At the end of the year, you always want to believe in the best. That the new year will be better than the previous one. That inflation will continue to slow down and recession will be avoided. That China will finally defeat COVID-19. That all will be well. And such hopes encourage the EURUSD bulls to perform feats because the euro is the currency of optimists and the U.S. dollar is the currency of pessimists. Alas, the euro's advance is very slow. The momentum is not as strong as we would like it to be and bulls are ready to step back at any moment.

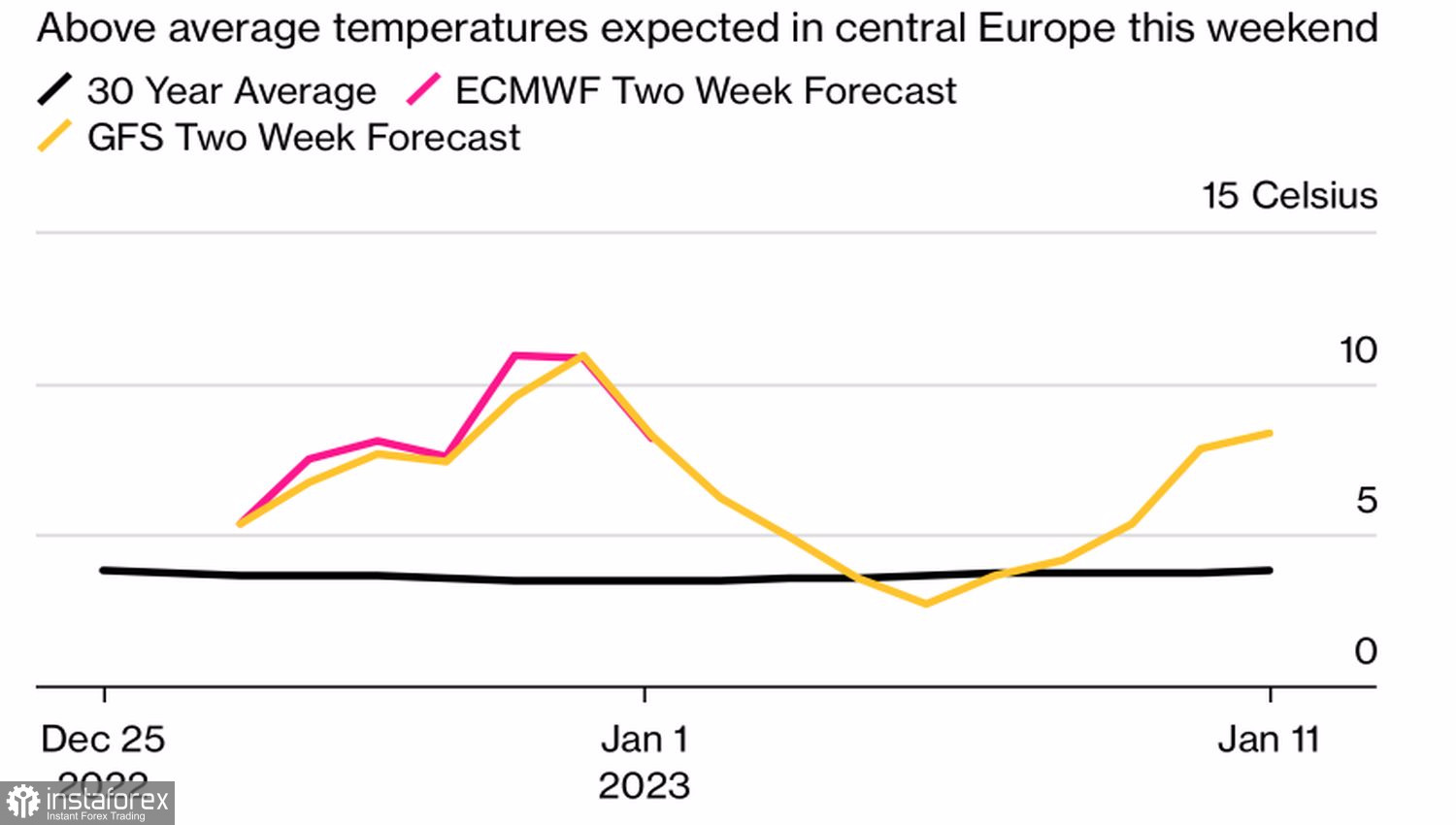

Are the gradual lifting of restrictions in China and warm weather in Europe enough reasons to forget about the pair's short-term consolidation in the range of 1.0575-1.655? Personally I doubt it, but investors are relieved by the thought that there will be a Santa Claus rally in the US market, which will add fuel to the growth of the main currency pair. For now, Beijing's decision to lift the quarantine for foreigners entering the country and the temperatures much higher than average in Europe are pointing to an upward movement. The circumstance of the latter leads to a drop in gas prices for the seventh consecutive trading session.

Temperature trends in Europe

The decline in the cost of blue fuel makes the energy crisis in the eurozone not as dire as initially thought. The recession in the bloc is likely to be mild and short-lived, which provides confidence to the bulls. Especially against the background of the approaching recession in the US economy, which is not fully taken into account in the quotes of the main currency pair.

The resilience of the European economy allows the European Central Bank to conduct an aggressive monetary policy. According to ECB President Christine Lagarde, the central bank intends to raise the deposit rate by 50 bps at the next few meetings and play long term. Klaas Knot, governor of the central bank of the Netherlands, says that only halfway has been passed and Isabel Schnabel, member of the Governing Council, thinks that market forecasts of a borrowing costs cap of 3.4% are underestimated.

The bears will be in trouble if the interest rate rises to 4-4.5% in 2023. The only thing that can save them is a new run-up in U.S. inflation which would force the Federal Reserve to raise borrowing costs above the FOMC's projected 5.1%. On the contrary, the approaching recession will increase the risks of a dovish reversal by the Fed and strike a blow to the US dollar.

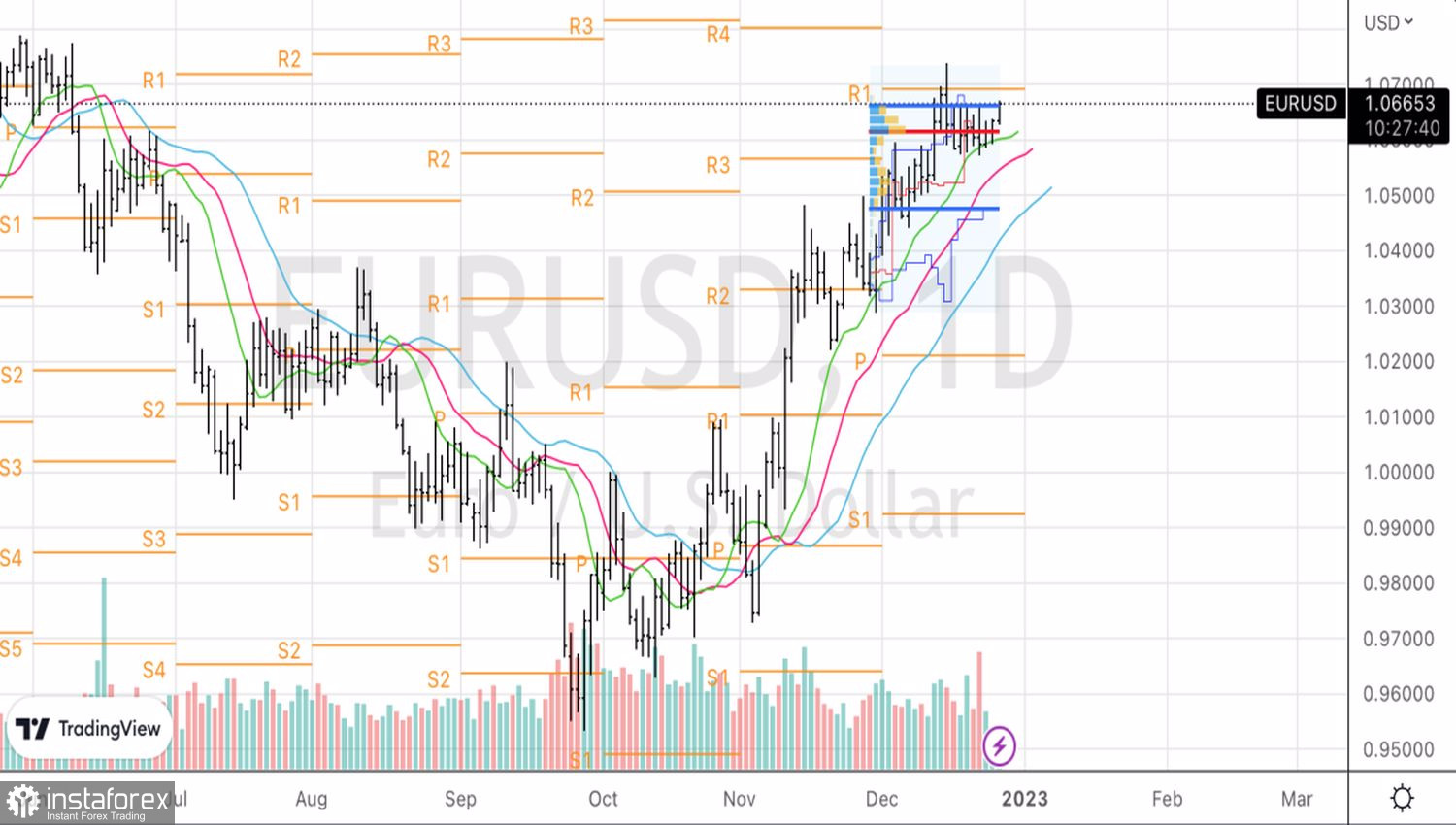

Thus, there is still a lot of uncertainty in the Forex market, which makes bulls cautious when they move up. The situation can flip at any time, and long positions will have to be discarded.

Technically, leaving the consolidation range of 1.0575-1.0655 or from the shelf of the Splash and Shelf pattern may develop an uptrend. In this case, you can build long positions in case EUR crosses the pivot level at 1.0695. On the contrary, returning to the area below the fair value at 1.061 and using a false breakout pattern will be a signal for a reversal.