If you look at the values of the beginning and the end of the trading day, the pound did not move anywhere. However, in the middle of the day, there was a sharp surge of activity. You could even say that it was out of the ordinary.The pound rose significantly at first, and then it returned to its starting position. The strange thing is that all this coincides with the start of the UK Border Force strike, as well as employees of railway companies. In fact, a transport collapse has begun in Great Britain. The demands are very simple - an increase in wages. The strike itself should last three days. And it will resume after the New Year. Logically, this should have led solely to the weakening of the pound. But for some mysterious reason, it was growing at the beginning. And by the end of the day there was no change at all. The only thing that can explain such a strange behavior is the total absence of major players on the market, and speculative actions in a thin market. So the strikes themselves were just an excuse for speculation. At the same time, while big investors are absent, apparently no one was going to move the market in any definite direction. And as you can see, few people were interested in the nature of that news. Speculators only needed a reason to move the quotes from one limit to another. And once again it evidently shows that trading in a thin market is connected with the risks of uncertainty.

As for today, yesterday's reaction to the events in Great Britain makes it clear that today's unemployment claims data will not affect anything at all. In principle, the number of applications should remain practically unchanged. If the initial claims data is expected to be increased by 4,000, the number of repeated claims will be decreased by 1,000. So it is safe to say that the changes will be symbolic even if they do take place.

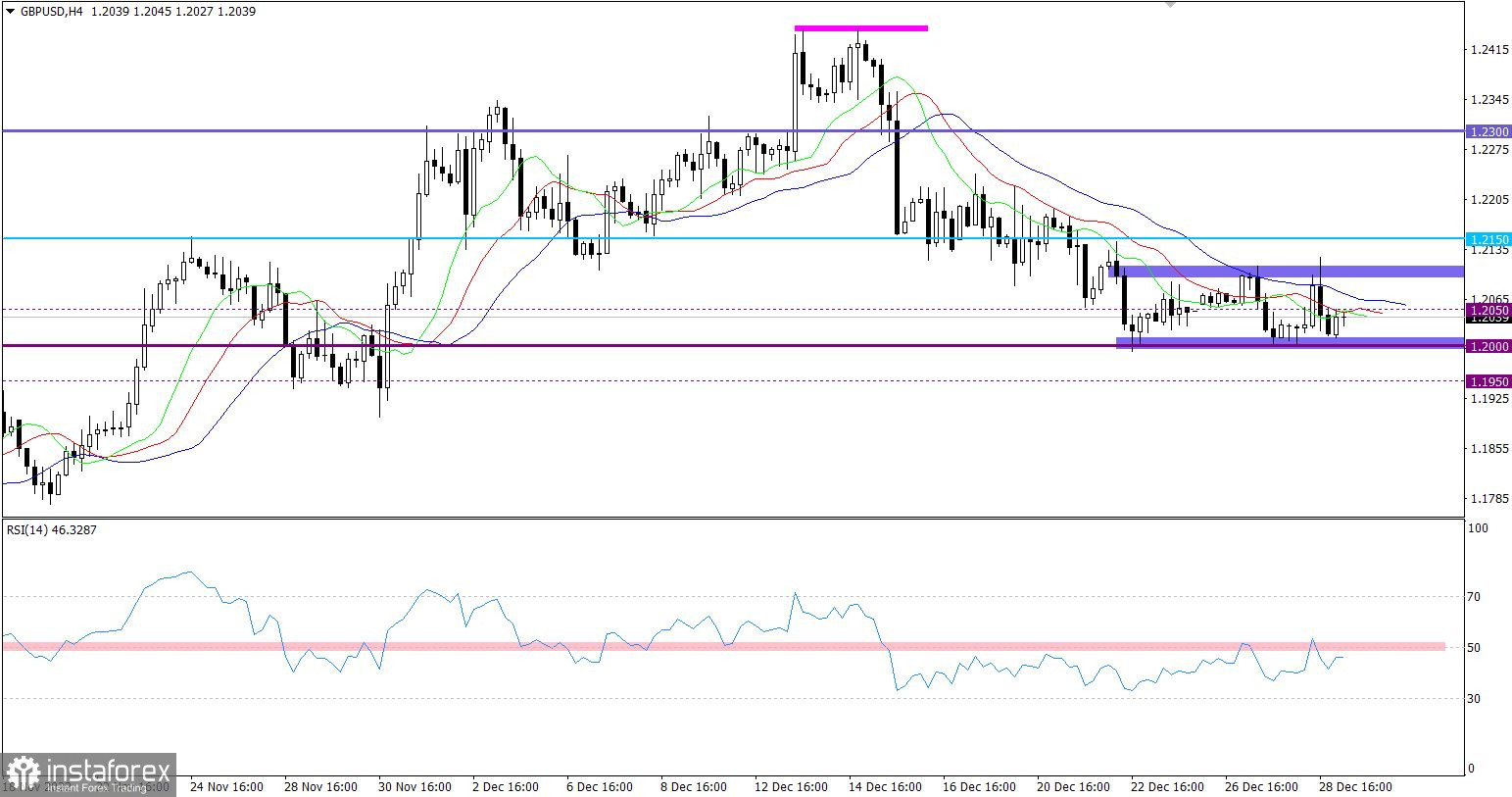

GBPUSD was very active yesterday, but it did not bring anything fundamental. In a moment, speculators managed to push the quote up to the range of 100, which was the fastest change of the price during the week. In the end, the quote returned to the area of the psychological level of 1.2000.

On the four-hour chart, the RSI technical indicator was temporarily above the average line of 50, almost immediately returned back. This indicates a bearish mood.

On the four-hour chart, Alligator's MAs are directed downward and the signal is unstable, as it periodically intersects. In fact, this is a stagnation phase.

Outlook

Based on the price movement within the trading week, we can say that the pair moves sideways. The psychological level of 1.2000 serves as the lower limit, while the upper limit would be 1.2100.

In this situation, the best thing to do is to go beyond this or that limit, which can indicate the subsequent price movement in the long term.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, there are technical signals due to the sideways movement.