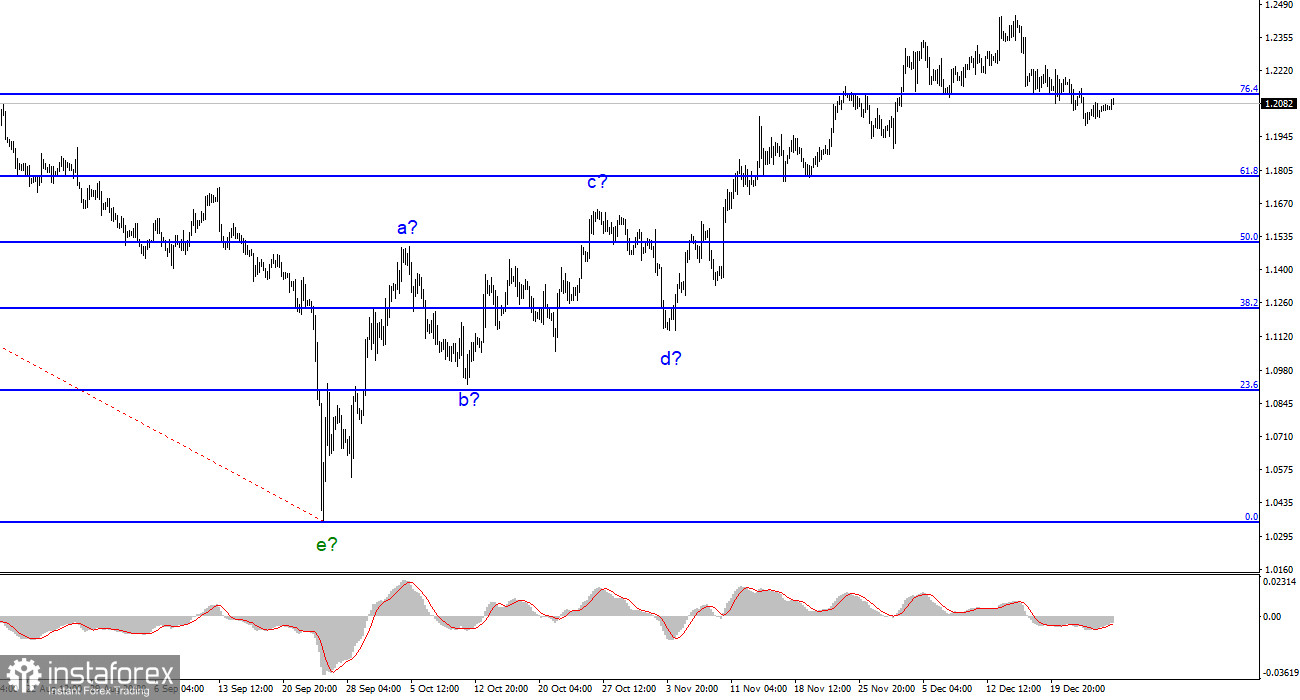

The wave marking for the pound/dollar instrument currently appears quite confusing, but it still does not call for any clarifications. We have a five-wave upward trend section, which has taken the form a-b-c-d-e and may already be complete. The British pound has a much higher chance of finishing the upward trend segment because the quotes are actively retracing from previously reached peaks. A European currency cannot, however, remain frozen in place indefinitely. I believe that it will eventually begin to deteriorate as well. It is challenging to sum up the recent weeks' British news background in a single word because it has been both robust and diverse. The British pound had sufficient justification at this point to rise or fall. As you can see, it primarily chose the first course of action, but things have since turned around. Market demand for the pound has peaked, and as a result, the news background (or lack thereof) already contributes more to a decline in market demand. Trading with this tool is now much more effective because the wave marking on the pound has been improved.

The holidays are still in effect, but formal trading has begun.

On Monday, the pound/dollar exchange rate increased by 16 basis points. Since yesterday was essentially a weekend, my readers shouldn't be perplexed by the total amplitude of 10 points, which occurs sporadically throughout the year. Due to the ongoing holidays and the lack of recent news, market activity should only slightly increase today. I anticipate that the British pound will continue to decline in the final weeks of 2022 because it has recently started to do so. To count on a robust movement and a healthy profit on transactions, however, is very difficult at the moment. The market is already in a festive mood, so readers should be aware that there won't likely be any significant movements.

Additionally, there won't be any intriguing economic reports this week. The first significant data, in particular business activity indices, won't be made public until next week. Based on this, I do not anticipate the market to be actively working right away after the New Year. I'm watching for the development of a downward trend section to continue, which should have at least three waves. In the upcoming weeks, I anticipate both of the instruments I'm considering declining. These expectations may be put off by the holidays, but there is no longer any evidence in the recent news to support an increase in demand for the pound. Even though it had previously not always backed the development of the British, the market was so eager to create an upward set of waves that wave e ended up being very long. However, the British economy has already started to contract, and the rate of inflation is still very high. The Bank of England increased the rate eight times, but only by 50 basis points in December, demonstrating that it was not willing to take a "tough" stance against rapid price growth.

Conclusions in general

The construction of a new downward trend segment is still predicted by the wave pattern of the pound/dollar instrument. I can currently recommend sales with targets around the level of 1.1508, which corresponds to a 50.0% Fibonacci ratio. Although wave e may still take a longer form than it does right now, it is most likely finished.

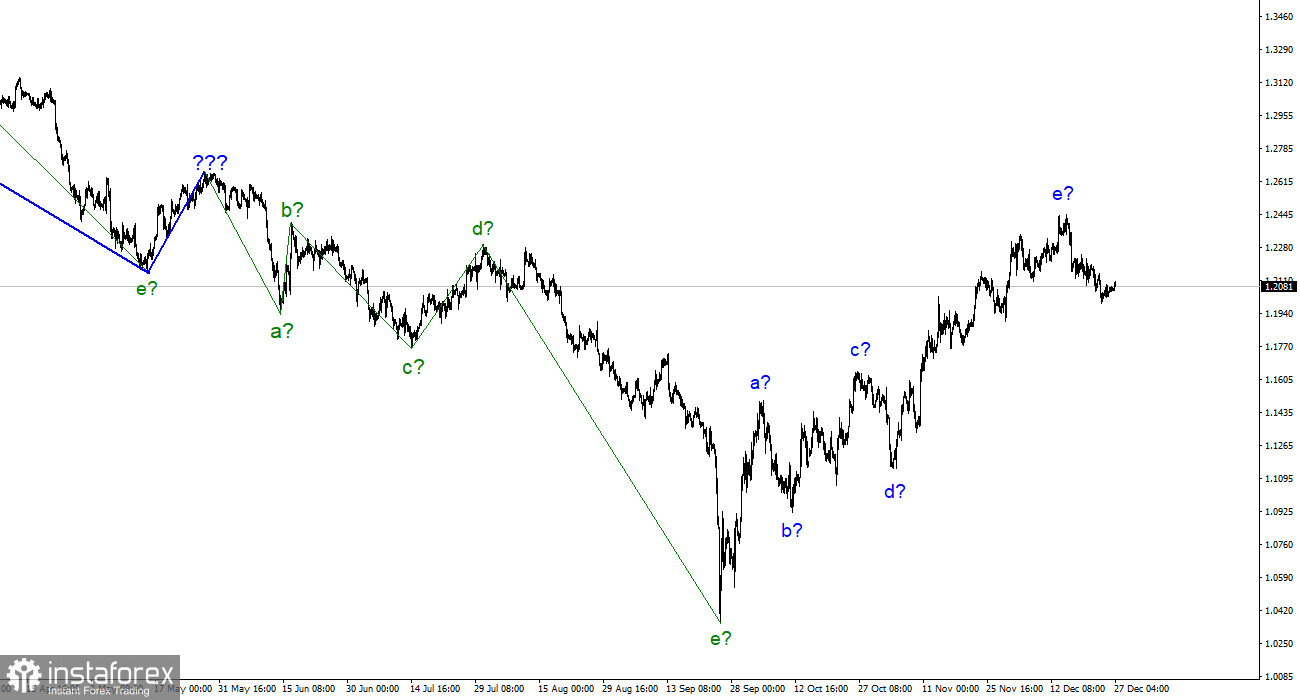

The euro/dollar instrument and the picture look very similar at the larger wave scale, which is good because both instruments should move similarly. Currently, the upward correction portion of the trend is almost finished (or has already been completed). If this is the case, a downward section will likely be built for at least three waves, with the possibility of a decline in the region of the 15th figure.