Although the UK and Europe had a weekend yesterday and the UK is still on holiday today, the market showed some activity. Thus, the pound sterling was inching up amid some technical factors. Meanwhile, the euro has been trading sideways for a week already. The fact is that not so long ago, the British currency was falling and at the end of the previous week, it even broke the lower limit of the range.

Yesterday, the pound sterling made an attempt to return to this limit. Extremely low activity and the absence of news prevented the currency from rising noticeably. That is why today, the pound sterling may once again attempt to return to 1.21-1.22 thanks to the US investors. However, this will be just a technical rebound.

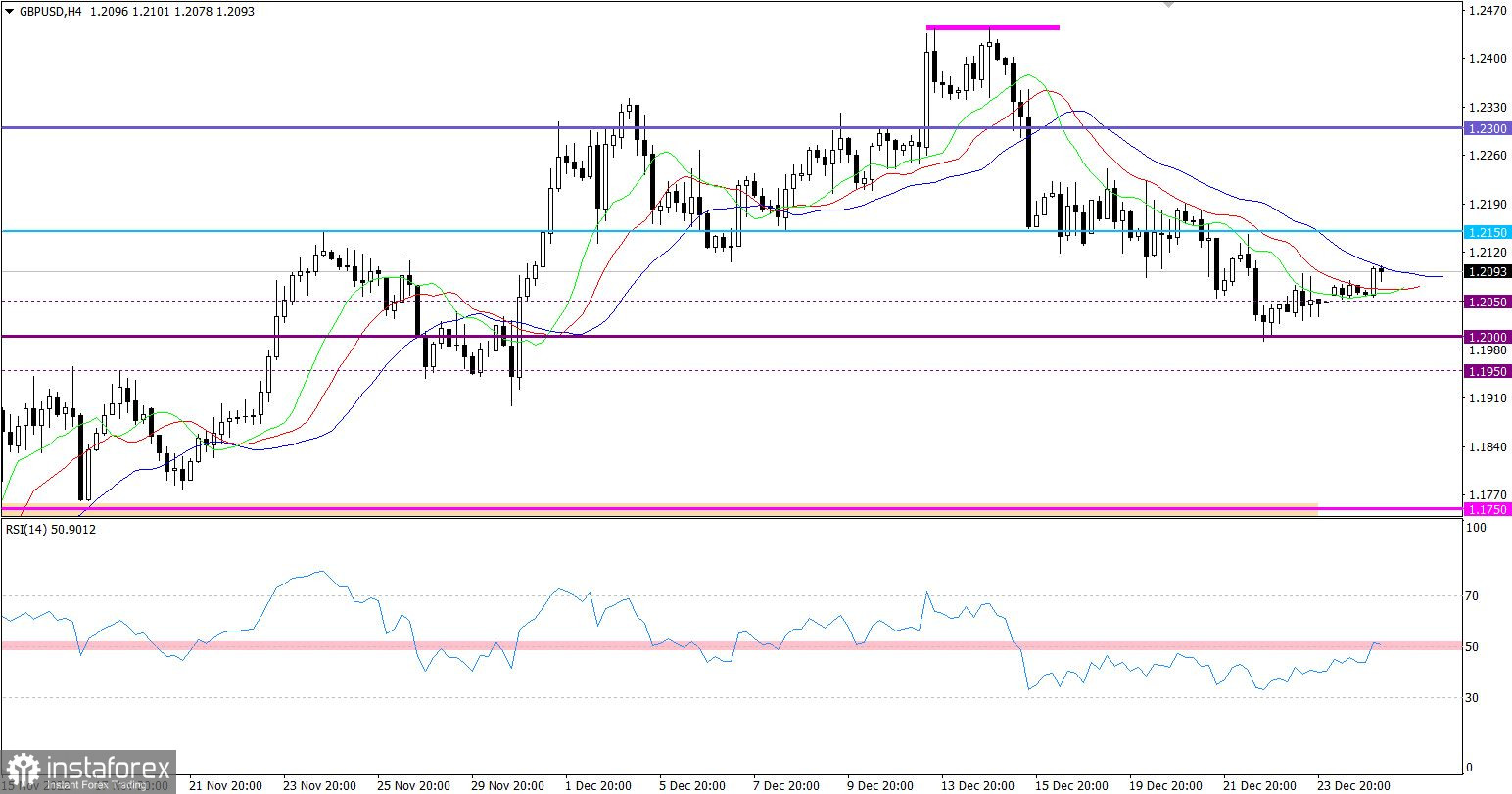

The pound/dollar pair is rising from the psychological level of 1.2000. As a result, the pound sterling added about 90 pips, manifesting the price consolidation above 1.2050.

On the four-hour chart, the RSI technical indicator upwardly crossed the mid line 50. This reflects a rise in the volume of long positions. On the daily chart, the indicator failed to settle below the middle level, which may act as a signal of the end of the correctional movement.

On the four-hour chart, two out of three Alligator's MAs are intersecting each other. This points to a slowdown in the correctional movement.

Outlook

The current correction from the high of the upward cycle is still in force. However, the situation may change if the price exceeds 1.2150 on the four-hour chart.

In the event of this, we will see a gradual recovery of long positions after a correctional movement.

If the price settles below 1.1950 on the four-hour chart, traders will get a technical signal of the continuation of the downward correction.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, technical signals are showing buy opportunities thanks to the recent price rebound from 1.2000.