Even though it was relatively simple, the GBP/USD currency pair was already trading more frequently on Tuesday than it was on Monday. Since the majority of locations around the world were closed for the celebration of Catholic Christmas the day before, Monday can be officially considered a holiday. As a result, the volatility that was ultimately displayed is regarded as "zero." The market remained motionless all day. Despite the lack of any noteworthy news or events on Tuesday, the pair managed to rise to the moving average line, bounce off of it, and then continue falling. Since we are still in the pre-holiday season, it is obvious that the movements were still weak. However, there are two crucial differences: 1) the pound/dollar pair is not flat, and 2) the pound/dollar pair keeps correcting downward as expected.

Recall that the pound sterling had risen by more than 2,000 points in just 2.5 months, signaling the beginning of a downward correction three weeks prior. Since the pair had previously been declining for almost two years, it is obvious that the reasons for this strengthening could be purely technical. Nevertheless, everything has a limit. No fundamental or macroeconomic factors contributed to this growth. Because of this, we anticipated a significant correction, and we think it will decline by another 400–500 points. A fairly lengthy period of consolidation that is expressed by alternating movements of 400–500 points up and down can then start. Naturally, this is assuming that the world does not experience a new cataclysm in the form of a persistent "coronavirus" epidemic or a significant deterioration in the geopolitical situation in Ukraine. In this scenario, the rising anti-risk market sentiment may cause the US dollar to begin to grow once more.

The UK's political crisis.

Many international financial experts assert that the British economy's crisis is only just getting started and that Andrew Bailey's predictions of a two-year recession are not at all unfounded. According to several sources, tax increases will aid in closing the budget "hole" and prevent the escalation of the national debt, but they will also result in lower consumer spending among the British people. Retail sales, GDP, and demand will all start to fall, which will all be adversely impacted by the Bank of England's high key rate. The British economy may spend the ensuing decade making fruitless attempts to "get off its knees" as a result of the two factors mentioned above (higher taxes and an increase in the key rate).

Any stick has two ends, as you can see. Every economic change has both positive and negative effects. Even more, we would argue that economics does not lend itself to the application of concepts like "positively" or "negatively." According to Liz Truss, lowering taxes in the UK would result in a ten-year increase in the budget deficit of hundreds of billions of pounds. Something would need to be used to make up for this deficit. How about that? Just using identical tax receipts. The EU nations (and not just them) are still extremely fortunate that the energy crisis this winter has been averted thanks to the recent sharp decline in oil and gas prices. In any case, the British economy would experience significant difficulties.

Many experts think that the government, which has used the benefits of leaving the EU very ineffectively, is the real culprit rather than the economy itself. The fact that four prime ministers have already been replaced since 2016 (Brexit) shouldn't surprise anyone, in theory. Each new administration creates a new cabinet, and together they attempt to take a different path to avoid the mistakes of their forerunners, who left office early. In this case, logic is crucial. The government is to blame if there are issues with the economy because it is in charge of managing it. Additionally, the entire nation simultaneously. As a result, the problems in the UK extend beyond economics. This particular political crisis has persisted for six years. Scotland wants to leave the United Kingdom, and this desire is not unfounded.

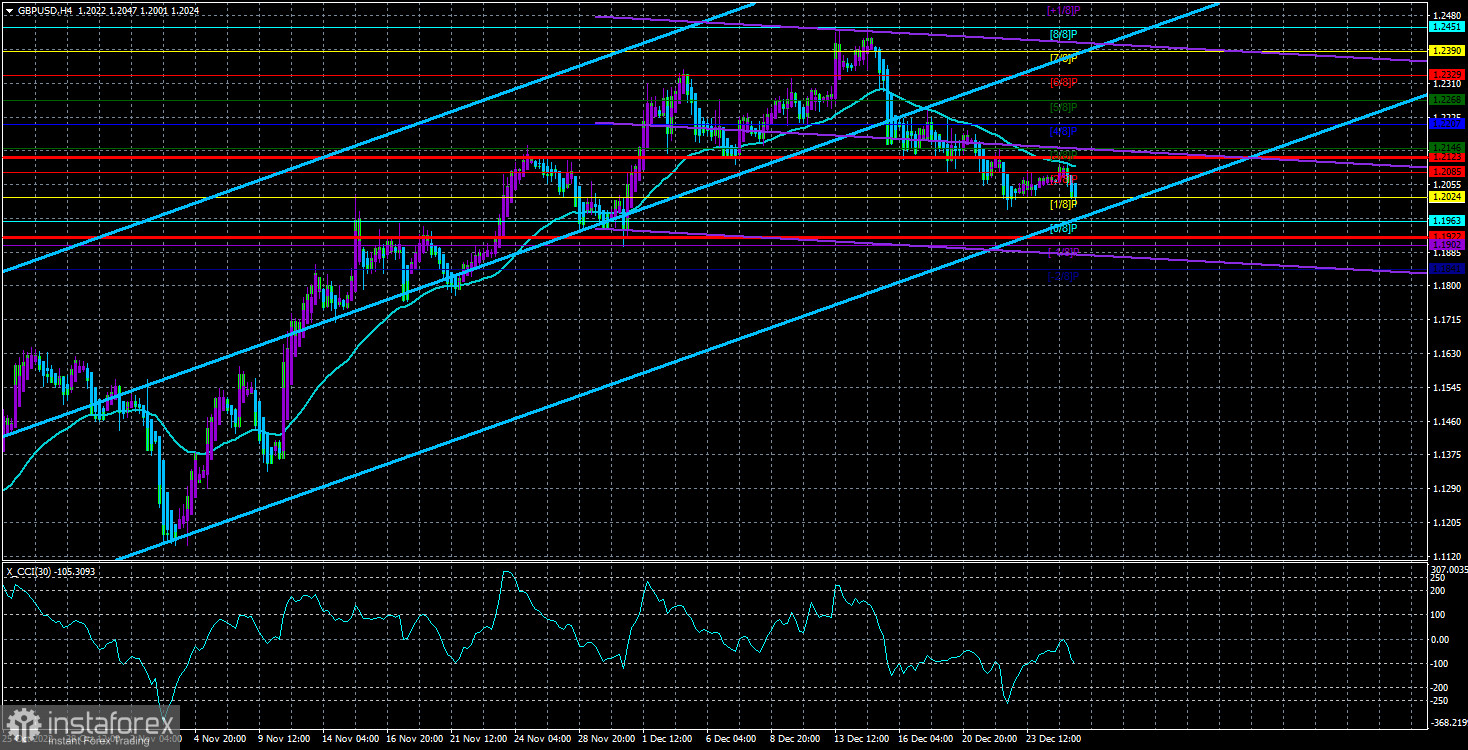

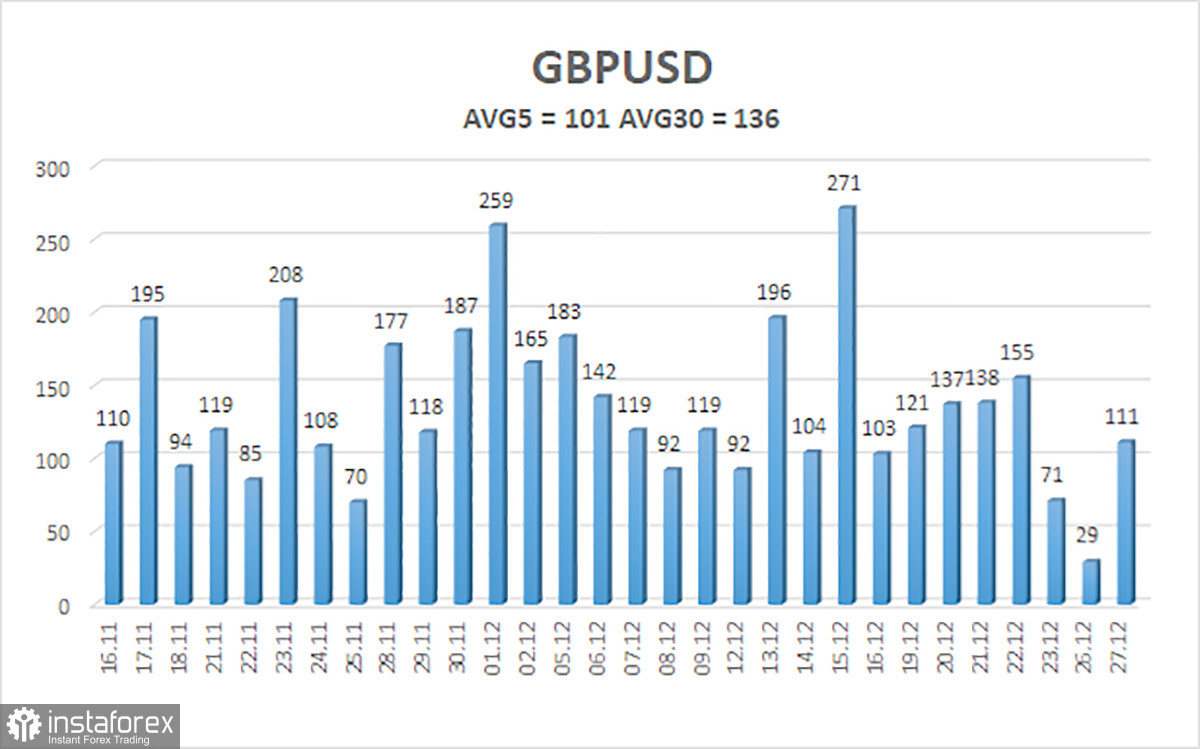

Over the previous five trading days, the GBP/USD pair has experienced 101 points of volatility on average. This value is "average" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Wednesday, December 28, with movement being constrained by levels of 1.1922 and 1.2123. A new round of upward correction is indicated by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest levels of resistance

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Suggestions:

On the 4-hour timeframe, the GBP/USD pair is still trending downward. Therefore, until the Heiken Ashi indicator appears, you should maintain sell orders with targets of 1.1963 and 1.1922. When the moving average is fixed above, buy orders should be placed with targets of 1.2207 and 1.2268. A flat is also highly likely right now.

Explanations for the illustrations:

Determine the present trend with the aid of linear regression channels. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.