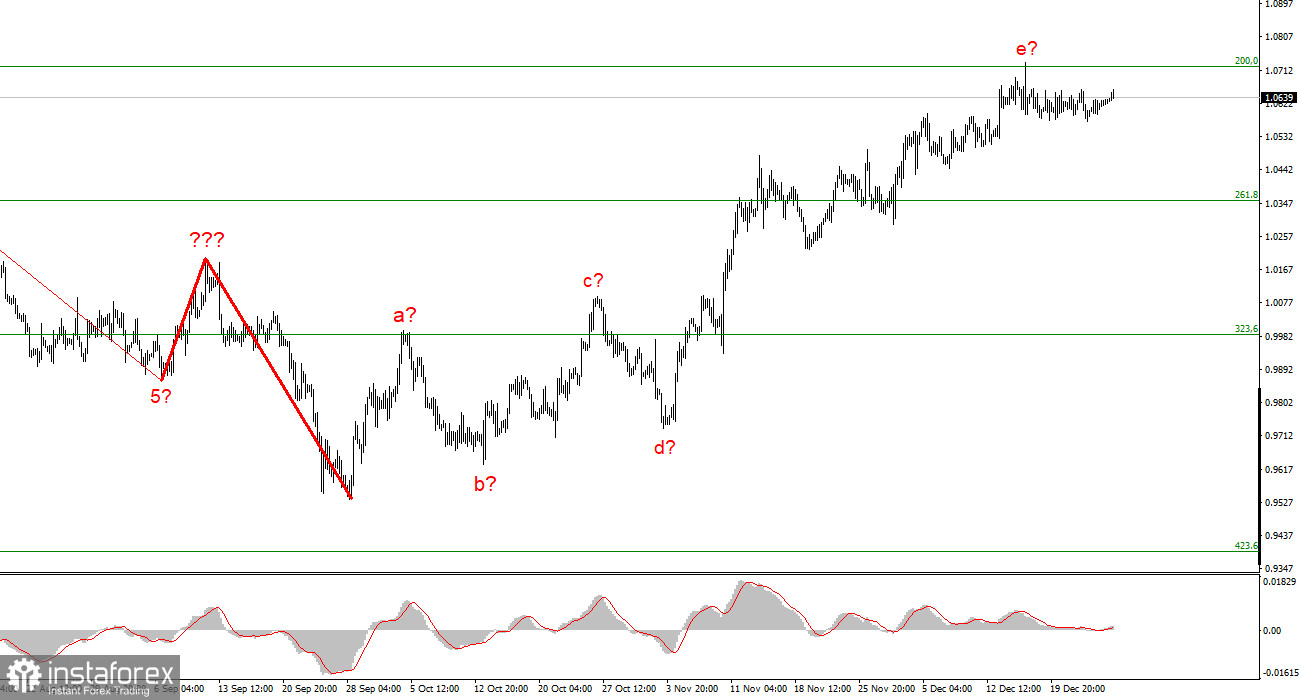

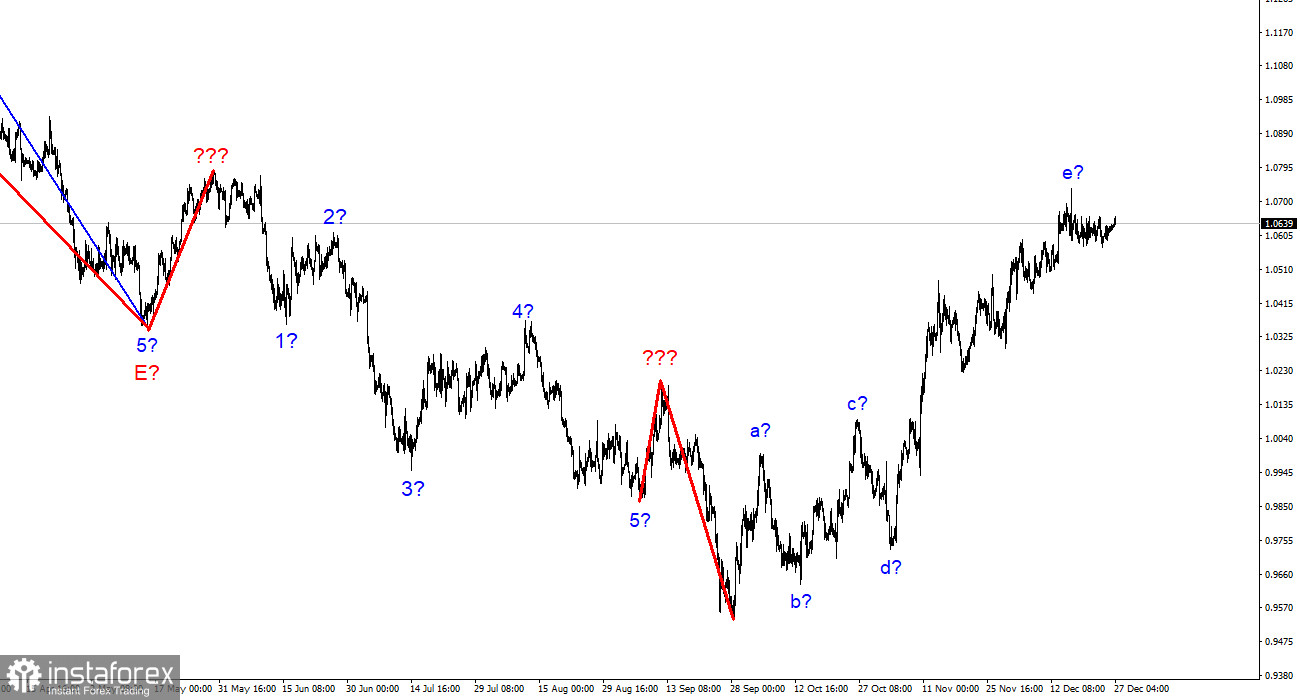

The euro/dollar instrument's 4-hour chart still shows a convincing wave marking, and the entire upward section of the trend is still very complex. It now has a clear corrective and lengthened form. The waves a-b-c-d-e have been combined into a complex correction structure, with wave e having a form that is significantly more complex than the other waves. Since the peak of wave e is much higher than the peak of wave C, if the current wave layout is accurate, construction on this structure may be nearly finished or may already be finished. In this scenario, we must construct at least three waves. In any case, I'm getting ready to lower the instrument. The market has demonstrated to everyone this year that it would rather wait and rest than actively work, so it may start as early as next year. The market is prepared to sell when an attempt to surpass the 1.0726 level, which corresponds to 200.0% Fibonacci, fails. Despite what might seem to be everything needed for it, the demand for US currency is still not increasing. The wave e's internal wave structure is extremely ambiguous, making it challenging to identify sub-waves.

A depressing start to the new week.

On Monday, the euro/dollar instrument increased by 20 basis points. Please note that these statistics are highly conditional, so readers should not draw any conclusions from them. The opening and closing levels of the day rarely fall on the same level. Therefore, even if there is no movement at all, one of the currencies will still rise or fall at least slightly at the end of the day. In contrast, there are currently no movements, amplitudes, or market participants.

Due to the fact that many nations celebrated Christmas on Monday, the volume of trade and subsequent movements were negatively impacted. There were no changes from yesterday when it was possible to completely avoid opening the trading terminal. The wave marking hasn't changed in over a week. No news context is provided. I still anticipate a decline in quotes based on the current wave markup because I think the upward trend section is finished. The markets will be ready to increase demand for the euro currency if an attempt to break the 200.0% Fibonacci mark is successful. Many analysts discussed the potential movements of the instrument in January 2023 in the final days of the previous year, and the majority of them agreed that the US currency should start to strengthen. I concur with this viewpoint in light of the wave analysis. You must wait because there have been no movements at all thus far. Maybe just until the holidays are over, or maybe it will be much longer. I don't believe the market will start operating actively on January 1 right away. Nearer to the middle of next month, active work is most likely to be seen.

Conclusions in general

I draw the conclusion from the analysis that the upward trend section's construction has grown more intricate and is almost finished. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. Although there is a chance that the upward portion of the trend will become even more extended and complicated, and the likelihood that this will happen is still high, at least we now have a signal for a decline from which we can start.

The wave marking of the descending trend segment noticeably becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this section is complete, work on a downward trend section can start.